-

Preamble

-

The Hon’ble PM Shri Narendra Modi dreamed of corruption free India taking help of Information and Technology and conceived the idea of Digital India. In a national Conclave of Tax officials, he desired to introduce a faceless assessment scheme with a view to help honest taxpayers and impart greater efficiency, transparency & accountability in the assessment process. To make his dreams come true, the Central Government in the last few years has taken various steps to reduce human interface between the Taxpayer and the Tax Administration to ensure consistency, transparency and increase efficiency in the ability of Tax Administration with the help of information and technology.

-

The The E-assessment Scheme, 2019 (Scheme) (also called Faceless/ Nameless/ Paperless/Jurisdictionless and hopefully corruptionless Assessment or Group assessment/ team base assessment), is the latest development in this direction. This is indeed a complete paradigm shift from the traditional assessment to the new way of making assessment. It is going to be the new face of Income-tax Department as this scheme is likely to be expanded substantially as time goes by.

-

The concept of e-assessment is not new and rather, is successful being used in a number of countries, both developed & developing, like Singapore (‘Leveraging Analytics Design & Digitalisation’ aka LEAD), UK (Advanced Digitised Approval based Assessment), Brazil (2 SPED), Mexico (Servicio de Administracion Tributataria aka SAT), Korea (Big Data and Artificial Intelligence System) Japan, Germany etc.

-

The Scheme was first introduced in the year 2015 on pilot basis in five cities viz. Ahmedabad, Bangalore, Chennai, Delhi and Mumbai, which was extended to two more metros in year 2016. It made a significant beginning by undertaking assessment of 58,322 cases of limited and unlimited scrutiny, consisting of cases of individual, firm, companies etc.

-

-

Historical Development

2.1 The use of technology by the Income Tax department in assessments proceedings can be seen from the following:

-

E-filing of ITRs :

-

In India, e-filing of income tax was introduced in September, 2004, initially on a voluntary usage basis for all categories of income tax assessee. In

-

In 2006, it was made mandatory for all corporate firms

to e-file their income tax returns. -

Taking this process further, from assessment year 2007 to 2008, e-filing of income tax return was made mandatory for all companies.

-

From 2013, the mandatory e-filing of ITR was further extended to Individuals, HUFs and even trusts satisfying the prescribed conditions.

-

-

Implementation of Computer Assisted Scrutiny Selection (CASS) (based on a detailed analysis of risk parameters and 360-degree data profiling of the taxpayers) which substantially reduced the manual intervention in the selection process of the cases for scrutiny assessment (except a few cases based on the predetermined revenue potential-base parameters).

-

The CBDT to avoid undue harassment and to ensure proper Tax Administration, in suppression of earlier instructions / guidelines for the selection of scrutiny cases during F.Y. 2014-15, instructed the AOs to confine their questionnaires, enquiry /verifications only to the specific points on the basis of which, the particular return was selected for scrutiny (called as Limited Scrutiny Cases).

-

Service of notice electronically via Email: Taking another step toward digitalizing the working of Income Tax Department, Section 282 was substituted vide Finance Act, 2009 to include service and delivery of notices, summons etc. via electronic mode viz email id, portal etc.

-

Introduction of “Annual Information Statement” (Section 285BB) – Initially Form 26AS was an account statement of tax paid by or on behalf of the assessee, being TDS, TCS, Advance Tax, Self-assessment tax, etc. However, now with a view to enlarge the scope of Form 26AS, the Government in the latest amendments vide Finance Act, 2020, has introduced S. 285BB (thereby omitted S. 203AA), as also new Rule 114-I has been inserted (vide Notification No. 30/2020 dated 28.05.2020), to cover additional information relating to:

-

specified financial transaction (i.e purchase or sale of immovable property, shares and mutual fund transactions),

-

Payment of taxes,

-

Demand and refund,

-

Pending proceedings and even completed proceedings,

-

The dept. can also upload information received from any officer, authority or body performing any function under any law,

-

Lastly, any information received DTAA or from any other person to the extent as it may deem fit in the interest of the Revenue,

-

which shall become part of the new Form 26AS, officially known as the “Annual Information Statement” (AIS). Importantly, this new statement works on real time basis.

This new statement, on one hand will be helpful for the AO to cross check the details with the return of income furnished by the AO and on the other hand, will help the assessee (and his tax consultants) in computing and filing their returns properly, as all the information would be pre-filled on the basis of Form 26AS.

2.2. E-Assessment Proceedings / Paperless Environment

-

The Department rolled out with e-assessment proceeding where the conduct of enquiry is compulsorily made through the e-mails only.

-

A new Rule u/s 127 was inserted by the Income Tax (Eighteenth Amendment) Rules, 2015 w.e.f. 2-12-2015, providing the frame work for issue of notices and other communication with the assessee.

-

The rule prescribed addresses to be the actual physical address, including the addresses of electronic or electronic mail messages on which notices and other communication could be delivered.

-

During the period from 2016 to 2018 the CBDT progressively amended the rules, notified various procedures and issued the required guidelines to increase the scope of e-proceedings.

-

“Concept of Hearing” was also introduced vide insertion of S.2(23C) in the Act by the finance Act, 2016 (w.e.f 1-4-2016), providing that the term “hearing” includes communication of data and documents through electronic mode. Consequently, the CBDT issued a revised format of the notice u/s 143(2) of the Act.

