Preamble:

Real estate sector, being one of largest contributor to GDP, plays important role in Indian economy. This sector, more specifically residential segment, has been a preferred investment for Indians from a long time.

To boost up the growth in Real estate sector and with a vision of housing for all, the GST Council, in its 33rd and 34th meeting held on 24.02.2019 and 19.03.2019 respectively, proposed a new scheme with avowed objective to boost up the growth of residential segment of Real estate sector.

For operationalizing such new scheme of taxation for Real estate, following Notifications no. 3/2019– Central Tax (Rate) to 8/2019 – Central Tax (Rate) were released on 29.03.2019 which are effective from 01.04.2019. These notifications have revamped entire system of taxing Real estate sector under GST legislation.

| Notification No. | Subject Content |

| 3/2019 – CT (R) | Amended GST rates for Real estate sector |

| 4/2019 – CT (R) | Granted exemption in respect of development rights, FSI and Long-term lease attributable to sale of under construction residential apartments |

| 5/2019 – CT (R) | Prescribed reverse charge in respect of non-exempt development rights, FSI and Long-term lease |

| 6/2019 – CT (R) | Provided the deferment of tax payable in case of area sharing arrangement on allotment of constructed area to landowner and also tax payable (if any) on the development rights to the earlier of the date of completion of the project or first occupancy

Also provided deferment of tax payment to the earlier of the date of completion of the project or first occupancy, in respect of Development rights, TDR, FSI, Lease premium, etc. attributable to unsold residential apartments |

| 7/2019 – CT (R) | Prescribed reverse charge in respect of shortfall of procurement of goods or services from registered persons

It also prescribes reverse charge in respect of cement and capital goods procured from unregistered persons |

| 8/2019 – CT (R) | Prescribed tax rate in respect of shortfall of procurement of goods or services (Other than Cement and Capital goods) from registered persons |

This article outlines the important aspects of this new scheme of taxation for Real estate sector effective from 01.04.2019.

New scheme of taxation for Real estate sector w.e.f. 01.04.2019:

Applicability of new scheme of taxation:

The new scheme of taxation is effective w.e.f. 01.04.2019 and applicable to the following:

• New projects commencing on or after 01.04.2019;

• Ongoing projects except when the registered person has opted to continue Old scheme of taxation appliable prior to 01.04.2019.

Para (v) of Notification no. 3/2019 – CT(R) dated 29.03.2019 defines the term “Ongoing project” to mean a project which meets all the following conditions, namely-

a) commencement certificate in respect of the project, where required to be issued by the competent authority, has been issued on or before 31st March, 2019, and it is certified by any of the following that construction of the project has started on or before 31st March, 2019:

(i) an architect registered with the Council of Architecture constituted under the Architects Act, 1972 (20 of 1972); or

(ii) a chartered engineer registered with the Institution of Engineers (India); or

(iii) a licensed surveyor of the respective local body of the city or town or village or development or planning authority.

b) where commencement certificate in respect of the project, is not required to be issued by the competent authority, it is certified by any of the authorities specified in sub- clause (a) above that construction of the project has started on or before the 31st March, 2019;

c) completion certificate has not been issued or first occupation of the project has not taken place on or before the 31st March, 2019;

d) apartments being constructed under the project have been, partly or wholly, booked on or before the 31st March, 2019.

Option available to builders in respect of ongoing project as on 01.04.2019

In respect of Ongoing projects as on 01.04.2019, the Builders were provided one-time option:

• To pay tax at existing effective rates i.e. 8% (affordable houses) or 12% (others) with Input tax credit (‘ITC’); or

• To pay tax at new rate i.e. 1% (affordable houses) or 5% (others) without ITC.

Above option was allowed by filing notified form on or before 10th May 2019 (later extended to 20th May 2019). In case of failure to exercise option, new taxation scheme (of paying tax at concessional rate at 1% or 5%) would apply by default.

Tax implications in respect of Ongoing Projects for which builder has opted for Old scheme:

Applicable tax rates in respect of Ongoing projects where the builder has opted for Old scheme of taxation are as under:

| Particulars | Effective Tax Rate |

| Sale of under-construction residential affordable house | 8% (with ITC) |

| Sale of under-construction residential units (other than affordable) | 12% (with ITC) |

| Sale of under-construction commercial units | 12% (with ITC) |

| Sale of residential and/ or commercial units Post project completion | Not taxable |

Following are the important implications in respect of above-mentioned ongoing projects:

• Accumulated ITC as on 31.03.2019 will remain intact;

• Credit of tax paid for inputs, input services and capital goods procured on or after 01.04.2019 can be availed;

• Output tax liability can be discharged from ITC balance;

• No stipulation of mandatory procurement of 80% of input and input services from registered vendors;

• No stipulation for payment under RCM on procurement from unregistered person of Cement and Capital Goods.

