The taxation of private trusts is itself a vexed issue. In spite of various rulings including those of the Apex Court, there is no certainty in this area.

Private trusts in contrast with public trusts are those trusts which are for the benefit of private individuals and not for the benefit of the public or section of public at large.

A. Background – The Indian Trust Act, 1882 (certain important provisions)

-

Definitions:

Section 3 – A “trust” is an obligation annexed to the ownership of property, and arising out of a confidence reposed in and accepted by the owner, or declared and accepted by him, for the benefit of another, or of another and the owner.

The person who reposes or declares the confidence is called the “author of the trust”:

The person who accepts the confidence is called the “trustee”:

The person for whose benefit the confidence is accepted is called the “beneficiary”:

The subject-matter of the trust is called “trust-property” or “trust-money”:

The “beneficial interest” or “interest” of the beneficiary is his right against the trustee as owner of the trust-property; and the instrument, if any, by which the trust is declared is called the “instrument of trust”

-

Chapter II deals with Creation of the Trust

Section 4 – Lawful purpose

A trust may be created for any lawful purpose. The purpose of a trust is lawful unless it is

(a) forbidden by law, or

(b) is of such a nature that, if permitted; it would defeat the provisions of any law, or

(c) is fraudulent, or

(d) involves or implies injury to the person or property of another, or

(e) the Court regards it as immoral or opposed to public policy.

Every trust of which the purpose is unlawful is void. And where a trust is created for two purposes, of which one is lawful and the other unlawful, and the two purposes cannot be separated, the whole trust is void.

Section 5 –

Trust of immovable property.

No trust in relation to immovable property is valid unless declared by a non-testamentary instrument in writing signed by the author of the trust or the trustee and registered, or by the will of the author of the trust or of the trustee.

Trust of movable property.

No trust in relation to movable property is valid unless declared as aforesaid, or unless the ownership of the property is transferred to the trustee.

Section 6 – Creation of trust.

Subject to the provisions of section 5, a trust is created when the author of the trust indicates with reasonable certainty by any words or acts (a) an intention on his part to create thereby a trust, (b) the purpose of the trust, (c) the beneficiary, and (d) the trust-property, and (unless the trust is declared by will or the author of the trust is himself to be the trustee) transfers the trust property to the trustee.

Section 7 -Who may create trusts.

A trust may be created—

(a) by every person competent to contract, and

(b) with the permission of a principal Civil Court of original jurisdiction, by or on behalf of a minor,

but subject in each case to the law for the time being in force as to the circumstances and extent in and to which the author of the trust may dispose of the trust property.

Section 8 – Subject of trust.

The subject-matter of a trust must be property transferable to the beneficiary. It must not be a merely beneficial interest under a subsisting trust

Section 9 – Who may be beneficiary.

Every person capable of holding property may be a beneficiary.

Section 10 – Who may be trustee.

Every person capable of holding property may be a trustee; but, where the trust involves the exercise of discretion, he cannot execute it unless he is competent to contract.

Acceptance of trust

No one bound to accept trust. A trust is accepted by any words or acts of the trustee indicating with reasonable certainty such acceptance.

-

Revocation or extinguishment of the trust

Section 77 – Trust how extinguished.

A trust is extinguished—

(a) when its purpose is completely fulfilled; or

(b) when its purpose becomes unlawful; or

(c) when the fulfilment of its purpose becomes impossible by destruction of the trust-property or otherwise; or

(d) when the trust, being revocable, is expressly revoked.

Section 78 – Revocation of trust.

A trust created by will may be revoked at the pleasure of the testator.

A trust otherwise created can be revoked only—

(a) where all the beneficiaries are competent to contract – by their consent;

(b) where the trust has been declared by a non-testamentary instrument or by word of mouth—in exercise of a power of revocation expressly reserved to the author of the trust; or

(c) where the trust is for the payment of the debts of the author of the trust, and has not been communicated to the creditors — at the pleasure of the author of the trust

Section 79 – Revocation not to defeat what trustees have duly done.

No trust can be revoked by the author of the trust so as to defeat or prejudice what the trustees may have duly done in execution of the trust.