-

In the year 2017, the Income-tax Department had developed an integrated platform, i.e., Income Tax Business Application (ITBA) for electronic conduct of various functions/proceedings including assessments.

-

Scope of e-proceedings assessment was extended vide instruction no. 08/2017 dated 29-9-2017 for all the cases getting time barred during F.Y. 2017-18 with option to the assessee to voluntarily opt-out from e-proceedings.

-

Instruction No. 01/2018 dated 12-2-2018 issued to cover all the pending scrutiny assessment under the e-proceeding scheme with the exception of some cases like search and seizure, re-assessment etc.

-

Instruction

No. 03/2018 dated 20-8-2018 was issued carving out the way for all cases required to be framed u/s 143(3) during F.Y. 2018-19, which were to be compulsorily (mandatorily) completed through e-proceeding only.

-

-

E-proceedings vs. E-Assessment

|

S. No. |

Particulars |

Assessment u/s 143(3) through e-Proceedings utility |

Faceless E-assessment 2019 |

|

1. |

Who is AO. |

AO is well known with name and face |

It is completely faceless and nameless |

|

2. |

Applicability |

Assessments u/s 143(3), Assessments u/s 147 |

Assessment u/s 143(3) and 144. |

|

3. |

Assessment Year |

Till AY 2017-18 and partial cases for AY 2018-19 |

58,322 cases for AY 2018-19 on Pilot basis |

|

4. |

Assessing Authority |

Jurisdictional Assessing Officer |

National E-assessment Centre (NeAC) |

|

5. |

Notice u/s 143(2) Issuing Authority |

Jurisdictional Assessing Officer |

NeAC, New Delhi |

|

6. |

Reply Period of Notice u/s 143(2) & 142(1) |

As specified in the Notice u/s 143(2) |

Within 15 days from the date of receipt of such Notice u/s 143(2)/142(1) |

|

7. |

Assignment of Case |

Jurisdictional Assessing Officer |

The NeAC assigns the case to a specific assessment unit in any one Regional E-assessment Centre through an automated allocation system, based on artificial intelligence and machine learning. |

|

8. |

Inquiries during the course of assessment proceedings |

Jurisdictional Assessing Officer Issues Notices/ Questionnaires u/s 142(1) of the Act, for seeking further information, documents or records, from the assessee. |

The NeAC may issue appropriate notice or requisition u/s 142(1) to the assessee for obtaining any further information, documents or evidence as required by the assessment unit in the Regional E-assessment Centre, to which the case has been assigned by the NeAC. |

|

9. |

Mode of Interface between the Assessee and the Assessing Authority |

Electronic Mode via the ‘e-Proceedings’ functionality in the ITBA Module. However, after serving the Show Cause Notice, an opportunity of Personal Hearing to the assessee involving physical interface between the assessee and the jurisdictional AO is to be provided. |

Electronic Mode via the ‘e-Proceedings’ functionality in the ITBA Module. However, after serving the Show Cause Notice, an opportunity of Personal Hearing to the assessee via video telephony only and without involving any physical interface between the assessee and the NeAC is to be provided. |

-

Assessment through E-proceeding – Recent Past:

4.1 The Scheme was based on the recommendations made by the Tax Administration Reform Commission (TARC), with the objective to enhance the effectiveness and efficiency of the Tax Administration. The relevant extract of the TARC are as under:

“Currently, the general perception among taxpayer is that the tax administration is focused on only one dimension that of revenue generation. This perception gains strength from the manner in which goals, in turn, drive the performance of individual tax officials. Therefore, the whole system of goal setting, performance assessment, incentivisation and promotion appears to be focused on only this dimension. This single minded revenue focus can never meet the criteria of the mission and values mentioned above. What is required is a robust framework that is holistic in its approach to issues of performance management.”

4.2 Accordingly, the Finance Minister Late Shri Arun Jately introduced the concept of E-assessment in the Union Budget Speech for F.Y. 2018-19 [401 ITR 1 (St) (at 29)]. The relevant extract is as under:

“E-assessment –

We had introduced E-assessment in 2016 on a pilot basis and in 2017 extended it to 102 cities with the objective of reducing the interface between the department and the taxpayers. With the experience gained so far, we are now ready to roll out the E-assessment across the country which will transform the age-old assessment procedure of the income tax department and the manner in which they interact with taxpayers and other stakeholders. Accordingly, I propose to amend the Income-tax Act to notify a new scheme for assessment where the assessment will be done in electronic mode which will almost eliminate person to person contact leading to greater efficiency and transparency.”

4.3 Consequently, by the Finance Act, 2018, two new sub sections (3A) and (3B) were inserted in S.143(3) w.e.f. 1-4-2018, which enabled the Central Government to come up with a Scheme for Faceless-Electronical Assessment.

-

Section 143(3A): The Central Government may make a scheme, by notification in the Official Gazette, for the purposes of making assessment of total income or loss of the assessee under sub-section (3) so as to impart greater efficiency, transparency and accountability by—

-

eliminating the interface between the Assessing Officer and the assessee in the course of proceedings to the extent technologically feasible;

-

optimising utilisation of the resources through economies of scale and functional specialisation;

-

introducing a team-based assessmentwith dynamic jurisdiction.

-

-

Section 143(3B): The Central Government may, for the purpose of giving effect to the scheme made under sub-section (3A), by notification in the Official Gazette, direct that any of the provisions of this Act relating to assessment of total income or loss shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the notification: Provided that no direction shall be issued after the 31st day of March, 2020 (now extended upto 31.3.2022 by The Finance Act 2020).

