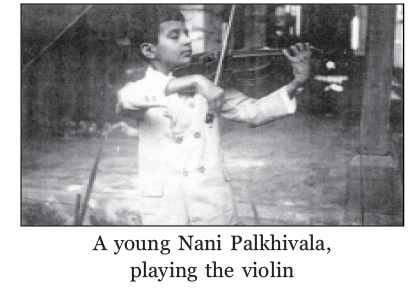

Nani Ardeshir Palkhivala fought for his country and his countrymen not only in Indian courts, but also in the international fora. His international endeavours which required painstaking research and scrupulous examining was often done free of cost. He was both, widely appreciated and credited for the work he did as an Indian representative. A brief account of this journey is elucidated below.

U. N. Special Tribunal (The Indo-Pakistan Western Boundary Case)

Palais des Nations, Geneva

Post war hostilities in 1965, Nani was asked by the Government of India to plead its case in the Indo – Pakistan Western Boundary in the Rann of Kutch. Pakistan had claimed a substantial part of the Rann and India challenged the same. The case concerned India’s integrity and Nani quickly decided that he would fight tooth and nail to defend it.

The question before the tribunal was one of finding, on the evidence placed before it, where exactly the boundary lay between India & Pakistan, in the region between Kutch and Sind. The tribunal was called upon to determine not where the boundary should lie but where in fact, on historical evidence, it lay in 1947 when the two dominions were created. India’s case, supported by maps and other historical evidence, was that the boundary had gradually got crystallized before 1870 and the position of the boundary had become clear and had been correctly delineated on the MacDonald maps published around 1870. Since the boundary was not wholly demarcated on the ground, the matter had to be decided on the historical evidence of maps and other authentic documents.

After establishing the historical background of the region, Nani went on to tear Pakistan’s argument to pieces. He told the tribunal that Pakistan’s case rested upon three theories:

(a) The General Theory of Confusion: All map makers and administrators were confused as to where the boundary laid.

(b) The Special Theory of Confusion: Certain people were especially confused on particular occasions where they treated the whole of Rann as belonging to Kutch.

(c) The Theory of Century of Error: the theory virtually suggests that, for hundred years, everybody made an error as to what precisely were the boundaries of the territory conquered by the British.

He placed special reliance on the MacDonald survey, he argued that before MacDonald one had legends masquerading as maps, but after MacDonald you had legends on maps. Nani’s performance was virtuoso, if almost the full text of Nani’s presentation had been reproduced here, it would show the minute problems he had studied (at one point referring to page numbers 12993 – 12994) and the way he presented his case. It redounded to Nani’s credit. The final Award given by the tribunal on 19th February 1968 entitled India to more than 90 per cent of the Rann of Kutch.

International Court of Justice

The Aftermath of the Pakistani Skyjacking

On 30th January, 1971, Pakistani terrorists hijacked an Indian Airlines Fokker Friendship aircraft flying from Srinagar to Jammu and forced it to land in Lahore. There were 28 passengers and four crew members onboard. One of the ‘Skyjackers’ had a grenade in his hand and threatened to use it if the plane was not diverted to Lahore while another pointed his revolver at the pilot. Having got the plane diverted to Lahore, the hijackers ordered the passengers to disembark, following which the plane was blown up right under the very nose of the Pakistani authorities. India then decided to suspend with immediate effect, the overflight of all Pakistani aircrafts, over the territory of India, until the matter was satisfactorily resolved by both governments.

Pakistan characterised the Indian action of suspending overflights as a breach of ‘International and bilateral commitments’ and complained to that effect to the International Civil Aviation Organization (ICAO). The legal commitments of the two countries in regard to overflights were embodied in the Convention of International Civil Aviation signed in Chicago in 1944, its annexe, the International Air Service Transit Agreement of 1944, the Indo-Pakistan agreement relating to air services reached in New Delhi on 23rd June, 1948 and the agreement arrived at by correspondence after the Tashkent Settlement in 1966. Charging India with a breach of these three international treaties and bilateral agreements, Pakistan proceeded to formally ask the council of the ICAO on 3rd March to declare that the Indian decision was illegal and to direct India to rescind it. Moreover, its application claimed compensation for the increase in costs due to the longer route that Pakistan planes now had to take to go to Dacca via Colombo.

