Introduction

E-Assessment Scheme (2019) 417 ITR(St.) 12

The E-Assessment scheme or the ‘Faceless Assessment’ involves creation of e-assessment centres at national and regional levels; auto-allocation of cases among these centres. The scheme marks a significant modification in the manner in which tax assessments will be undertaken. Under the new scheme, Individual taxpayers would not be required to appear either personally or through authorised representative in relation to the proceedings related to the scheme before any income tax authority. All the communication between the department and taxpayer would be done electronically. Even all the internal communication within the income tax department will be electronic. The government has proposed its intention of curbing corruption, eliminating facetime with Assessing Officers allowing time and energy to be saved, better transparency would be there by way of recording of all communications and documentary evidences being digitalized and ultimately resulting into greater efficiency through this method of faceless assessment.

The E-Assessment Scheme was mentioned by the Hon’ble Finance Minister in his Budget Speech reported in (2018) 401 ITR(St.) 1(29) dated 01.02.2018. He stated that E-assessment was introduced in 2016 on a pilot basis and in 2017, extended it to 102 cities with the objective of reducing the interface between the department and the taxpayers. With the experience gained so far, they were ready to roll out the E-assessment across the country, which is expected to transform the age-old assessment procedure of the income tax department and the manner in which they interact with taxpayers and other stakeholders. Accordingly, he proposed to amend the Income-tax Act to notify a new scheme for assessment where the assessment would be done in electronic mode which will almost eliminate person-to-person contact leading to greater efficiency and transparency. Accordingly, sections 143(3A), 143(3B) & 143(3C) were introduced w.e.f. 1.4.2018 where power has been granted to the Central Government to make any scheme in this regard.

Brief glimpse of Notification

1. Scope of the Notification

The scope of the Notification has been explained in Clause 4 where it has been highlighted that such scheme shall be made in respect of such territorial area, or persons or class of persons, or incomes or class of incomes, or cases or class of cases, as may be specified by the board.

2. Communication

2.1. All communications will be conducted electronically. Taxpayers or advocates shall not remain physically present. In some cases, video conferencing may be allowed. Clause No. 11 of the Notification mentions, ‘A person shall not be required to appear either personally or through authorised representative in connection with any proceedings under this Scheme before the income-tax authority at the National E-assessment Centre or Regional E-assessment Centre or any unit set up under this Scheme.’

2.2. Clause No. 8 mentions that all communications between the National E-assessment Centre and the assessee, or his authorised representative, shall be exchanged exclusively by electronic mode. Electronic mode here may mean that all documents would be digitalized and uploaded on a certain server. In case of a personal hearing, which may be requested by the assessee, a video conference may take place so that the assessee would be able to give oral submissions and explanations etc.

2.3. Section 282 of the IT Act specifically provides notice can be served in the form of any electronic record as provided in chapter IV of the Information Technology Act, 2000. Explanation to section 282(2) provides that the expressions “Electronic Mail” and “Electronic Mail Message” are assigned the meaning as in explanation to section 66A of the Information Technology Act, 2000. The notification in its definition Clause 2(xvi) expands the scope so as to include even ‘message on WhatsApp’.

3. Centres:

3.1. National E-Assessment Centre (NEC)

The purpose of setting up the NEC has been stated to be facilitation of the conduct of e-assessment proceedings in a centralized manner. However, it may be noted that the constitution of the NEC has not been specified under the notification.

3.2. Regional E-Assessment Centre (REC)

To facilitate the conduct of e-assessment proceedings in the cadre controlling region of a Principal Chief Commissioner.

3.3. Assessment Units

To facilitate the conduct of e-assessment, to perform the function of making assessment.

3.4. Verification Units

To facilitate the conduct of e-assessment, to perform the function of verification.

3.5. Technical Units

To facilitate the conduct of e-assessment, to perform the function of providing technical assistance which includes any assistance or advice on legal, accounting, forensic, information technology, valuation, transfer pricing, data analytics, management or any other technical matter which may be required in a particular case or a class of cases, under this Scheme.