B. Types of Trusts (relevant for income tax purposes)

-

Revocable: A trust that can be revoked (cancelled) by its settlor at any time during this life;

-

Irrevocable:A trust will not come to an end until the term / purpose of the trust has been fulfilled;

A cue can be taken from section 63 of the Income-tax Act, 1961 (‘the Act’), where the term revocable transfer has been defined as under:

Section 63(a) A transfer shall be deemed to be revocable if—

(i) it contains any provision for the re-transfer directly or indirectly of the whole or any part of the income or assets to the transferor, or

(ii) it, in any way, gives the transferor a right to re-assume power directly or indirectly over the whole or any part of the income or assets

Further, section 63(b) states that transfer includes trust.

-

Discretionary/ Indeterminate:An arrangement where the trustee may choose, from time to time, who (if any-one) among the beneficiaries is to benefit from the trust, and to what extent; (income as well as capital) the beneficiary thus has no more than a hope that the discretion would be exercised in his favour.

-

Determinate/ Specific:The entitlement of the beneficiaries is fixed by the settlor at the time of settlement or by way of a formula, the trustees having little or no discretion;

Under the Act, Explanation 1 to section 164 explains the meaning of the term indeterminate as under:

“(i) any income in respect of which the persons mentioned in clause (iii) and clause (iv) of sub-section (1) of section 160 are liable as representative assessee or any part thereof shall be deemed as being not specifically receivable on behalf or for the benefit of any one person unless the person on whose behalf or for whose benefit such income or such part thereof is receivable during the previous year is expressly stated in the order of the court or the instrument of trust or wakf deed, as the case may be, and is identifiable as such on the date of such order, instrument or deed ;

(ii) the individual shares of the persons on whose behalf or for whose benefit such income or such part thereof is received shall be deemed to be indeterminate or unknown unless the individual shares of the persons on whose behalf or for whose benefit such income or such part thereof is receivable, are expressly stated in the order of the court or the instrument of trust or wakf deed, as the case may be, and are ascertainable as such on the date of such order, instrument or deed.”

The Courts have held that a Trust would be determinate trust even if the Trust Deed only provides for manner of computation of beneficial interest of each beneficiary (e.g. equally, among all living family members or a case where the beneficial interest in the Trust would vary due to birth and demise of family members) and may not state the interest of each beneficiary in absolute terms. [See CWT v. Trustees of H. E. H. Nizam’s Family (Remainder Wealth) Trust (1977) 108 ITR 555 (SC), CIT v. India Advantage Fund-VII [2017] 392 ITR 209 (Karnataka HC), CIT v. Bapalal [2010] 321 ITR 322 (Mad. HC) & Pandit v. CIT [1972] 83 ITR 136 (Bom HC)]

-

Combination trustsnamely: of (i)-(iii)/(iv), (ii)-(iii)/(iv)

C. Some of the objects for creation of trusts

-

Inheritance tax planning

There is a possibility of reintroduction of Estate duty which levies tax on inheritance. An inheritance tax is the tax levied on any person who inherits money or property i.e. tax on property passing off on death of an individual. It is however possible to structure business and family assets under an appropriate trust entity so as to mitigate inheritance tax as it is passed onto generations. For example, one possible way of mitigation could be through creation of an irrevocable discretionary trust which apart from preserving the value of business and sustaining future growth, also facilitates maintenance of required control of the promoters, easy management, efficient distribution of income and wealth, along with mitigation of inheritance tax on devolvement of assets.

-

Trusts to reduce tax incidence

Earlier trusts used to be created rampantly for income tax planning. However, with the introduction of tax at Maximum marginal rate (‘MMR’) in the year 1985, on the discretionary trusts in a case where even one of the beneficiary has income chargeable to tax at MMR, the avenue for exploiting such vehicles has been curtailed.

Still, there are certain areas where private trust especially, the discretionary trust, can be used as an income tax planning tool. Benefit can be taken of the fact that the share of the beneficiaries of the discretionary trust cannot be ascertained. For example, deemed dividend u/s 2(22)(e), transactions between related party u/s 40A(2) etc.

-

Protection against unforeseen action by creditors/lenders

A Trust is again a very important vehicle to safeguard assets for the benefit of one’s family from a potential insolvency in future. In such a situation the purpose is dual. The settlor may not want to let go of the entire control of the property but at the same time fears that if he continues to own it in his name it may be attached in any action against him for recovery of debts. Such planning is subject to the fact that the same is made well in advanced and is not with the intention of defrauding one’s creditors.

-

Trusts for the benefit of minors / persons not competent to contract.