Tax implications in respect of New projects commencing from 01.04.2019 or Ongoing Projects for which builder has not opted for Old scheme:

Applicable tax rates in respect of New projects commencing from 01.04.2019 or ongoing projects where the builder has not opted for Old scheme of taxation are as under:

| Particulars | Effective Tax Rate | Mode of discharge of tax liability |

| Sale of under-construction residential affordable house (Including houses under Specified Schemes) | 1% (without ITC) | Cash |

| Sale of under-construction residential house (other than affordable) | 5% (without ITC) | Cash |

| Sale of under-construction commercial units in Residential Real Estate Project (‘RREP’) | 5% (without ITC) | Cash |

| Sale of under-construction commercial units other than in RREP (Mixed projects) | 12% (proportionate ITC) | Cash / ITC |

| Sale of under-construction commercial units (in exclusive commercial complex) | 12% (with ITC) | Cash / ITC |

| Sale of completed residential and/or commercial units Post project completion | Not taxable | NA |

The builder needs to comply with following conditions:

• Non availment of ITC:

The builder is not entitled to ITC in respect of supplies used in construction services taxed at concessional rate of 1% or 5%.

• Reversal of ITC claimed till 31.03.2019:

The builder needs to reverse the ITC availed from inception of ongoing projects to the extent it relates to construction services to be taxed at 1% or 5%. Accumulated ITC as on 31st March, 2019 attributable to installments due on or after 01.04.2019 (to be taxed at concessional rate) is to be reversed.

Following are the procedural aspects in respect of ITC reversal:

- Reversal is to be worked out project wise;

- The reversal is to be done before due date for filing of return for September, 2019 (i.e. 20.10.2019);

- Such reversal can be done either by utilizing ITC balance lying in the electronic credit ledger or by making cash payment;

- Application can be made in in Form GST DRC – 20 to Commissioner for seeking extension of time and instalments for payment. The Commissioner has discretionary power to permit extension of time for period not exceeding 24 months. In such a case, Interest at the rate of 18% p.a. will apply from 20th October 2019 till date of payment in instalments.

• Mandatory procurement from registered persons:

The builder is obliged to procure 80% of value of input and input services from registered persons in respect of projects which are taxed at concessional rate of 1% or 5%.

In case of shortfall of mandatory procurement of 80% from registered persons, the builder is liable to pay tax at the rate of 18% on such shortfall under Reverse Charge Mechanism (‘RCM’).

For calculating shortfall, following procurements should be excluded:

- Development rights and FSI;

- Long term lease of land (against upfront payment in the form of premium, salami, development charges etc.);

- Motor spirit, High speed diesel and Natural gas;

- Electricity.

In respect of following purchases, builder is liable to pay tax at following rates under RCM:

- 28% on Cement purchased from unregistered person;

- Applicable rate on purchase of Capital goods from unregistered person.

In order to satisfy aforesaid condition of mandatory procurement, the registered person (i.e. Builder) shall maintain project wise account of inward supplies from registered and unregistered supplier and calculate tax payments on the shortfall at the end of each financial year. Builder shall submit the above details in the prescribed form electronically on the common portal by end of the quarter (i.e. 30th June) following the financial year. Such a form is not yet notified.

Tax liability on the shortfall of inward supplies from unregistered person to be added to output tax liability in the month of June following the end of the financial year.

However, the liability on Cement and Capital goods purchased from unregistered persons needs to be discharged under RCM on monthly basis.

Meaning of important terms as given in Notification no. 03/2019-CT(R) dated 29.03.2019:

• “Residential Real Estate Project (RREP)” shall mean a Real Estate Project (‘REP’) in which the carpet area of the commercial apartments is not more than 15 % of the total carpet area of all the apartments in the REP.