3.6. Review Units

To facilitate the conduct of E-assessment, to perform the function of review of the draft assessment order, which includes checking whether the relevant and material evidence has been brought on record, whether the relevant points of fact and law have been duly incorporated in the draft order, whether the issues on which addition or disallowance should be made have been discussed in the draft order, whether the applicable judicial decisions have been considered and dealt with in the draft order, checking for arithmetical correctness of modifications proposed, if any, and such other functions as may be required for the purposes of review, and specify their respective jurisdiction.

4. Setup

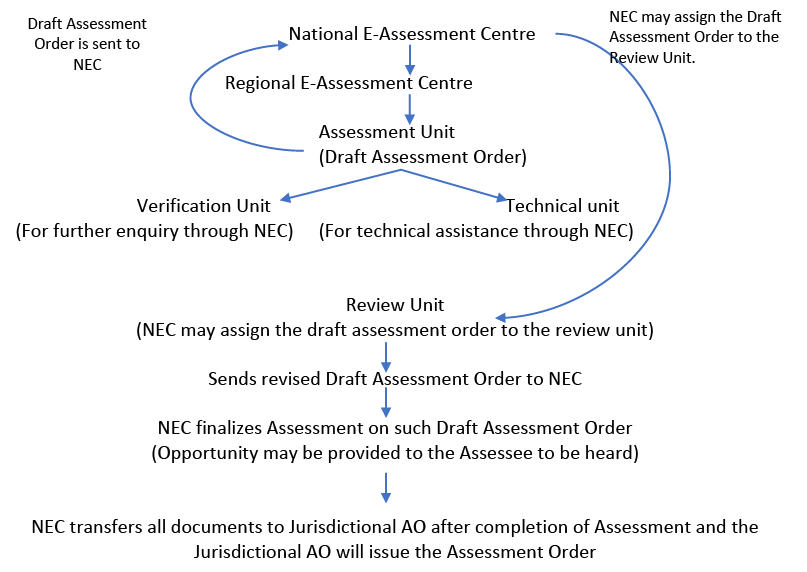

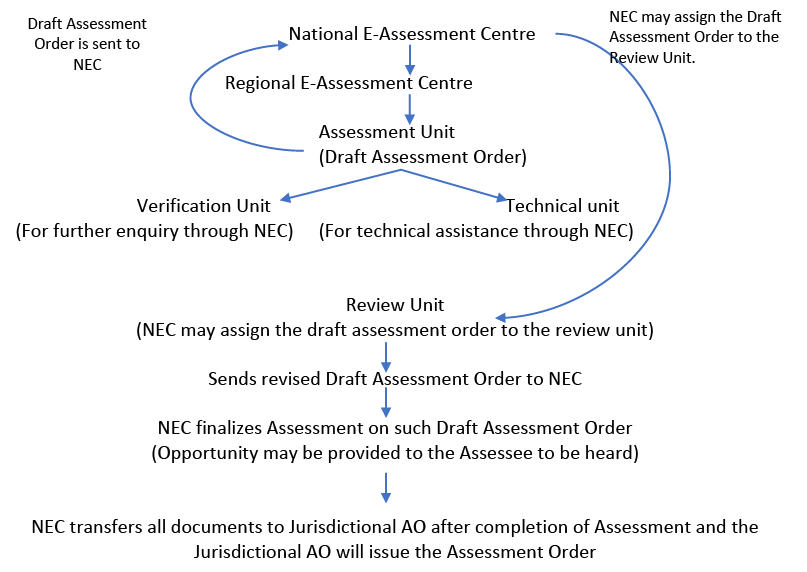

4.1. The National E-Assessment Centre (NEC) would, in select cases, serve a notice on the Assessee u/s. 143(2) specifying the issues. Thereafter, the NEC would assign the cases selected to specific Assessment Units in any one Regional E-assessment Centre through an automated allocation system.