A settlor of the trust may want either his minor children or a person with disability to enjoy the property he holds. However, he may not be in a position to manage the properties himself or for some reason believes that he may not survive the minority of the beneficiary or survive the person with disability. In such an event a private trust is created whereby during the period of minority or until the beneficiary attains a particular age or until the death of the person with disability the property is settled on a trustee.

-

Trust for welfare of the employees – Gratuity/Superannuation/Provident Fund/ ESOP trusts

As employers, corporations or other business entities are under an obligation to ensure welfare benefits to their employees in the form of provident fund, pension, gratuity and in some cases superannuation. These obligations are continuing obligations and are to be discharged on the occurrence of a particular event or the superannuation of an employee. Since, these obligations would involve pay out of substantial funds to the beneficiaries it is common to create trusts and the business entities make annual contributions to ensure that the obligations can be discharged when they arise. The objective of creation of these trusts is that if these funds are left at the disposal of the employers fund may not ultimately be available when the obligations arise on account of mismanagement. The law therefore mandates creation of such trusts.

Further, trusts are also created for transfer of shares under ESOPs scheme, wherein the trust act as an extended arm of the company issuing such shares.

-

Trust as an investment holding vehicle

The importance and efficiency of Trusts being used as investment holding vehicle is significant. Apart from the fact that it ensures retention of control over the business and increase in efficiency, it also provides tax efficient treatment of income upstreaming and asset upstreaming. The transfer of income by the Trust to its beneficiaries should not result in any additional taxation in the hands of the said beneficiaries. Similarly, the transfer of asset by the Trust to its beneficiaries should also not have any tax implications [this is subject to our discussion on provision of section 56(2)(x)].

-

Offshore trusts

Frequently, offshore Trusts are used by returning non-resident Indians to block the levy of the Indian tax law to the wealth earned by them while they were living abroad. This is typically done by creating an offshore Trust before the NRI returns back to India and contributing the foreign wealth within that offshore Trust.

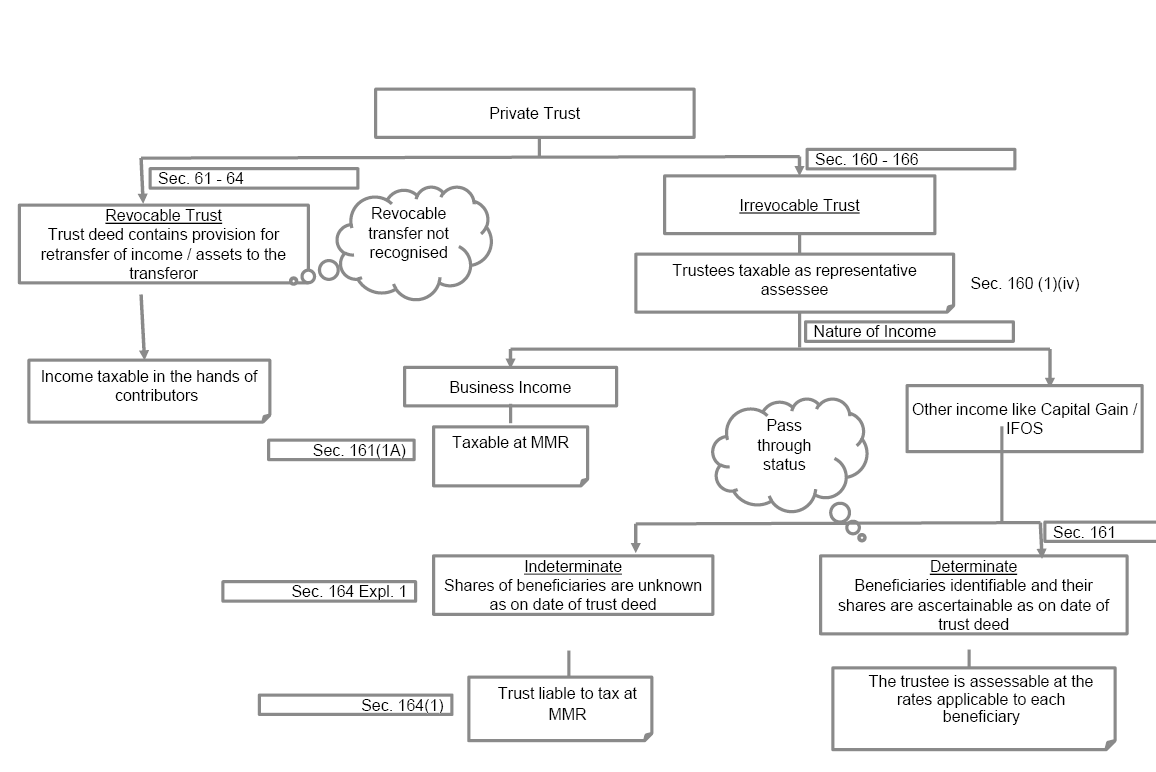

D. Taxation of Private Trusts

We may break the taxation of private trusts into two parts: viz taxation of private revocable trusts and taxation of private irrevocable trusts.

