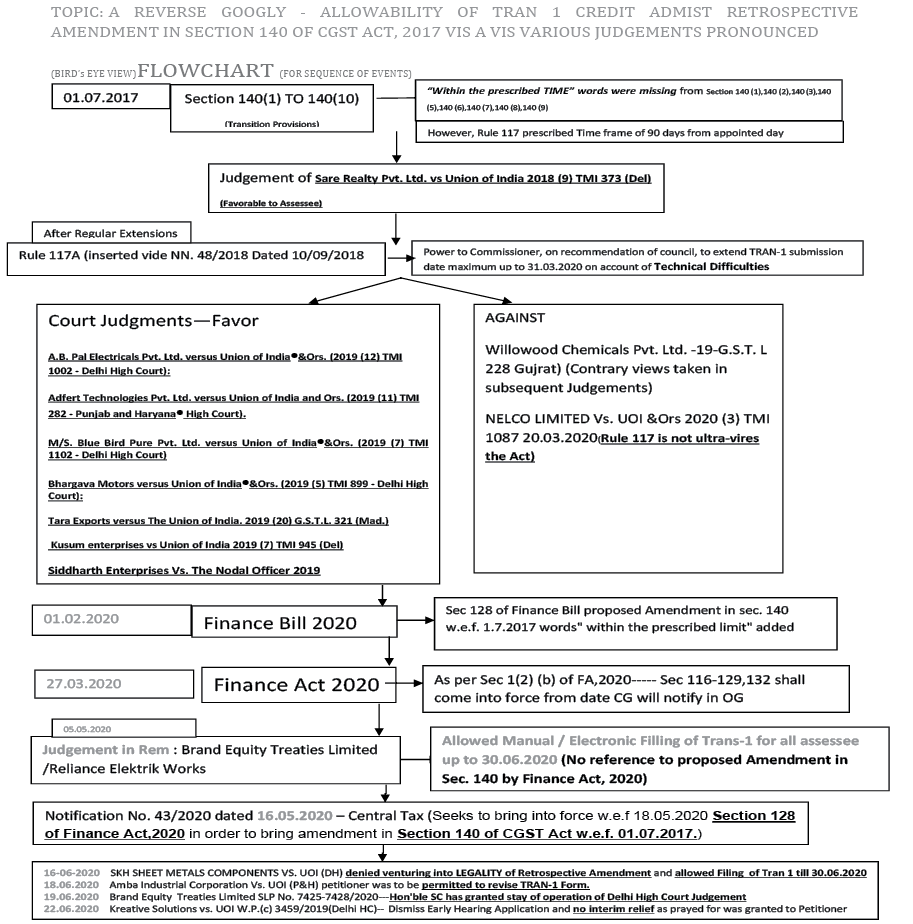

ANALYSIS OF ABOVE EVENTS:

1) Analysis of Judgement of Reliance Electric Works (Delhi HC-Writ Pronounced on 5-5-2020)

(5 applicants seek the identical relief for identical controversy)

1.1 Relief:–

-

To permit the petitioners to avail ITC of accumulated CENVAT credit by filling Trans 1 beyond time prescribed in Rules.

-

Rule 117 is arbitrary, unconstitutional & violative of Article 14 (Equality before Law) to the extent it proposes time limit for c/f of CENVAT Credit to GST regime.

1.2 Facts:– There has been delay in filling of Form Trans 1 and factual situation in each one of present case is different and is substantially distinguishable from cases where relief already granted on the ground that the delay was not on account of Technical glitch on the portal, but due to technical difficulties at the end of assessee.

The case relates only to the Transitional Credit u/s 140(1) i.e. Credit as per

Return immediately filed before appointed date.

1.3 Arguments forwarded by Assessee:–

-

CENVAT Credit accumulated in erstwhile regime represents the property of petitioner which is vested Right and cannot be taken away on failure to fulfill conditions procedural in nature. It is a constitutionally protected right.

-

Time limit in Rule 117 is procedural in nature and not mandatory, as it is without substantive provision.

1.4 Arguments of the Department:–

-

Delay is due to casual approach & negligence, not attributable to any technical glitch.

-

Defended Rule 117 by referring to section 164 of CGST Act.

-

“in such manner as may be prescribed” in section 140(1) empowers Govt. to fix time frame.

-

ITC is a benefit/ concession extended as per scheme of the statute subject to certain conditions and is not a vested right.