Nani’s riposte was the preliminary objection that the council had no jurisdiction to deal with Pakistan’s compliant. India’s plea was that as a sovereign state it had the right to suspend the treaties under international law and well established state practice and usage. The jurisdiction of the council was only limited to one relating to ‘interpretation or application’ of the provisions of the treaties. Any other issues were outside the competence of the council. The ICAO Council however ruled against India and a month later, India appealed to the International Court of Justice at the Hague against the council’s decision. This appeal to the World Court was challenged by Pakistan.

The World Court hearing began on 20th June, 1972 with Nani as India’s chief counsel. It fell to Nani to present India’s case at the court’s three – hour opening session and thereafter. He advanced his arguments in great detail, marshalling historical facts in support.

The World Court delivered its judgment on 18th August, 1972. By 13 votes to 3 the court rejected the government of Pakistan’s objection on the competence and found that it had jurisdiction to entertain India’s appeal. However on the flipside by 14 votes to 2, it also held the council of International Civil Aviation Organization to be competent to entertain the application and complaint laid before it by the Government of Pakistan. However, the ruling on our objections will govern the council’s proceedings in the dispute from now on.

Ambassador of Washington

After the defeat of Indira Gandhi in the 1977, Shri Morarji Desai was placed on the Prime Ministerial throne. The 20 months of Emergency left Indian ambassador in Washington, Mr. Kewal Singh in bad light. In such a situation Morarji Desai rightly thought it fitting to appoint Shri Nani A. Palkhivala as the Indian Ambassador to Washington, which after much persuasion from Mr. Atal Bihari Vajpayee was taken up by Nani. On his appointment as the Indian Ambassador to the United States he resigned from the boards of all Tata companies and he rejoined them on his return in 1979.

When Nani reached Washington with Nargesh (wife) on 24th September, 1977, he could hardly have hoped to be received by President Jimmy Carter within a fortnight. Newly appointed ambassadors were often asked to wait for several weeks before being invited to present their credentials. Nani was invited to present his on 7th October, which, in its own way, was demonstrative of the respect in which he was held. The ceremony took place at the White House, and President Jimmy Carter’s reply to Nani’s credentials was:

‘… I welcome you personally, Mr. Ambassador. Your reputation in India as a champion of human rights and constitutional liberties, achieved at some personal risk at times, precedes you. I am certain that your mission will be effective and successful one and will contribute to that enhancement of our relations to which both of our countries are committed’

Nani spoke like a professional diplomat, even when asked the most embarrassing of questions, he would answer them calmly, without a trace of discomfiture. During his term as ambassador Nani accomplished the successful signing of the Delhi Declaration, in the drafting of which he played a significant role. It is not often that two countries, which are separated not only in terms of distance but also of culture and tradition and levels of economics development, feel it necessary and desirable to issue an affirmation of fundamental principles, ideals and values which they share. It must be remembered that Nani was chosen as ambassador precisely because it was hoped that he would facilitate frank discussion on vital issues at the highest level, which included nuclear proliferation, arms reduction, Pakistan and India’s non – alignment stand. In this Nani succeeded in great measure.

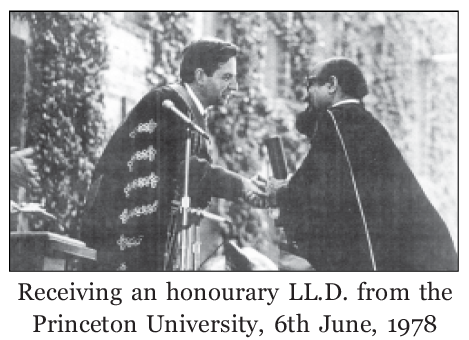

Nani was in constant demand during his stay in America. In his 20 months as ambassador he gave 171 lectures – an average of 2 a week. Two American universities bestowed honorary doctorates on him: Lawrence University, Wisconsin and Princeton. Princeton was the first to do so on 6th June, 1978. The citation was a fitting appraisal:

‘Defender of constitutional liberties, champion of human rights, he has courageously advanced his conviction that expediency in the name of progress, at the cost of freedom, is no progress at all, but retrogression. Lawyer, teacher, author, and economic developer, he brings to us as Ambassador of India intelligence, good humour, experience, and vision for international understanding’