-

Taxation of private revocable trusts.

In case where an income is transferred (whether revocable or not) to a person without transfer of the corresponding asset from which the income arises, the income so transferred would taxable in the hands of the transferor only (Section 60).

Where an income arises as a result of revocable transfer of asset, such income is to be taxed in the hands of the transferor (Section 61).

However, provision of section 61 would not apply where the trust is not revocable during the lifetime of the beneficiary and where the transferor derives no direct or indirect benefit from such income (Section 62).

-

Taxation of Private irrevocable trust – Brief Background

Under the Act, there are specific sections which lay down certain important provisions in respect of taxability of private trusts. These provisions are contained in section 160 to 166 of the Act. These sections (including their predecessors and those under The Wealth Tax Act, 1957) were subject matter of judicial interpretation by various courts.

In case of a private trust, the real owners of the income are the beneficiaries for whose benefit the trust has been settled. Therefore, the tax should ideally be levied in the hands of the beneficiaries. However, the Act provides for an alternate mechanism of recovering the tax from the trustees of the trust on behalf of the beneficiaries.

In this respect, section 160(1)(iv) of the Act treats the trustees of the trust declared by an instrument in writing who receive or are entitled to receive income on behalf of for the benefit of any person, as representative assessee. Similarly section 160(1)(v) treats the trustees of an oral trust, who receive or are entitled to receive income on behalf of for the benefit of any person, as representative assessee.

Further, section 161 prescribes the liability of the representative assessee. Section 161(1) reads as under:

“Every representative assessee, as regards the income in respect of which he is a representative assessee, shall be subject to the same duties, responsibilities and liabilities as if the income were income received by or accruing to or in favour of him beneficially, and shall be liable to assessment in his own name in respect of that income; but any such assessment shall be deemed to be made upon him in his representative capacity only, and the tax shall, subject to the other provisions contained in this Chapter, be levied upon and recovered from him in like manner and to the same extent as it would be leviable upon and recoverable from the person represented by him.”

Thus, section 161(1) states that tax shall be recovered from the trustees in the like manner and to the same extent as it would be leviable and recoverable from the person represented by him.

Section 166 states that “nothing in the foregoing sections in this Chapter shall prevent either the direct assessment of the person on whose behalf or for whose benefit income therein referred to is receivable, or the recovery from such person of the tax payable in respect of such income”

Thus, section 166 states that even the beneficiaries can be assessed in respect of the income of the trust received by the trustee on their behalf. This is how alternate mechanism exists under the Act to either assessee the beneficiaries i.e. the real owner of the income or the trustees in representative capacity.

Important findings in this regard are given by the Hon’ble Apex Court in case of CWT v. Trustees of H. E. H. Nizam’s Family (Remainder Wealth) Trust (1977) 108 ITR 555 (SC).

Section 164(1) states that:

where any income in respect of which the trustees are liable as representative assessees or any part thereof

(i) is not specifically receivable on behalf or for the benefit of any one person or

(ii) where the individual shares of the persons on whose behalf or for whose benefit such income or such part thereof is receivable are indeterminate or unknown

then tax shall be charged on the relevant income or part of relevant income at MMR.

Thus, in case of an indeterminate trust, subject to certain exceptions, the tax is paid by the representative assessee i.e. the trustees at MMR.

From the above discussion it can be deduced, that it is not the trust which is taxable. The beneficiaries are taxable and in the alternate the tax can be recovered from the trustees.

-

Status of the Trust

As can be seen from the above discussion, what is taxable is the income of the beneficiary and not the receipt by the Trust/ Trustee on behalf of the beneficiary. Thus, the trust per se is not taxable. In a way, a pass through status is given to the trust because of the peculiar relationship between the trustee and the beneficiary. Also, the liability to pay tax in a representative capacity is on the trustee and not on the trust per se. Can therefore, one can say that, trust is a person under the Act?