1.5 Held:- (It can be classified under 3 broad heads)

-

TIME PERIOD UNDER RULE 117

-

Time period for furnishing Trans 1 has been extended from time to time by Govt. Acknowledging the technical difficulties faced by the taxpayers owing to several judgments and committee reports and finally 117A was inserted vide Notification 48/2018 inserted to empower commissioner , on recommendation of council, to extend TRAN-1 submission date maximum up to 31-3-2020 on account of Technical Difficulties

-

This also substantiates that the period for filing the TRAN-1 is not considered – either by the legislature, or the executive as sacrosanct or mandatory and is extended from time to time, largely on account of its inefficient network.

-

The Act does not completely restrict the transition of CENVAT credit in the GST regime by a particular date, and there is no rationale for curtailing the said period, except under the law of limitations.

-

Taxpayers cannot be robbed of their valuable rights on an unreasonable and unfounded basis of them not having filed TRAN-1 Form within 90 days, when civil rights can be enforced within a period of three years from the date of commencement of limitation under the Limitation Act, 1963.

-

Section 140 (1) is categorical. It states only the manner i.e. the procedure of carrying forward was left to be provided by use of the words “in such manner as may be prescribed”.

-

In absence of any consequence being provided under Section 140, to the delayed filing of TRAN-1 Form, Rule 117 has to be read and understood as directory and not mandatory. The procedure could not run contrary to the substantive right vested Section 140(1).

-

However, it does not mean that the availing of CENVAT credit can be in perpetuity. In absence of any specific provisions under the Act, we would have to hold that in terms of the residuary provisions of the Limitation Act, the period of three years should be the guiding principle and thus a period of three years from the appointed date would be the maximum period for availing of such credit. (Used Residuary Provision of the Limitation Act)

-

-

CENVAT CREDIT IS A VESTED RIGHT

-

The credit of taxes already paid in every sense stood accumulated, acquired and vested on the appointed date as it was reflected in the said CENVAT credit register in the previous regime.

-

The CENVAT credit which stood accrued and vested is the property of the assessee, and is a constitutional right under Article 300A of the Constitution. The same cannot be taken away merely by way of delegated legislation by framing rules, without there being any overarching provision in the GST Act.

-

This credit, under the Section 140(1), has to be carried forward and in that sense, the vested right of the property of the petitioner stood accrued and the same cannot be taken away by the respondents by way of Rules.

-

-

TECHNICAL DIFFICULTY (A broad definition)

-

“Technical difficulty on the common portal” imply? There is no definition to this concept and the respondent seems to contend that it should be restricted only to “technical glitches on the common portal”. However, “Technical difficulty” is too broad a term and cannot have a narrow interpretation, or application. Further, technical difficulties cannot be restricted only to a difficulty faced by or on the part of the respondent. It would include within its purview any such technical difficulties faced by the taxpayers as well, which could also be a result of the respondent’s follies. Thus, the phrase “technical difficulty” is being given a restrictive meaning which is supplied by the GST system logs.

-

There could be various different types of technical difficulties occurring on the common portal which may not be solely on account of the failure to upload the form. The access to the GST portal could be hindered for myriad reasons, sometimes not resulting in the creation of a GST log-in record. Further, the difficulties may also be offline, as a result of several other restrictive factors. It would be an erroneous approach to attach undue importance to the concept of “technical glitch” only to that which occurs on the GST Common portal, as a pre- condition, for an assessee/taxpayer to be granted the benefit of Sub- Rule (1A) of Rule 117.It cannot be arbitrary or discriminatory, if it has to pass the muster of Article 14 of the Constitution.

-

1.6 IMPACT

Permitted to file relevant TRAN-1 Form on or before 30.06.2020. Respondents are directed to either open the online portal so as to enable the Petitioners to file declaration TRAN-1 electronically, or to accept the same manually. Respondents shall thereafter process the claims in accordance with law. We are also of the opinion that other taxpayers who are similarly situated should also be entitled to avail the benefit of this judgment.

Note: Supreme Court has stayed Delhi High Court decision in case of Brand Equity Treaties Ltd. v. Union of India [2020] 116 taxmann.com 415 (Delhi); issues notice

The other decisions as referred above for allowing transitional credits are discussed as follows:

-

A. B. Pal Electricals Pvt. Ltd. v. Union of India & Ors. (17.12.2019) (2019 (12) TMI 1002– Delhi HC): In this case it was held that the CENVAT credit accumulated in erstwhile regime represents the property of petitioner and a constitutionally protected right under Article 300A of the Constitution of India. There is no law which extinguishes the said right to property of the assessee of the credit standing in their favor.