4.2. The Assessment Unit may request NEC for a certain enquiry or verification by the verification unit or request NEC for seeking technical assistance from the technical unit. After considering the documents on record, the Assessment Unit would make a draft assessment order which would be examined by NEC for finalization processes.

4.3. NEC may also send it to the Review Unit, if it deems it necessary, which in turn would provide its inputs and suggestions to NEC.

4.4. The Draft Assessment Order would then be finalized and forwarded to the jurisdictional AO.

4.5. The AO may, based on such assessment, proceed to impose penalty, launch prosecution, etc.

The chart below explains the procedure followed by the respective centres/units:

5. Post Assessment Procedure

5.1. At the end, everything would be transferred to the AO having jurisdiction for the purpose of imposition of penalty, collection and recovery of demand, rectification of mistake, giving effect to appellate orders, submission of remand report, or any other report to be furnished, or any representation to be made, or any record to be produced before the Commissioner (Appeals), Appellate Tribunal or Courts, as the case may be, proposal seeking sanction for launch of prosecution and filing of complaint before the Court.

5.2. A moot question may arise that after order is received from NEC, the Assessing Officer having jurisdiction signs and issues the order. Whether it would be legally justifiable for the AO to sign such an order where he is not a participant at all. Therefore, it is suggested that at least the Jurisdictional AO should be made a party to the on-going procedure.

5.3. If there is an appeal by the assessee then the AO would be responsible to submit all data to the appellate authority.

6. Document Identification Number (DIN)

Document Identification Number (DIN) had been introduced via Circular No. 19/2019 dt. 14.08.2019 to curb the practice of issuing the notice or summons or any other letter of correspondence manually without maintaining a proper audit trail of such communication. Hence, it had been decided that no communication would be issued by the income-tax authorities relating to assessment, appeals, orders, penalty, prosecution, approval, etc. to the assessee or any other person on or after 1st October 2019 unless a computer generated Document Identification Number (DIN) has been allotted and is duly quoted in the body of the communication.

Issue arises for consideration is that section 282B of the IT Act is a section specifically for Allotment of Document Identification Number. This section was omitted by Finance Act, 2011 w.e.f. 1.4.2011. Thus, as the law stands to date, there is no mechanism under the Income-tax Act for Allotment of DIN. It is interesting to note that before the issuance of the Notification dt. 12.09.2019, Circular No. 19/2019 was issued with subject“Generation/Allotment/Quoting of Document Identification Number in Notice/Order/Summons/letter/correspondence issued by the Income-tax Department”, wherein at para 2, towards the end, it is specifically mentioned, “DIN has been allotted and is duly quoted in the body of such communication”. Thus, it is pointed out that the erstwhile section 282B needs to be revived/reintroduced. Also, it must be clarified that the DIN would apply for each Assessment Year or it would be continuously for all Assessment Years.

7. Exceptions: Circular No. 27/2019, dated 26.09.2019

7.1. This circular is peculiar for conduct of assessment proceedings through e-proceeding facility for financial year 2019-20 only.

7.2. It has been stated, in all cases (other than the cases covered under the ‘E-Assessment Scheme, 2019’ notified by the Board), where assessment is to be framed under section 143(3) of the Act during the Financial Year 2019-20, it is hereby directed that such assessment proceedings shall be conducted electronically subject to exceptions mentioned below:

a. Where assessment is to be framed under section(s) 153A, 153C and 144 of the Act;

b. In set-aside assessments;

c. Assessments being framed in non-PAN cases;

d. Cases where Income-tax return was filed in paper mode and the assessee concerned does not yet have an ‘E-filing’ account;

e. In respect of assessments to be framed under section 147 of the Act, any relaxation from e-proceeding due to the difficulties in migration of data from ITO to ITBA etc., shall be dealt as per clause (f) below;

f. The jurisdictional Pro CIT/CIT, in extraordinary circumstances such as complexities of the case or administrative difficulties in conduct of assessment through ‘E-Proceeding’, can permit conduct of assessment proceedings through the conventional mode.