Section 2(31) of the Act defines person.

Under the definition of the term person, the trust can possibly be qualified as individual, AOP, BOI or artificial juridical person.

Trust is not a juristic person and therefore, cannot be considered as an artificial juridical person – 178 ITR 1(Mad) Thanti Trust v. WTO

Trust cannot be considered as a Body of Individuals – 188 ITR 253(Bom) Lalchand Tikamdas Makhija & Anr. v. CIT

Private trust is not an AOP – CWT v. Trustees of H. E. H. Nizam’s Family (Remainder Wealth) Trust (1977) 108 ITR 555 (SC). Also see 188 ITR 224(Bom) CIT v. Marsons Beneficiary Trust.

Though there are contrary judgments to the effect that the Trust would constitute an AOP – CIT v. Smt. Pushpawati 327 ITR 490 (Del)

As per section 161(1) of the Act, tax shall be levied upon and recovered from the trustee in like manner and to the same extent as it would be leviable upon and recoverable from the person represented by him. The Hon’ble Supreme Court in case of Nizam (supra) has interpreted the above provision to state that “the assessment of the trustee would have to be made in the same status as that of the beneficiary whose interest is sought to be taxed in the hands of the trustee”

Thus, the status of the trustee would depend upon the status of the beneficiaries. The above applies in case of a determinate trust.

However, the Court have also held that the trustees constitute an assessable unit and were liable to be taxed as an Individual – See 88 ITR 47(SC) Trustees of Gordhandas Govindram Family Charity Trust vs CIT, CWT v. Trustees of H. E. H. Nizam’s Family (Remainder Wealth) Trust (1977) 108 ITR 555 (SC), 221 ITR 649 (Mad), 263 ITR 428(Mad), 201 ITR 989(Cal) etc.

Even CBDT has accepted that the private discretionary trust is assessable as an Individual – Circular No. 6/2012, dt. 3rd August, 2012 reported in 346 ITR (St) 96.

The status of the Trust as an individual is possibly in case of a discretionary trust, where the income cannot be attributed to any beneficiary.

-

Taxability of Private Determinate Trust.

Status of the Trust –would take the same status as the beneficiaries to the extent of their share

Residential status of the Trust –would take the same status as the beneficiaries to the extent of their share

Taxability in the hands of the Trustee or beneficiary? –in so far as the private non-discretionary trust is concerned, the shares of the real owners of the income i.e. the beneficiaries is known and therefore, the income can be taxed either in the hands of the beneficiaries directly or in the hands of the trustees in their capacity of representative assessee. However, there would be no double taxation. This has been clarified by the Board in Circular No. 157

dt. 26.12.1974.Taxability in the hands of the trustee – in a representative capacity u/s 161(1) r.w.s. 160 of the Act. Tax shall be levied upon and recovered from him in like manner and to the same extent as it would be leviable upon and recoverable from the person represented by him.

The Supreme Court in case of Nizams (supra) has held that

“It is also necessary to notice the consequences that seem to flow from the proposition laid down in s. 21, sub-s. (1), that the trustee is assessable” in the like manner and to the same extent “as the beneficiary. The consequences are three-fold. In the first place, it follows inevitably from this proposition that there would have to be as many assessments on the trustee as there are beneficiaries with determinate and known shares, though, for the sake of convenience, there may be only one assessment order specifying separately the tax due in respect of the wealth of each beneficiary. Secondly, the assessment of the trustee would have to be made in the same status as that of the beneficiary whose interest is sought to be taxed in the hands of the trustee….And, lastly, the amount of tax payable by the trustee would be the same as that payable by each beneficiary in respect of his beneficial interest, if he were assessed directly.”

Benefits available –All the benefits, deductions or allowances which an individual beneficiary could have obtained are also available to the trustees assessed in representative capacity– for instance benefit u/s 54 of the Act. (See 237 ITR 82 (Bom) Mrs. Amy P. Cama, Trustee of the Estate of Late M. R. Adenwalla v. CIT)

Rate of tax –If taxable in hands of the beneficiaries then the normal rates applicable to the beneficiaries. Similar position to apply even if tax recovered from the Trustee in representative capacity. Section 161(1A) states that, where the income consists of any profits or gains of business, then the same is to be taxed at MMR, subject to certain exception. Further, special rates as are applicable to special category of income like long term capital gain would continue to apply. [See in favour – Mahindra & Mahindra Employees’ Stock Option Trust [2015] 44 ITR(T) 658 (Mumbai – Trib.), Jamsetji Tata Trust v. JCIT [2014] 148 ITD 388 (Mumbai – Trib.). Against – DCIT v. India Cements Educational Society [2016] 46 ITR(T) 80 (Chennai – Trib.) and Companies Incorporated in Mauritius, In re [1997] 224 ITR 473 (AAR)]

-

Taxability of Private Discretionary Trust.