-

M/S. Blue Bird Pure Pvt. Ltd. v. Union of India & Ors.(22.07.2019) (2019 (7) TMI 1102 – Delhi High Court)

-

Sare Realty Pvt. Ltd. vs Union of India 2018 (9) TMI 373 (Del) (01.08.2018)

-

Bhargava Motors v. Union of India & Ors. (2019 (5) TMI 899– Delhi High Court) (13-05-2019): It was observed by the Hon’ble High Court that the GST system is still in a ‘trial and error phase’ as far as its implementation is concerned. Further, the Petitioner’s difficulty in filling up a correct credit amount in the TRAN-1 form is a genuine one which should not preclude him from having his claim examined by the authorities in accordance with the law. A direction is accordingly issued to the Respondents to either open the portal so as to enable the Petitioner to again file TRAN-1 electronically or to accept a manually filed TRAN-1.

-

Kusum enterprises v. Union of India 2019 (7) TMI 945 (Del) (12.07.2019)

-

Adfert Technologies Pvt. Ltd. v. Union of India and Ors. (04.11.2019) (2019) (11) TMI 282– Punjab and Haryana

-

High Court). In this case, a detailed order accepting the claims of the petitioners has been passed. It is pertinent to mention here that the SLP filed by the Government against this order was dismissed by the Hon’ble Supreme Court. [2020] 115 taxmann.com 29 (SC)

-

Aadinath Industries & Anr vs. UOI (20.09.2019)

-

Lease Plan India Pvt. Ltd v. Govt. of National Capital Territory of Delhi & Ors.(15.10.2019)

-

Tara Exports v. The Union of India. 2019 (20) G.S.T.L. 321 (Mad.)

-

Siddharth Enterprises v. The Nodal Officer 2019 (9) TMI 319.

The other side of the coin as referred above, the judgements Against allowing belated transitional credits are discussed as follows:

-

Willowood Chemicals Pvt. Ltd. v. Union of India 2018 (19) G.S.T.L. 228 (Guj.), it has been held that the plenary prescription of time limit for declarations was neither without authority nor unreasonable. It was within rule making power available under Sections 164(1) and 164(2) of CGST Act, 2017. (Contrary views taken in subsequent Judgements by same HC and other HC)

-

Nelco Limited v. Union of India & Ors 2020 (3) TMI 1087have taken a different stand and have considered Rule 117 not ultravires the act by referring to Sec. 164 of CGST Act, 2017.

2 Amendment in Section 140 by Finance Act, 2020

|

Section Amended |

Old Provision | Amendment | New Provision | Reason | Effect |

|---|---|---|---|---|---|

|

Section 140 (1), Section 140 (2), Section 140 (3), Section 140 (5), Section 140 (6), Section 140 (7), Section 140 (8), Section 140 (9) (Transitional Credit Provisions) |

140. (1) A registered person, other than a person opting to pay tax under section 10, shall be entitled to take, in his electronic credit ledger, the amount of CENVAT credit carried forward in the return relating to the period ending with the day immediately preceding the appointed day, furnished by him under the existing law in such manner as may be prescribed: ………………… … |

(1), after the words “existing law”, the words “within such time and” shall be inserted and shall be deemed to have been inserted; |

(1) A registered person, other than a person opting to pay tax under section 10, shall be entitled to take, in his electronic credit ledger, the amount of CENVAT credit carried forward in the return relating to the period ending with the day immediately preceding the appointed day, furnished by him under the existing law within such time and in such manner as may be prescribed: ………………… …………… …………. |

Section 140 of the CGST Act is being amended w.e.f. 01.07.17, to prescribe the manner and time limit for taking transitional credit |

Retrospective Amendment w.e.f 01.07.2017 to overcome the effect of Judgements like Siddhartha Enterprises etc. allowing Transitional Credit based upon the ground that Rules cannot provide the Time Limit when in Act, there is No Time Frame Provided. Procedural amendment in Act in Sections 140(1), (2), (3), (5), (6), (7), (8), (9) to include provision for Time Frame for Transitional Credit to be provided by Rules. This may imply that the ground raised by the petitioner before various courts challenging vires of Rule 117 of the CGST Act, 2017 stands exhausted.