4.4 This was further continued by the Finance Minister Nirmala Sitaraman in her Budget speech on this aspect is worth noting and reproduce here under:

Faceless e-assessment

-

“The existing system of scrutiny assessments in the Income-tax Department involves a high level of personal interaction between the taxpayer and the Department, which leads to certain undesirable practices on the part of tax officials. To eliminate such instances, and to give shape to the vision of the Hon’ble Prime Minister, a scheme of faceless assessment in electronic mode involving no human interface is being launched this year in a phased manner. To start with, such e-assessments shall be carried out in cases requiring verification of certain specified transactions or discrepancies.

Cases selected for scrutiny shall be allocated to assessment units in a random manner and notices shall be issued electronically by a Central Cell, without disclosing the name, designation or location of the Assessing Officer. The Central Cell shall be the single point of contact between the taxpayer and the Department. This new scheme of assessment will represent a paradigm shift in the functioning of the Income Tax Department.”

-

The E-Assessment Scheme – Introduction

5.1 Finally, the Government notified a Scheme names as “E-Assessment Scheme, 2019” u/s 143(3A) vide Notification No. 61/2019 dated 12.09.2019 (further supplemented by the direction u/s 143(3B) vide Notification No.62/2019 dated 12.09.2019) to conduct e-Assessments proceedings w.e.f. 12.09.2019.

5.2 E-assessment scheme is a code by itself with respect to assessment specified in the scheme, comprising of 24 definitions and 12 clauses. The said scheme provided the framework to carry out e-assessments with the intention to bring about a 360-degree change in the way; the tax assessments are being made hitherto. However, the Scheme does not apply to Wealth-tax Act.

5.3 Scope of the scheme (Clause 3): The scope of the Scheme, has been defined in Clause 3, to be made in respect of such territorial area, or persons or class of persons, or incomes or class of incomes, or cases or class of cases, as may be specified by the CBDT(Board).

5.4 “E-assessment” [Clause 2(xiii)] – means

-

the assessment proceedings

-

conducted electronically

-

in ‘e-Proceeding’ facility

-

through assessee’s registered account

-

in designated portal (incometaxindiaefiling.gov.in)

5.5 Assessment:

5.5.1 Covered: The term Assessment [Clause 2(iii)] means “the assessment of total income/loss u/s 143(3) of the Act.”

5.5.2 Not Covered: Impliedly therefore, the following types of assessments are not included in this Scheme: – [Refer Circular no. 27/2019 for exclusions from e-proceedings]

-

Best Judgment Assessment made u/s 144: However, The Finance Act, 2020 now covered such assessments also w.e.f A.Y. 2020-21.

-

Assessment of Escaped income u/s 147.

-

Search Assessment u/s 153A or u/s 153C.

-

Set-aside Assessments

-

6.1 The E-Assessment Scheme – Prime Objective :

To reduce the human interface between the taxpayer and the tax officer to the extent technologically feasible.

Ensuring transparency in the assessment proceedings

A team based assessment with dynamic jurisdictions.

Increase the efficiency of the tax administration.

To ensure that the assessments are technically sound,

Taking a consistent view on various issues.

To avoid prolonged and unwanted litigations.

6.2 Expected Benefits:

Ease of compliance for taxpayers – with the comfort of sitting at home or office.

Transparency and efficiency – of the Department

Improvement in Quality of Assessment

Will avoid humiliation to the Assessee/ AR

Saving of time, money an arising being wasted by the assessee/ AR in big cities. Also, chances of harassments shall be minimal

-

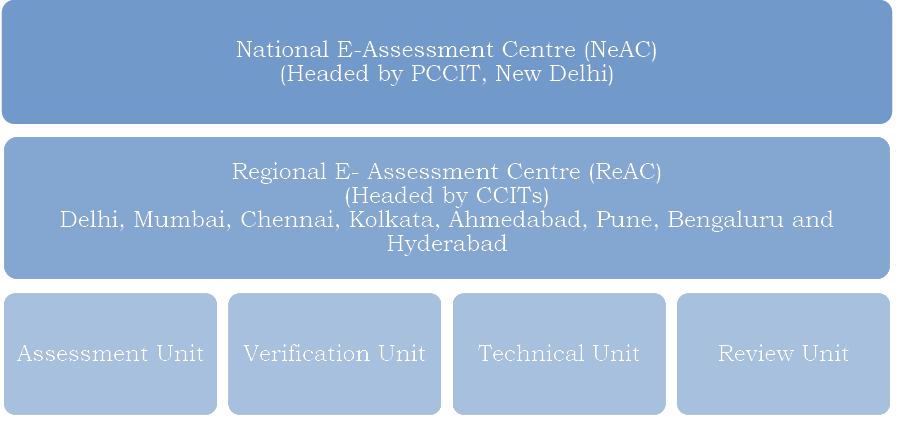

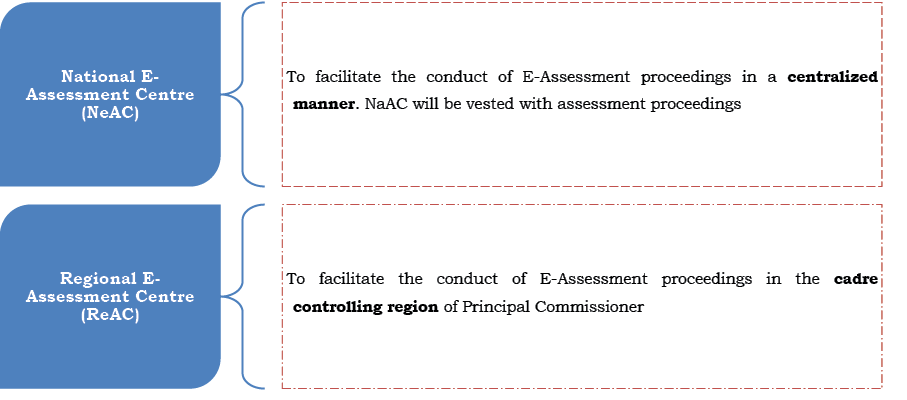

Organizational Structure:

-

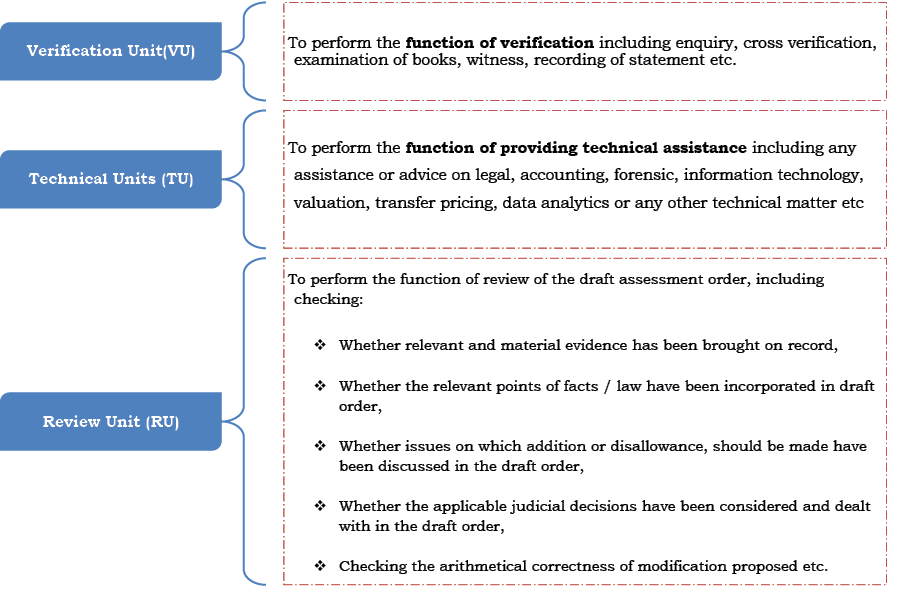

Role of various Agencies such as NeAC, ReAC, AU, VU, TU, RU:

-

Features of E-assessment

-

Electronic exchange of information [Clause (viii)]

-

All the communication, whether internal between the various centres and units or externally with the taxpayer, shall be carried out only by electronic mode.

-

The electronic modes include emails, upload of documents on e-filing portal, mobile app, real time alerts and messages to taxpayers, etc.

-

-

Taxpayers or its authorize representative shall not remain physically present before the AO during assessment proceedings.

-

No personal appearance in the Centres or Units however such communication shall be conducted through video conferencing only if demanded. (Clause 11)

-

The video conferencing (VC) shall be only in accordance with the procedure laid down by the Board. However, there appears no separate VC procedure notified by board.

-

-

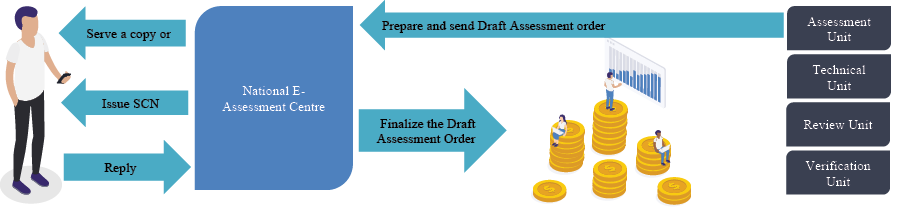

Procedure for E-Assessment

-

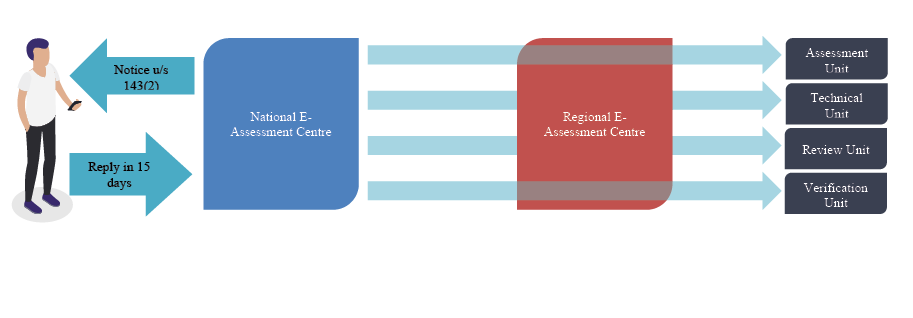

The National E-Assessment centre shall serve notice to the taxpayer under section 143(2) mentioning the issues in respect of which his case is selected for assessment [Clause 5 (i)]

-

The Taxpayer should respond to the notice within 15 days. [Clause 5 (ii)]

-

The National E-assessment centre shall assign the case to a specific assessment unit in any one of the 8 Regional e-assessment Centre through Automated Allocation System (AAS). [Clause 5 (iii)]