Status of the Trust –would take the same status as the beneficiaries since the representative assessee has to be taxed in the like manner and to the same extent as per section 161 [See the judgment of the Apex Court in case of CIT v. Smt. Kamalini Khatau – 209 ITR 101(SC)]. Therefore, if all the beneficiary are of same status i.e. either individual or company etc. then the trustees would take the same status.

However, if the beneficiaries are carrying different status, then the status of the trustees cannot be determined. In such cases, the Courts have held that the trustees should be taken an assessable unit liable to be taxed as an individual (as discussed above).

Proviso to section 164(1) states that, in certain cases tax would be leviable as if it were the total income of an AOP. Proviso to section 164(1) only lays down that the rate of AOP would apply and it cannot be inferred therefrom that the trust would be considered as an AOP.

Residential status of the Trust –would take the same status as the beneficiaries. If all are resident, the Trustees would be treated as a resident and vice versa. However, in case where some of the beneficiaries are resident and some are not, then determination of the residential status of the trustees is a grey area with no reasonable certainty. Though there are opinions to the effect that the residential status of the trustees would be taken into consideration, however, there is no or less legal backing.

Taxability in the hands of the Trustee or beneficiary –

In so far as the private non-discretionary trust is concerned, the shares of the real owners of the income i.e. the beneficiaries is not known. Where the income of the trust accruing in a particular year is not distributed amongst the beneficiaries, one would not be aware about the income of any particular beneficiary. In such a case, the tax has to be paid by the trustee in representative capacity u/s 164(1).

In case where the income has been distributed to the beneficiaries, tax can be recovered from the trustee u/s 164(1). Further, in such cases, the Courts have held that the tax can be recovered from the beneficiaries also [See Kamalini Khatau (supra)].

However, as already specified earlier there cannot be any double taxation.

Taxability in the hands of the trustee –in a representative capacity u/s 161(1) r.w.s. 160 of the Act. Tax shall be levied upon and recovered from him in like manner and to the same extent as it would be leviable upon and recoverable from the person represented

by him. [See Kamalini Khatau (supra)].Benefits available – it will be difficult to argue that all the benefits available to the individual would be available to the trustee, unless any specific condition to claim the deduction etc. has been fulfilled on behalf of any specific beneficiary. However, since the trustee would be assessable as individual, all benefits so available to an individual would be available to the trustee.

Rate of tax –

Section 164(1) states that the income of an indeterminate trust would be taxable at MMR. Though it uses the word ‘charge’, section 164 does not create a charge [See Kamalini Khatau (supra)].

Proviso, to section 164(1) provides for exceptions to the above rate of MMR and in case of such exceptions, the rate applicable to AOP would apply.

If tax is recovered from the beneficiaries, it is doubtful whether the rates as applicable to the beneficiaries would apply or whether MMR would apply in accordance with section 164(1).

Further, section 161(1A) which provides for taxation of business income at MMR, would equally apply in case of indeterminate trust.

Also, as discussed earlier, special rates as are applicable to special income like long term capital gain would continue to apply.

E. Other issues:

-

Income retains the same character when taxed in the hands of the trustees or the beneficiary – 59 ITR 666(SC) – CIT v. H.E.H. Mir Osman Ali Bahadur. The natural corollary of this would be that the tax would also be charged at the specific rates applicable to special category of income (already discussed above).

-

Credit of Tax in case of other person –There is a possibility that in case of a determinate trust, the Officer, by resorting to section 166 and in case of a discretionary trust, by resorting to the judgment in case of Kamalini Khatau (supra), assess the beneficiary though tax would have been paid by the Trustees; or a reverse case where the tax is paid by beneficiary, the Officer would like to tax the Trustees. In such cases, the Courts have held that credit of taxes paid by one should be given to the other. [See (1966) 60 ITR 74 (SC) ITO v. Bachu Lal Kapoor, 33 ITR 517(Bom) Trustees Of Late Sri R.J. Vakil v. CIT]

-

The representative assesse is also liable for penaltyas by virtue of Section 160(2), such representative assessee is deemed to be assessee [See 100 ITR 551(All) Pratap Chandra v. ITO]

-

Taxability in the hands of the transferor –Where a settlor irrevocably transfers any asset by way of a trust to a trustee, and if such an asset is held as capital asset in his hands, then such transfer would be exempt from taxation as per section 47(iii) of the Act. Accordingly, the recipient i.e. the beneficiary/ trustee will get the cost of acquisition of the previous owner as per section 49(1) and even the period of holding would include the period for which such asset was held by the previous owner.