|

|

NOTE: Amendment only with respect to 140(1) discussed above being relevant to the context. |

|||||

3 “A Retrospective Googly” Notification No. 43/2020 – Central Tax dated 16-5-2020 has enforced the retrospective amendment made in section 140 of the CGST Act vide section 128 of the Finance Act, 2020 as per section 1(2) of Finance Act, 2020. The opening lines of section 128 states that the same is effective from 1st July, 2017. However, the same has been notified vide Notification No. 43/2020-Central Tax dated 16th May, 2020, which stipulates that the said provision shall come into force on 18th May, 2020. In the author’s opinion it is applicable retrospectively from 1-7-2017.

4 Can Government bring retrospective Amendments

The power of the government to make retrospective law cannot be denied but however is a limited power. The legislature cannot set at naught the judgements pronounced and overturn these by amending laws not for purpose of making corrections or removing anomalies but to bring in new provisions which did not exist earlier. The mute question is whether Statutes dealing with Substantive/Vested Rights can be retrospectively amended.

| Citation | Case Law |

|---|---|

|

[2018] 91 taxmann.com 228 (SC) SUPREME COURT OF INDIA State of Karnataka v. Karnataka Pawn Brokers Assn. |

Legislative, power of (Retrospective amendment) – Whether Legislature has power to enact validating laws even with retrospective effect, however, this can be done to remove causes of invalidity – Held, yes – Whether thus, Legislature cannot set at naught judgments which have been pronounced by amending law not for purpose of making corrections or removing anomalies but to bring in new provisions which did not exist earlier – Held, yes – Whether a judicial pronouncement is always binding unless, very fundamentals on which it is based are altered and decision could not have been given in altered circumstances – Held, yes – Whether Legislature cannot, by way of introducing an amendment, overturn a judicial pronouncement and declare it to be wrong or a nullity – Held, yes – Whether what Legislature can do is to amend provisions of statute to remove basis of judgment – Held, yes [Paras 22 and 23] |

|

Hitendra Vishnu Thakur vs. State of Maharashtra 1994(4) SCC 602 |

A procedural statute should not generally speaking be applied retrospectively where the result would be to create new disabilities or obligations or to impose new duties in respect of transactions already accomplished. |

|

Cheviti Venkanna Yadav vs. State of Telangana And Ors. [2016 (10) Tmi 1229 – Supreme Court] |

Whether the base of earlier judgment has been removed to erase the effect of the judgment? – Held that: – The legislature cannot, by way of an enactment, declare a decision of the court as erroneous or a nullity, but can amend the statute or the provision so as to make it applicable to the past. The legislature has the power to rectify, through an amendment, a defect in law noticed in the enactment and even highlighted in the decision of the court. This plenary power to bring the statute in conformity with the legislative intent and correct the flaw pointed out by the court, can have a curative and neutralizing effect. When such a correction is made, the purpose behind the same is not to overrule the decision of the court or encroach upon the judicial turf, but simply enact a fresh law with retrospective effect to alter the foundation and meaning of the legislation and to remove the base on which the judgment is founded. This does not amount to statutory overruling by the legislature. In this manner, the earlier decision of the court becomes non-existent and unenforceable for interpretation of the new legislation. No doubt, the new legislation can be tested and challenged on its own merits and on the question whether the legislature possesses the competence to legislate on the subject matter in question, but not on the ground of over-reach or colorable legislation. |

|

[2011] 335 ITR 541 (Delhi)High Court Of Delhi Commissioner of Income- tax v. Karan Bihari Thapar* |

Amendment brought being substantive in nature, cannot be given retrospective effect. |

However, there are judgements favoring Retrospective Amendments like R.C. Tobacco Pvt. Ltd. 2005 taxmann.com 1137(SC), ACIT vs. Netley ‘B’ Estate [2015] 56 tamann.com 436(SC). Moreover, Sec 164(3) of CGST Act, gives the power to give Retrospective Effect to any of the rules made from a date not earlier than the date on which provisions of this Act comes into force.

5 JUDGEMENTS IN DUE COURSE:

Where, the judgement of Brand Equity Treaties Ltd., was pronounced before the amendment to Section 140 was made effective , the following two judgements have come in due course after the said amendment made effective.