-

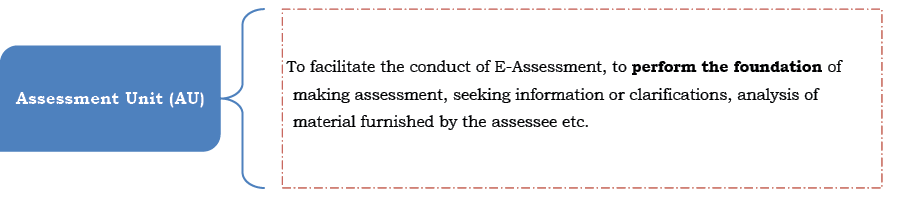

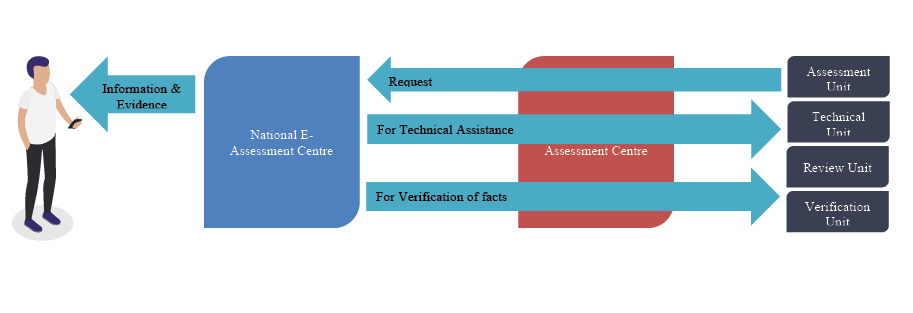

The assessment unit may request the National E-assessment centre for:

-

information, documents, evidences as required; and /or

-

conducting enquiry or verification by verification unit; and /or

-

seeking technical assistance from technical unit. [Clause 5 (iv)

-

-

5.1 The National E-assessment centre shall communicate to:

Taxpayer for information / documents and evidence; and /or

Verification Unit for conducting enquiry or verification through AAS; and /or

Technical Unit for technical assistance through AAS

5.2 And will pass on the response received, to the assessment unit. [Clause 5 (v), (vi), (vii)

-

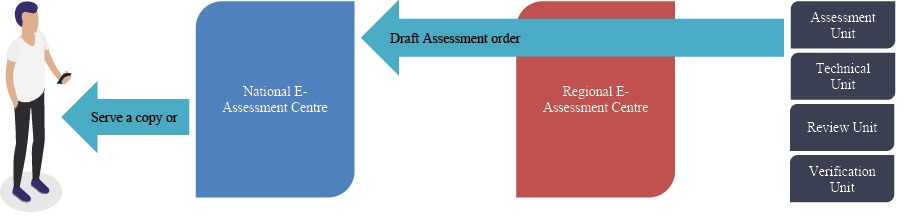

Assessment Unit, after taking into account all relevant available material on record

-

shall prepare DRAFT assessment order in writing,

-

either accepting or modifying the returned income of the taxpayer and send it to National E-assessment Centre

-

along with the details of penalty proceedings to be initiated if any . [Clause 5 (viii),(ix)]

-

-

7.1 On receipt of draft asst. order, the National E-assessment centre shall, based on Risk Management Strategy (RMS) and Automated Examination Tool (AET),:

-

Finalize the assessment as per draft asst. order

-

Serve a copy of such order to the Taxpayer

-

and notice for initiate penalty proceedings if any;

-

along with the demand notice specifying the some payable by / refundable OR [Clause 5(xii)]

7.2 Issue a show cause notice to the assessee (as to why the suggestion of assessment Unit in Draft order be not accepted.) or [Clause 5(xiii)]

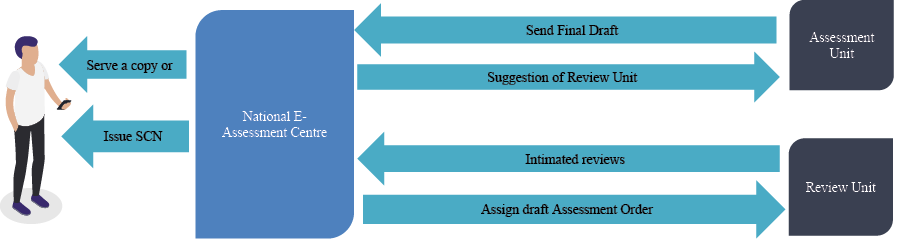

7.3 Instead of sending to assessee, assign the draft asst. order to any one Review Unit (out of any 8 ReAC) through AAS.

-

-

Review Unit will review the draft assessment order and intimate the National E-assessment Centre

-

Of its concurrence with it or

-

Suggest suitable modification to NeAC. [Clause 5 (xi)]

-

-

On receipt of concurrence, the National E-assessment Centre will

-

Finalize the order and serve on the tax payer, or

-

Issue show cause notice to the taxpayer. [Clause 5 (xii)] or

-

-

On receipt of modifications, the National E-assessment Centre shall send the modifications suggested by the review unit to the assessment unit. [Clause 5 (xiii)]

-

The Assessment unit shall prepare the FINAL DRAFT Assessment order and send to National E-assessment Centre. [Clause 5 (xiv)]