In case, if the settlor holds the asset as stock in trade, then business loss would be booked in his case. Correspondingly, the recipient would not get the advantage of extended period of holding and cost to the previous owner

-

Taxability u/s 56(2)(x)

Background

Section 4,5 have to be given effect to read with section 161. As held by Apex Court in case of Nizam (supra), trustees are taxable u/s 4 and 5 read with section 160 and 161. Without section 160, 161, no effect can be given to section 4 and 5. Same principle would be applicable to section 56(2)(x). Thus, even while interpreting section 56(2)(x), reference should be made to section 160 and 161 of the Act to arrive at a conclusion that it is not the trust per se which is a taxable entity, but the beneficiary and alternatively the trustee on behalf of the beneficiary which can be taxed.

Let us analyse various transactions to which section 56(2)(x) can be attracted.

Settlement of any sum of money or any property by the settlor on the trustee to be used for the benefit of the beneficiaries or any subsequent donation by any person.

Taxability in the hands of the trustee –

Section 56(2)(x) levies tax on receipt of property without consideration or for inadequate consideration. When a settlor settles a property on the trustee, there is an obligation on the trustee to use the property for the object of the trust and for the benefit of the beneficiaries. It can therefore, be said that on settlement of Trust, when the Trustee is receiving the property, there is an obligation accepted by the Trustee and acceptance of such obligation would be an adequate consideration for the receipt of property, thereby ousting the applicability of section 56(2)(x).

Trustee receives the property which is to be held in a fiduciary capacity for the benefit of the beneficiaries. No gain, profit or rights accrue in the favour of the trustee in his personal capacity. In fact section 51 of the Indian Trust Act, 1882, clearly states that a trustee may not use or deal with the trust-property for his own profit or for any other purpose unconnected with the trust. In such a scenario, it cannot be said that Trustee acquires a right in rem or any beneficial right in the property which would be sine qua non for being taxed u/s 56(2)(x).

Reference in this regard can be made to the judgment of the Apex Court in case of Nizam, wherein the Court held that “the very concept of a trust connotes that though the legal title vests in the trustee, he does not own or hold the trust properties for his personal benefit but he holds the same for the benefit of others, whether individuals or purposes.” Further, in the said case, the Court held that under the Wealth tax Act, 1957, what can be taxed in the hands of the trustee would be the value of the interest of the beneficiaries in the property and not the value of the property per se. By extending this logic, one can state that whatever is held by the Trustee is for the beneficiaries and

therefore, nothing can be taxed in his hands.The above reasoning would apply whether a trust is determinate or indeterminate.

Taxability in the hands of the beneficiary–

Determinate trust

In case of determinate trust, one view which exists is that the beneficiary doesn’t receive any property physically, though he receives a beneficial interest in the property as the legal ownership of the property vests with the trustee. As per section 3 of the Indian Trust Act, 1882, the “beneficial interest” or “interest” of the beneficiary is his right against the trustee as owner of the trust-property. The said expression has been interpreted by the Supreme Court in case of W.O. Holdsworth v. The State of Uttar Pradesh [1958] 33 ITR 472 (SC) as “The trustee is thus the legal owner of the trust property and the property vests in him as such. He no doubt holds the trust property for the benefit of the beneficiaries but he does not hold it on their behalf. The expression “for the benefit of” and “on behalf of” are not synonymous with each other.” Thus, the rights which the beneficiary get is a limited one and such right in the property is not covered within the definition of term property as covered by section 56(2)(x)

and therefore, no tax would be leviable.The other view which exist is that the property is received by the trustee on behalf of and for the benefit of the beneficiary. Such receipt of the property by the beneficiary direct would have attracted the provisions of section 56(2)(x) of the Act and therefore, the term “in the like manner and to the same extent” would bring such income within the ambit of section 56(2)(x).