7.3. The circular seems to be an addendum to the current Notification which has been released by way of Circular No. 27/2019, dt. 26.09.2019. The circular mentions exceptions to e-proceedings i.e., it has mentioned certain cases where ‘E-Proceeding’ shall not be mandatory.

7.4. The circular specifically mentions that it is applicable to the year 2019-20, making it clear that the list of exceptions thereunder would not be applicable in later years. This may also mean that such changes may be incorporated by way of amendments through the next budget session and Finance Act.

7.5. In the above exceptional cases, where E-assessment is not feasible, there is room for flexibility and NEC may refer the case to the Jurisdictional AO. In such cases, there is no more faceless assessment. The entire assessment before the AO would be carried out in the traditional manner and hence the purpose of the Notification may not achieved.

8. Issues Involved

Issue 1: Scope of the Notification

The scope seems to be flexible where the application of such scheme can be extended or restricted to certain classes, sections, places or all of them. This could also imply that the Board could decide that the scheme be applicable to a class of persons like builders or persons receiving foreign remittances or those receiving gifts or class of persons dealing in hawala transactions, suspected benami transactions etc. Thus there is reasonable classification and justification towards class of persons, income and territory. However, an issue can arise whether the power of classification with regard to territory, persons and income be bestowed upon by the Board on itself through a notification, or should a legislation be introduced. This gives rise to the power and the issue of delegated legislation, when such a notification is issued.

Issue 2: Time Consuming Process

The Assessment unit may ask the NEC for further information as required. A question may arise that where assessment unit requires further information/details, it may approach the NEC. This procedure of the Assessment Unit asking further information may at times be time consuming and thereby unnecessarily prolonging duration and the allocation of Assessment.

Issue 3: Time Limit to reply to notice u/s. 143(2) – [Clause 5(ii)]

The scheme has proposed the time limit of 15 days within which an assessee has to respond to a notice u/s. 143(2). However, under section 143(2) of the Income-tax Act, no such limitation has been prescribed. The notice could mention a time limit within which the information sought for may be provided by the assessee.

Now the notification imposes a duty on the assessee where the assessee may reply to such notice within 15 days. One may have to question as to whether such a duty cast upon the assessee can be done through a notification, which permanently supersedes the provision of the Act, or whether an amendment has to be brought in giving effect to the notification? A further question which could arise is whether CBDT has the power to change/amend the procedure as laid down under the legislature. Such an act may require legislative approval.

Issue 4: National E-Assessment Centre to assign cases to specific assessment units [Clause 5(iii)]

It has been mentioned that the National E-Assessment Centre would be set up by the CBDT for the purposes of making assessments as per the procedure laid down by the scheme.

Here the NEC has been given vide powers where the selection of the cases and assignment of the same to various assessment units are held by it. This may incorporate some arbitrariness where sole power has been provided to the NEC, where no check would be there such NEC, more particularly when the composition of NEC has not been specified.

Issue 5: Risk Management Strategy [Clause 5(x)]

Clause 5(x) states, ‘the National E-Assessment Centre shall examine the draft assessment order in accordance with the Risk Management Strategy specified by the Board, including by way of an automated examination tool’. Risk Management Strategy has not been defined in the notification. The paragraph further mentions that there would be an automated examination tool as well for examining the draft assessment order. A question may arise as to what is the objective of Risk Management Strategy, no indication is given anywhere in the notification.

Issue 6: Review [Clause 5(x)(c)]

Clause 5(x)(c) states, ‘assign the draft assessment order to a review unit in any one Regional E-Assessment Centre, through an automated allocation system, for conducting review of such order’. When sub-paragraphs (c) is read with paragraph (x) & (xii) in Clause No. 5, there seems to be a second review in terms of examination of the draft assessment order.

Clause 5, para (x) mentions that NEC would examine the draft assessment order first and only then, finalize the draft assessment order or assign the draft order to a review unit for review.