• “Real Estate Project (REP)” shall have the same meaning as assigned to it in in clause (zn) of section 2 of the Real Estate (Regulation and Development) Act, 2016;

The term ‘Real Estate Project’ is defined under Section 2(zn) Real Estate (Regulation and Development) Act, 2016 to mean the development of a building or a building consisting of apartments, or converting an existing building or a part thereof into apartments, or the development of land into plots or apartment, as the case may be, for the purpose of selling all or some of the said apartments or plots or building, as the case may be, and includes the common areas, the development works, all improvements and structures thereon, and all easement, rights and appurtenances belonging thereto;

• “Affordable residential apartment” shall mean:

a) Residential apartment (in new project or ongoing project) having carpet area not exceeding 60 square meter in metropolitan cities or 90 square meter in cities or towns other than metropolitan cities and for which the gross amount charged is not more than ` 45 lakhs.

b) an apartment being constructed in an ongoing project under any of the schemes specified in sub-item (b), sub-item (c), sub-item (d), sub-item (da) and sub-item (db) of item (iv); sub-item (b), sub-item (c), sub-item (d) and sub-item (da) of item (v); and sub-item (c) of item (vi), against serial number 3 of Notification no. 11/2017-CT(R) dated 28.06.2017, in respect of which the promoter has not exercised option to pay CGST under Old scheme of taxation.

• ‘Metropolitan cities’ include following:

Bengaluru, Chennai, Delhi NCR (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata, Mumbai (whole of Mumbai Metropolitan region (MMR) i.e. consists of 8 Municipal corporation and 9 Municipal councils around Mumbai).

• Threshold Value of `45 lakhs as mentioned above in definition of ‘Affordable Residential Apartment’ will be determined as a sum of following:

- Consideration charged for services;

- Amount charged for the transfer of land or undivided share of land, as the case may be including by way of lease or sublease;

- Any other amount charged from the apartment buyer including development charges, parking charges. preferential location charges, common facility charges, etc.

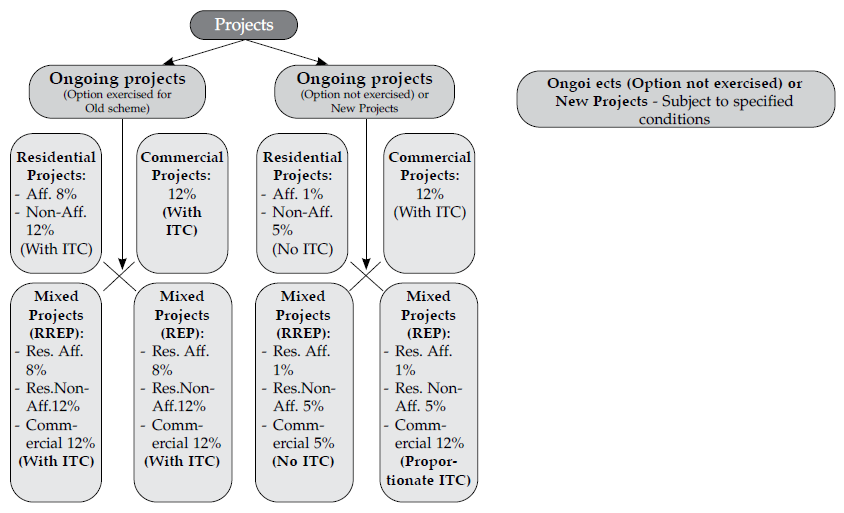

Snapshot of new scheme of taxation:

Tax implications of TDR, FSI and long-term lease transferred on or after 01.04.2019:

Tax implications in respect of Transfer of Development rights, TDR, FSI or provision of long-term lease on or after 01.04.2019 are summarized as under:

| Particulars | Transfer of TDR/FSI/ Long term Lease | |

| For construction of Residential apartments | For construction of Commercial apartments | |

| Taxability | • Development rights / TDR / FSI / long term lease attributable to sale of under construction residential units is exempt.

• Development rights / TDR / FSI / long term lease attributable to unsold residential flats on the date of issuance of completion certificate or first occupation, whichever is earlier, is taxable. |

• There is no exemption in respect of transfer of DR / TDR / FSI / Lease used for sale of under construction commercial units.