However, the above view is subject to the conditions mentioned in the trust deed in this regard. The Madras High Court in case of CIT vs. Muthukrishnan 260 ITR 526(Mad), held that where the specific sum of amount was required to be credited to the corpus of the trust and the same was to be distributed to the beneficiaries only in the year of termination of the trust, such amount cannot be taxed in the hands of the beneficiaries and therefore, in the hands of the trustees. Similarly there may be a case where the beneficiary of income may be one person and beneficiary of corpus may be another person. In such case, one has to look into the trust deed to consider the tax treatment u/s 56(2)(x).

Indeterminate trust

In case of an indeterminate trust, on settlement, the trustee is granted the power and discretion to decide the beneficiary who is supposed to receive the property of the trust. The Supreme Court has held in case of CWT v. Estate of HMM Vikramsinhji of Gondal – 268 CTR 232 (SC), that in case of a discretionary trust, the beneficiary acquires nothing more than a hope that the discretion would be exercised in his favour. In such a case, there is no question of

taxability in the hands of the beneficiary.

Exception as given under proviso to section 56(2)(x)

Ten clauses are given in proviso to section 56(2)(x) which provides for the exceptions. The tenth clause is dealt with separately.

If receipt by the beneficiary from the settlor would be covered by such exceptions, then no taxability arises.

For example:

If all beneficiaries of the trust are relatives of the settlor/ donor, then the receipt of the property cannot be taxed. If it is a determinate trust and only some of the beneficiaries are relatives of the settlor/ donor, then to the extent of their share, section 56(2)(x) cannot be attracted.

In case of a discretionary trust, the benefit of this exemption can be taken only when all the beneficiaries are relative of the settlor/ donor.

Similarly, receipt of property on the occasion of the marriage of the beneficiary cannot be taxed.

Thus, one has to look at all the exceptions provided in the proviso and nature of the trust to determine the exemption available under the relevant clauses.

Receipt of property from an individual by a trust created or established solely for the benefit of relative of the individual [Clause (X) of the proviso to section 56(2)(x)]

The said clauses state that receipt by a trust from an individual would be exempt if the beneficiaries are the relatives of the individual. Merely because the exception clause provides for only one situation does not mean the other situations would be taxable. It is settled law that an exemption may be out of abundant caution and cannot be interpreted to mean that the transaction was otherwise exigible to tax [See CIT v. Madurai Mills – 89 ITR 45 (SC)].

Also, as already discussed above, one has to take into consideration the provisions of section 160 and 161 while determining the taxation of receipts u/s 56(2)(x) i.e. tax is not levied on the trust but on the beneficiaries and only in the alternate it is recovered from the trustee.

Also, interesting to note is the fact that under Clause (I) of the proviso, receipt from any relative is exempt whereas under this clause, receipt by trust consisting of all relatives is exempt.

Distribution / payment by the trustee out of the corpus or out of the income to the beneficiary.

First and foremost thing – when the receipt of the sum of money/ property/ accrual of any income has already been subject matter of tax in the hands of the trustee or beneficiary, then on distribution of such income/ property, no taxable event arises in the hands of the beneficiary. Accordingly, neither the trustee can be taxed in a representative capacity nor the beneficiary. This is because, there can be no double taxation of the same income.

If on the receipt of any sum of money/ property, no tax was paid by the beneficiary or by the trustee on behalf of the beneficiary, in such cases a taxable event arises on receipt of such property or sum of money by the beneficiary on distribution. Such sum of money/ property would be taxable as the same can be stated to be received without consideration.

For example, in a case of a discretionary trust, where the receipt of property on settlement is held to be not taxable in light of the above discussion, then on distribution to the beneficiary, the same can be held to be taxable u/s 56(2)(x).

Another view in this regard is that receipt by beneficiaries on the distribution of the corpus of trust or otherwise cannot be termed to be an amount received ‘without consideration’ as such amount would be on extinguishment of beneficial right in the property. Such an argument would not be helpful in case of a discretionary trust, as already discussed above, in such cases, the beneficiary does not acquire any right but only a hope.

Applicability of GAAR (Chapter XA of the Act)

If a person creates a trust with a main purpose of obtaining a tax benefit, then the said creation of the trust can be treated as an impermissible avoidance arrangement and the provisions of GAAR may be invoked, subject to the threshold prescribed in this regard.

[Source : Paper printed in the Souvenir of National Tax Conference held on 16th & 17th February, 2019 at Aurangabad]