-

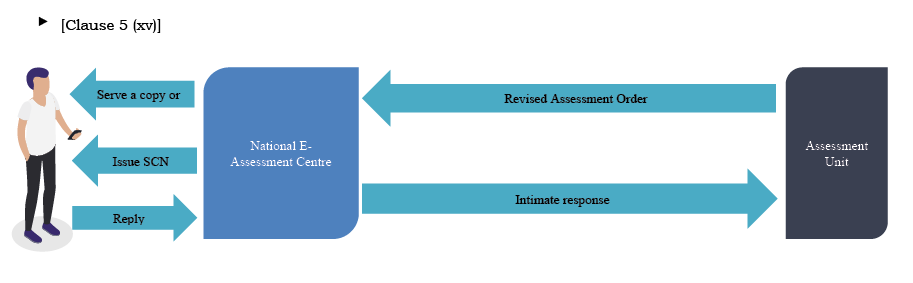

On receipt of Final Draft Assessment order, the National E-assessment Centre shall:

-

Finalize the order and serve on the assessee (as per the preceding paras); or

-

Issue a show cause notice to the taxpayer (as to why the Final Draft Assessment order should not be accepted). [Clause 5 (xv)]

-

-

Where show cause notices is issued by National E-assessment Centre as mentioned in the clause 5(x)- (as to why the final draft assessment order should not be accepted),

-

the assessee must responds within the stipulated time to the NEC [Clause 5 (xvi)]

-

Accepting or objecting to the suggestions with its own clarification / explanation in support

-

-

National E-assessment Centre, shall

-

If no response is received from the assessee, finalize such draft assessment order and served upon the taxpayer as per clause 5(xa) or,

-

Send the response received, if any, to the assessment unit. [Clause 5 (xvii)]

-

The response received from the assessee shall be dealt with as per procedures (send to assessment unit) laid in clauses 5(xvi, xviii)

-

-

The assessment unit, after taking into account response so received make a Revised Draft Assessment Order and send it to NeAC. (Clause 5(xviii))

-

The NeAC, upon receiving the REVISED Draft Assessment order, shall:

-

v In case no modification is made prejudicial to the interest of assessee, finalize the assessment order and serve upon the assessee as per clause 5(x)(a); or

-

v If any modification prejudicial to the interest of assessee is proposed, shall issue show cause notice to the assessee as per the procedure prescribed (Clause 5(x)(b))

-

v and deal with the response received from the assessee as per the procedure mentioned above, shall be dealt as per Clause 5(xvi), (xvii), (xviii). (Clause 5(xix))

-

-

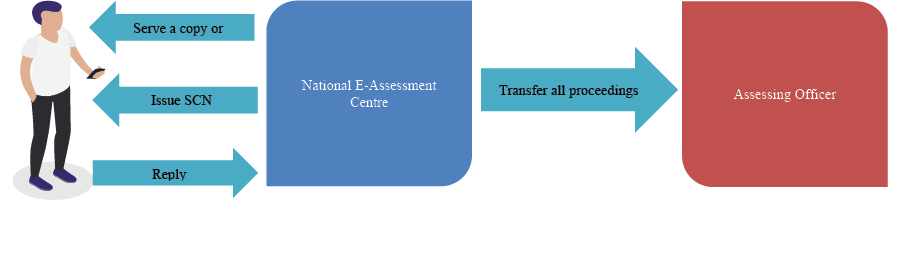

The National E-assessment Centre, after completion of assessment order shall transfer all the electronic records to the jurisdictional Assessing officer for various purposes, discussed in the next page.

-

Powers of Jurisdictional Assessing Officer: Once the electronic record has been transferred to the Assessing officer, he would have powers only for the following:

-

imposition of penalty;

-

collection and recovery of demand;

-

rectification of mistake;

-

giving effect to appellate orders;

-

submission of remand report, or any other report to be furnished, or any representation to be made, or any record to be produced before the commissioner (Appeals), Appellate Tribunal or Courts, as the case may be; proposal seeking sanction for launch of prosecution and filing of complaint before the Court;

-

-

Faceless appeals:

-

E-filing of appeals before CIT (Appeals) has already been enabled through e-Filling portal. However, the process that follows after filling of appeal is neither electronic nor faceless. In order to further harness, the power technology and to achieve the motto of faceless assessment at CIT(A) level, an appellate system, with dynamic jurisdiction in which appeal shall be disposed of by one or more Commissioner (Appeals), has been introduced.

-

Applicable from Assessment Year 2020-21, in Sec. 250 new Ss. (6B), (6C) and (6D) have been inserted to provide for a scheme, by notification, for the disposal of appeal u/s 250 so as to impart greater efficiency, transparency and accountability by

-

eliminating the interface between the CIT(A) and the appellant to the extent feasible technologically;

-

optimizing the utilization of the resources through economies of scale and functional specialization;

-

Introducing an appellate system with dynamic jurisdiction in which appeal shall be disposed of by one or more CIT(Appeals).

-

-

v Necessary directions are required to be made by the Central Government by 31-03-2022, specifying that any of the provisions of this Act relation to jurisdiction and procedure of disposal of appeal shall not apply or shall apply with such exceptions, modifications and adaptions.

-

Every notification to be issued u/s 250(6B) or 250(6C) is required to laid before each house of parliament.

-

The Hon’ble President of Income Tax Appellate Tribunal (ITAT), Shri P.P. Bhatt, recently announced that the E-filing portal for the Hon’ble ITATs has been developed and ready for launch post compliance of mandatory scrutiny audit in accordance with the Government of India’s guidelines.