Review system is a welcome move, as it would give reasonable perfection to the assessment order and would also deal with technical, legal and expert views. Thus with such a precise and well covered assessment order which is in many cases reviewed, there would be few chances of the assessee going in appeal. Under such circumstances, it is suggested that the appeal should lie directly to the Income Tax Appellate Tribunal and that the whole mechanism of going through the CIT(A) should be done away with. It is emphasized that when an order is prepared with the approval of the assessment unit, technical unit and is subject to review and inputs, then the assessment order is reasonably certain and strong and appeal should lie exclusively to the Income Tax Appellate Tribunal. The filing of appeal with the CIT(A) should be done away with as it would be only procedural and it would be difficult for the CIT(A) to overturn the orders issued by NEC which have undergone the process of review. Thus eliminating the stage of CIT(A) would go a long way in rendering speedy and easy justice.

Issue 7: Sanction for Prosecution [Clause 5(xx)(f)]

It has been mentioned all documents would be transferred to the AO having jurisdiction over the case after completion of the assessment for reasons mentioned therein. Such reasons include a case where the AO would have to seek sanction for launch of prosecution. Clarification may need to be given as to whether NEC would be consulted before launching of prosecution.

Issue 8: Assessment to be done by Jurisdictional AO [Clause 5(xxi)]

Power is given to the NEC to transfer any case directly to the jurisdictional AO without compliance of clauses of notification, if it deems necessary. Such powers may be termed as arbitrary and if it is optional upon the NEC to determine and refer any case to the AO, then following the entire process till the finalization of draft assessment order may be regarded as arbitrary and biased.

Can this mean that e-assessment is not mandatory? It could also mean that in certain cases where e-assessment is not feasible, there is room for flexibility and that NEC refers the case to the Jurisdictional AO. There is no more faceless assessment, the entire assessment before the AO would be carried out in the traditional manner and hence the purpose of the Notification is not achieved. Now a circular is issued carving certain exceptions which is applicable for financial year

2019-20. This requires more clarity and in the next Finance Act, more provisions and clarity with exceptions be provided.

Issue 9: Lengthy Submissions

At any level of the Assessment Proceedings, the submissions would have to be communicated through the registered account. In such a case, the assessee may be expected to digitalize the paper documents first and then upload the same on the site. This may cause great problems if such documents run into a number of pages since digitalizing each page and then uploading the same may be a tedious task.

This further raises the issue of whether adequate infrastructure in terms of appropriate servers be provided which would be able to handle volumes of data of millions of assessees pouring in everyday for the next foreseeable future. Whether such data would be secured? And hacking of such data may cause losses to many if businesses are involved. Whether confidentiality would be affected?

Issue 10: Access to Submissions

All submissions are supposed to be communicated electronically as per Clause No. 8 of the notification. It is desirable that documents/materials be made accessible to the assessee for the purpose of availing the same at a future date. Such access may be required, as a proof before the higher authorities that documents were submitted to the assessment unit.

Issue 11: Duty to provide video conferencing facility [Clause 11(4)]

The notification casts a duty on the Board where appropriate facilities at appropriate locations would be provided for video conferencing with the income-tax authority, by the assessee.

There is no mention of the Locations where such video conferencing would take place. Further, what would be the fate of the assessee if the location for such video conferencing would be too far away from such assessee’s residence? Locations and Logistics have not been specified and the same may have to be worked out in a way that it does not cause hardship to the assessee.

Issue 12: Recordings [Clause 11(2 & 3)]

No clarification on whether such video conference would be recorded, is provided. Recording of video conferences would help the assessee as well as the department in understanding the questions asked and the submissions made during the assessment proceedings. Recording of such video conferences would also be vital evidences before the higher authorities to understand as to what had transpired before the lower authorities. It is suggested that a paragraph may be inserted for recording of such video conferences as proof and evidence.

Connected with it would be the issue of cross-examination. Whether the cross Examination would involve all three parties and whether a record of cross examination would be submitted to the assessee for purpose of evidence before higher authorities.