• It may be noted that there is a specific exemption in respect of upfront premium for long term lease of 30 years or more, of industrial plots or plots for development of infrastructure for financial business, provided by the State Government Industrial Development Corporations or Undertakings, etc. |

| Date of payment | In area sharing, revenue sharing or outright purchase of DR/TDR/FSI/ Lease, date of payment would be earlier of:

• Issuance of Completion certificate; or • First occupation of project. |

• In case of Outright purchase:

Date of transfer of DR/TDR/FSI/ Lease. • In case of Area Sharing: Earlier of Issuance of Completion certificate or First occupation of project. • In case of Revenue Sharing: As and when the revenue share is paid to landowner. |

| Person liable to pay tax | Builder (Promoter – Developer) is liable to pay tax under RCM. | Builder (Promoter – Developer) is liable to pay tax under RCM. |

| ITC of tax paid under RCM by Developer | • ITC is not eligible where builder has opted for new scheme of taxation;

• ITC is eligible where builder has opted for Old scheme of taxation. |

• For Commercial projects, ITC is eligible;

• For REP, ITC attributable to Commercial portion can be claimed; • For RREP (with Commercial portion less than 15%), ITC is not eligible for developer opting new scheme. However, same is eligible for developer opting Old scheme. |

| GST Rate | Tax would be lower of:

• 18% on Value of DR/TDR/FSI in proportion to carpet area of such unsold flats to total carpet area of residential flats; or • 1% / 5% of Value of such unsold flats. — Working of value of DR/TDR/FSI, etc. and value of unsold flats to be done as mentioned below. |

18% on Value of DR/TDR/FSI/Lease.

— Working of value of DR/TDR/FSI, etc. to be done as mentioned below. |

| Valuation | Valuation of DR/TDR/FSI/Lease:

• Outright purchase: value of monetary consideration paid for outright purchase. • Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI. • Revenue sharing: monetary consideration paid to the Landowner as revenue share. Value of unsold flats: It is deemed as equal to value of similar apartments charged by the promoter nearest to the date of completion certificate or first occupation, whichever is earlier. |

Valuation of DR/TDR/FSI/Lease:

• Outright purchase: value of monetary consideration paid for outright purchase. • Area sharing: value of similar units charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI. • Revenue sharing: monetary consideration paid to the Landowner as revenue share. |

Tax implications of area allotted by builder to the landowner:

This is a transaction of area sharing between landowner and developer. In this case, developer provides construction services (i.e. apartments are allotted) to the landowner against receipt of consideration in form of development rights. Such construction services are taxable supply under Section 7 of CGST Act, 2017 (hereinafter referred to as ‘Act’) and hence liable to GST unless otherwise exempted.

| Particulars | Provision of construction services | |

| For construction of Residential apartments | For construction of Commercial apartments | |

| Taxability | Liable to GST. | Liable to GST. |

| Date of payment | In area sharing, time of supply will be earlier of:

• Issuance of Completion certificate; or • First occupation of project. |

In area sharing, time of supply will be earlier of:

• Issuance of Completion certificate; or • First occupation of project. |

| Person liable to pay tax | Builder (Promoter – Developer) is liable to pay tax under forward charge. | • Builder (Promoter – Developer) is liable to pay tax under forward charge. |

| ITC attributable to area allotted to landowner | Developer is not entitled to ITC relatable to owner’s area. | • In case of RREP, developer is not entitled to ITC relatable to commercial units on which output tax is paid at the rate of 5%.

• In case of REP, developer is entitled to proportionate ITC to the extent related to commercial units. • In case of exclusive commercial project, developer is entitled to such ITC. |

| GST Rate | • In case of Residential Affordable apartments, 1% of value of such apartments.

• In case of Residential Non-affordable apartments, 5% of value of such apartments. |

• In case of Commercial apartments in RREP, 5% of value of such units.

• In case of Commercial apartments in REP or in exclusive commercial project, 12% of value of such units. |

| Valuation | Total amount charged for similar apartments in the project from the independent buyers nearest to the date of transfer of development rights. | Total amount charged for similar apartments in the project from the independent buyers nearest to the date of transfer of development rights. |

In case where the landowner sells the apartments or units allotted to him during construction, he would be liable to GST on sale of such under-construction apartments or units. The rate of tax would be 1% on residential affordable apartments, 5% on other residential apartments, 5% on commercial apartments in RREP and 12% on commercial apartments in REP or exclusive commercial project.

Landowner is entitled to input tax credit of GST levied by developer on construction of owner’s flat subject to cap of output tax payable on apartments or units sold under construction.

Conclusion:

The avowed objective of this new scheme of taxation was to rationalize the scheme of Real estate taxation and to boost up the demand for residential apartments by reducing the GST rates drastically. However, this move of reducing GST rates has come along with blanket blockage of input tax credit. There has been hue and cry that denial of input tax credit is counterproductive in certain circumstances and will make houses costlier. Someone has aptly commented that these amendments are like chopping the head to get rid of headache. In fact, the amend scheme of taxation has become highly complicated and tax inefficient in case of joint development especially for commercial projects. The Government should have granted option to builders to follow old or new scheme of taxation.