-

-

Faceless Penalty:

Consequent to the E-Assessment Scheme, changes have been made u/s 274 to provide for a scheme, by notification, for imposing penalty so as to impart greater efficiency, transparency and accountability on the lines of e-assessment scheme and faceless appeals. Necessary direction to be made by the Central Government by 31-03-2022.

-

The authentication of electronic record (clause 9):

-

If the originator is NeAC and ReAC, they shall be affixing digital signature as per Section 3(2) of the Information Technology Act, 2000

-

If the originator is an assessee or any other person

-

by the digital signature or

-

by way of electronic signature or

-

Electronic authentication technique as per Section 3A(2) of the Information Technology Act, 2000.

-

-

-

Delivery of Electronic Record (Notice, Order etc.) (Clause 10):

15.1 Clause 2(1) does not define service or delivery. However, clause 2(2) refers to the definitions provided under the Act.

15.2 Clause 10 of this Scheme provides that every notice or order or any other electronic communication under this Scheme shall be delivered to the addressee, being the assessee, by way of-

placing an authenticated copy thereof in the assessee’s registered account; or

sending an authenticated copy thereof to the registered email address of the assessee or his authorized representative; or

Uploading an authenticated copy on the assessee’s Mobile App; and followed by a real time alert.

15.3 The assessee shall also file his response through his registered accounts only and once acknowledgment is sent by the NeAC, containing hash result, the response shall be deemed to be authenticated.

15.4 Interestingly, the notification in its definition Clause 2(xvi) r/w 2(xx) expands the scope so as to include even ‘message on WhatsApp’ as a real time alert.

15.5 Section 282 of the Act r/w Rule 127 specifically provides that notice can be served in the form of any electronic record as provided in chapter IV of the Information Technology Act, 2000.

15.6 Explanation to section 282(2) provides that the expressions “Electronic Mail” and “Electronic Mail Message” are assigned the meaning as in Explanation to section 66A of the Information Technology Act, 2000.

-

General Issues and suggestions

16.1 The Scheme, no doubt is a welcoming step, yet however the observance of the principal natural justice must be kept into mind. Such principal is deep rooted in our Constitution and Indian Jurisprudence. As per Article 21, every proceeding/ procedural must be reasonable, fair and equitable. Hence those principals have to be kept in mind while implementing the scheme.

Although the effort of the government to make the assessment and now also the penalties and appeals to be faceless, is certainly laudable when read with its objective yet however, there is some reservation to such steps being taken, more particularly when e-assessment itself is very cumbersome.

Virtual hearing: This may violate the settled doctrine of Audi Alteram Partem which inherently requires personal/face to face hearing for the simple reason that words have got their own limitations and even a thesis may not make the reader understand what the author wants to convey. The Scheme appears to have taken care of such a situation vide Clause 11(2), providing personal hearing if demanded (only through video conferencing, including use of any telecommunication application) but we have yet to see the effectiveness of VC, particular when no elaborate procedure is prescribed.

Senior Adv. Shri K. Shivram, in his recent article namely “The Silver Lining During Lockdown” has stated as under :

“ All lot of tax professionals are asking out of concern whether the virtual hearing will be future litigation practice of our country. One school of thought is virtual hearing cannot be the effective alternative for actual court hearings. Hon’ble Justice Mr. B. N. Srikrishna, former Judge of Supreme Court of India, at the inaugural speech during one of the seminars addressing the AIFTP has stated that technology will help the lawyers to make better representation, however a lawyer develops his reputation by appearing before the courts over the years which cannot be substituted by the technology. Hon’ble Justice Dr. D. Y. Chandrachud, Judge of Supreme Court of India, while addressing the laws students, in a Webinar organized by the Nyaya Forum – The National Academy of Legal Studies and Research, Hyderabad, on the topic ‘Future of Virtual Courts and access to Justice in India’ on 24th May, 2020 stated that

“I want to dissuade people from idea that virtual court hearing are some sort of a panacea. They will not be able to replace court hearings.”

One will appreciate that the young lawyers learns the values, ethics and conventions of the profession by attending the courts and watching performance of the seniors who argue before the Courts and Tribunals. It may not be possible in virtual courts. Accordingly, we are of the strong view the virtual courts may not be substitute for actual court hearings. ”

16.2. Suggestion of other units not binding: The scheme provides for the suggestions by other units viz. Verification Unit, Review Unit and Technical Unit, however, their suggestions have not been made binding on the Assessment unit/ NeAC, as the procedure adopted in the case of Transfer pricing u/s 92CA. Thus, it leaves the entire discretion to the Assessment Unit/NeAC. Hence, such assessment cannot be a team based assessment.

The probable reason behind this may be that AO/ Assessment unit must have some amount of discussion as ultimately he is the quasi-judicial authority. Its functioning is similar to that of a judicial court and thus, should not be made binding. Matters like Report by the Valuation officer or remand report by the officer i.r.t creditor etc. though may be negative but then ultimately the AO has to exercise his judicial discretion in the larger interest.

16.3. Constitutions validity of the Power conferred upon the CBDT:

The Central Government has been empowered u/s 143(3B) of the Act, to come out with Notifications till 31.03.2020, which are necessary to give effect to the E-Assessment Scheme by making exceptions, modifications and adaptations to any provision of the Act.