Whether re-examination would be permitted and whether NEC/any other unit under the scheme/representative of any unit, would have any right to ask questions to both the parties?

Issue 13: Issue Based Assessment or a General Assessment [Clause 5(i)]

Under Clause 5 paragraph (1), a notice would be served under section 143(2) specifying the issues for selection of the case for assessment. Would this mean that the selection of cases for assessment, be issue based? Can the assessment units or the Assessing Officer go beyond such issues raised or would they be restricted to completing the assessment based on the issues raised only, since it is specifically mentioned in Clause 5(i) that ‘specifying the issues for selection of his case for assessment’ implying thereby that specific issues only are required to be considered. Under such circumstances, would the authorities have jurisdiction to travel beyond the specified issues? In such cases, the assessee has a right to challenge the other issues by way of writ petition analogous to reassessment proceedings.

Issue 14: Prescribed Authority u/s. 143(2)

Whether NEC can be considered as a prescribed authority as per section 143(2) of the Income Tax Act? As per section 143(2), the Assessing Officer or the prescribed income-tax authority, as the case may be, if, considers it necessary, shall serve on the assessee a notice requiring him, to attend the office of the Assessing Officer or to produce any evidence on which the assessee may rely in support of the return. Prescribed authority under Rule 12E is Income-tax authority not below the rank of an Income-tax Officer.

With the new notification, can the NEC be considered to be the prescribed authority? If the NEC is supposed to be considered as the prescribed authority, whether any amendment is required to be made in the Income-tax Act/Income-tax Rules to make an addition of such words to provide for the inclusion of NEC under the umbrella of a prescribed authority, more particularly when the composition of NEC is not specified.

Issue 15: Applicability of section 136 of the Income-tax Act

Section 136 provides that any proceedings under the Income-tax Act before an Income-tax authority shall be deemed to be a Judicial proceeding within the meaning of provisions of Indian Penal Code and every Income-tax authority shall be deemed to be a Civil Court. Question arises for consideration is, whether the authorities and NEC would be regarded as falling within the parameters of section 136. To what extent, these proceedings are deemed to be judicial proceedings within the meaning of sections 193, 228 and 196 of Indian Penal Code will be required to be considered, as the notification only prescribes the mechanism and the modality more particularly the procedure is prescribed.

Issue 16: Constitutional Remedies

Question arises that whether a writ petition could be filed on the ground that adequate opportunity is not accorded to the assessee. A writ petition may also lie where the time limit of 15 days is not extended to give replies or where cross-examination is not allowed. A writ petition could also lie challenging that the technical unit or the Review Unit should disclose in advance their points and grievances so that they could be adequately challenged. These are some of the issues under which a writ petition would lie.

A vexed question would arise that technically where would the writ petition be filed, since at the time of issuance of the notice no jurisdiction of AO is mentioned. However, it is clarified that the writ would lie exclusively where the person is regularly assessed.

Benefits of E-Assessment

1. In the budget speech of 1.2.2018, Finance Minister had specifically mentioned that there is the right time to bring in e-assessment. From then i.e., 1.2.2018, the ball started rolling till date i.e., 12.9.2019 where the implementation of such proposal has taken place.

2. The notification eliminates person-to- person contact.

3. Eliminates facetime with Assessing Officers allowing time and energy to be saved.

4. Better transparency would be there by way of recording of all communications and documentary evidences being digitalized.

5. Results in greater efficiency since the assessment would be reviewed. In some cases, once at the time of examination of the draft assessment order and once at the time of assigning the same to a review unit, which makes the entire process more stable. With multiple internal processes to eliminate unnecessary scrutiny of cases, much litigation time of assessees and the courts would be avoided. Even inputs on technical issues of transfer pricing and cross border transactions where expert opinion could be sought, would be considered.

6. No chance of interfering in the process of assessment by any other authority. It is a straight jacket formula where NEC would conduct the proceedings within the framework laid down by CBDT.