-

SKH Sheet Metals Components(Delhi) [2020] 117 taxmann.com 94 Where tax department had miserably failed to address problem faced by petitioner that occurred while filing a Form, seemingly on account of a bona fide or inadvertent mistake, petitioner was to be permitted to revise TRAN-1 Form for transition of ITC. Delhi High Court denied venturing into LEGALITY of Retrospective Amendment viz a viz Brand Equity and considered that said Judgement had several other grounds and reasons enumerated and those continue to apply with full Rigor even today, regardless of the Amendment in Section 140 of CGST Act, 2017.

-

Amba Industrial Corporation (Punjab & Haryana) [2020] 117 taxmann.com 195 stating where assessee failed to upload TRAN-I for availing benefit of previous un-utilized input tax credit by last date i.e. 27-12-2017, respondent-GST authorities were to be directed to permit assessee to upload TRAN-I on or before 30-6-2020 and in case respondent failed to do so, assessee would be at liberty to avail ITC in question in GSTR-3B of July, 2020.

6 IMPLICATIONS:

-

At first Instance, the said notification negates the effect of all such orders to the extent of validity of time period provisions, as prescribed in Rule 117.The legal loophole has been plugged by the government and it will surely open up another round of litigation in this regard.

-

However, the Hon’ble HC in case of Brand Equities has given a wider definition of Technical Difficulties, hence the assessee can take the benefit of Rule 117A in which the time period has been extended to 31.03.2020 and till 30.06.2020 due to covid Blanket exemption vide Not. 35/2020, based upon the reasonable ground of technical difficulties.

-

Moreover, the sufficiency of time period prescribed of 90 days plus 90 days extension as per Rule 117(1) can also be made a point to ponder, that the same is insufficient or inappropriate for transitional credit involving number of issues, as against the preparedness of the government in implementation of GST procedures involving number of technical glitches.

-

As per the judgements quoted above the Hon’ble courts have held that the credit as reflecting in earlier regime returns is a VESTED Right in pursuance of Article 300A of constitution and if it is a vested right, it cannot be curtailed. It must be appreciated that the credit being sought, may be belated, but belongs to the credit of taxes already paid by the registered person.

Even the Hon’ble SC in Eicher Motors Ltd. vs. UOI 1999(106)E.L.T. 3(S.C), Dai Ichi Karkaria Ltd. 1999(112) E.L.T. 353(S.C), Samtel India Ltd. vs CCE, Jaipur [2003 (155)ELT 14 SC), Jayam and Co. vs Assistant Commissioner (2016) 96 VST 1 (SC), New Swadeshi Sugar Mills(2016) 1 SCC 614, Osram Surya (P) Ltd. vs. Commissioner of Central Excise, Indore 2002(142) E.L.T. 5(SC) has held ITC a vested Right.

-

As ITC is a vested right and curtailing it through Retrospective Amendment, the validity of bringing in Retrospective amendment by Government can be challenged. It is a Procedural Amendment Affecting Vested Substantive Right of a Litigant. How a vested right can be taken away by a retrospective law amendment. The change made is not only a procedural alteration but has effect of adding a new provision. The Retrospective Amendment must be checked on the basis of Morality, Legality, Reasonableness and its Ramifications.

7 RECOMMENDATION:

-

Hence, it shall be open to the registered person to claim its credits on various other grounds as mentioned above. As a matter of abundant caution, all such claims should be filed before 30.06.2020(before expiry of Limitation period), online, if the jurisdictional officer allows or manually or thru E-mail to the jurisdictional officer to keep the claim alive in light of the judgement in due course and must be maintaining the trail keeping in mind the judgement of M/s Shree Motors vs. UOI (2020) 115 Taxmann.com 344 which asked the trail to be produced.

-

The registered person can claim this credit in GSTR-3B as held by the P&H High Court in its latest judgment on TRAN-1 but not to utilize the credit till the final disposal by the Supreme Court in favor of the assessee.

-

The registered person can also seek to Legal Remedy by filling a Writ depending upon the stake involved.

Despite all, the fact is that, still there are a number of questions that are unanswered like jurisdictional restrictions of High Court decision, validity of Retrospective Amendment, preparedness of GSTN, extensions pertaining to arbitrary approach of Government, the burden of Legislative Errors be borne by Financial Costs and adverse implications to assessee and will be settled in due course by the Hon’ble courts.