A serious question arises is it not excess delegation of power upon the government in as much as power the make the Law is sole prerogative of the Parliament and it is only the implementation of such law to be carried out by the Government. Thus, the Government is allowed to make changes in the Act merely by way of notification. Although the intention behind such provision is to ensure smooth implementation of the scheme, yet one cannot deny the fact that there is a possibility of abuse of power.

Section 143 (3C) although requires such the notifications to be tabled before both the House of Parliaments, but neither any specific time-frame is prescribed to do so nor it is clear whether the notification necessitates discussion in the Parliament.

16.4. Direction by Jt. Commissioner u/s 144A: Under the traditional assessment procedure, an opportunity is given to the assessee to approach the Jt. Commissioner u/s 144A on a particular issue and seek his binding direction to be given to the AO to complete the assessment. However, there appears no such specific provision in the said Scheme. No doubt, in such team based assessment, the specified Income Tax Authorities includes Jt. Commissioner, holding concurrent charge to perform the function of an Assessing Officer, yet however, it may result into violation of principal of natural justice for want of opportunity of being heard before such higher authority.

16.5. Scope of Assessment Scheme-Limited Scrutiny

The language of the Scheme and the CBDT Notification No. 61 & 62 /2019 suggest that every notice issued u/s 143(2) must specify the issues for which that particular case has been selected for scrutiny. However, the notices issued u/s 143(2) till now are not specific (rather mention broader issue only), being against the legislative intent behind bringing the Scheme.

Further, it is also not clear as to how the scope of limited scrutiny will be converted into complete scrutiny during the course of assessment proceedings by taking approval of the Commissioner under this new E-assessments regime.

16.6. Applicability of S. 136 of the Income-tax Act:

Section 136 provides that any proceedings before an income-tax authority shall be deemed to be a Judicial proceeding within the meaning of provisions of Indian Penal Code and every income-tax Authority shall be deemed to be a Civil Court.

Whether the authorities and NeAC would be regarded as falling within the parameters of section 136.

To what extent, these proceedings are deemed to be judicial proceedings within the meaning of sections 193, 228 and 196 of Indian Penal Code, as the notification only prescribes the mechanism and the modality more particularly the procedure is prescribed.

16.6. How satisfaction as required u/s 14A, 68 to 69C etc will be recorded? Will it be recorded by Assessment Unit or can also be directed by Review Unit or National E-assessment Center?

16.7. Access to the video recordings submissions filed:

From the Scheme it does not transpires whether the written submissions / documents / material placed by the assessee or the video recordings done shall be made available to the assessee for its record and for future reference and use as an evidence before higher authorities or the courts if need arise.

16.8. Time consuming process:

The entire Scheme envisages the communication between the assessment unit and the assessee to route through NeAC only. Similarly, the inter unit communications are also to be routed through NeAC only. This will comprise many rounds and will continue till the final assessment order is passed. Such procedure may prove to be time consuming and sometime thereby prolonging the duration and hence requires to be addressed suitably.

16.9. Notice u/s 143(2) – 15 days

The Scheme [under clause 5 (ii)] has provided for only 15 days’ time within which the assessee essentially has to make his submissions. Thus, there appears no further provision or clarification that the assessee would be able to get this time extended however, if challenged, the Hon₹ble courts may read in between the line. But the Scheme ought to suitably provide flexibility and may also set a limitation on the number of adjournments to ensure timely completion of the assessment proceedings.

Further, when the Statute itself does not speak of any such time limit whether the Government can override the Statute through the notifications only.

16.10. National E-Assessment Centre to assign cases to specific assessment units [Clause 5(iii)]:

The Scheme gives wide powers to the NeAC viz. selection of the cases and assignment thereof to various assessment units. Since sole power has been provided to the NeAC, where no check would be there, it may result in arbitrariness. This becomes much more problematic as the composition of NeAC has not been specified.

16.11. Risk Management Strategy [Clause 5(x)]:

The Scheme also talks about a Risk Management Strategy and however the same has not been defined in the notification. Surprisingly, no indication is given anywhere in the notification as to what is the objective of Risk Management Strategy, The Scheme in Clause 5(x) simply states ‘the National e-assessment Centre shall examine the draft assessment order in accordance with the risk management strategy specified by the Board, including by way of an automated examination tool’.

16.12. Revision and Reassessment

Since, there are several units including a verification unit and a review unit, working on every assessment. It can be construed that a thorough and fair perusal of documents have been carried out by the units.

In such a situation, it becomes imperative to curtail the powers of the Department with regards to reassessment proceedings under section 147 of the Act and revision proceedings under section 263 of the Act.

16.13. Transfer of Case by NeAC : [Clause 5 (xxi)]

Clause 5(xxi) provides that NeAC may at any stage of the assessment, if considered necessary, transfer the case to the Jurisdictional Assessing Officer, notwithstanding anything contained in Clause (5xx). This appears to be a case where unbidden power and discretion has been bestowed upon the NeAC who, at any stage of proceeding, may transfer the case to the Jurisdictional AO instead of getting it done as a faceless assessment. There appears no elaboration under what circumstances the NeAC may consider it necessary to do so. Prima Facie there may be chances of abuse of the power.

16.15. Initiation of Penalty Proceedings during E-Assessment Proceedings :

Clause 6(i) provides that any unit may, in the course of assessment proceedings, for non-compliance of any notice, direction or order issued under this scheme on the part of assessee / any other person, send recommendation to the NeAC for initiation of penalty proceeding under chapter -xxi of the Act. This perhaps means that it is not any or every penalty prescribed under chapter-XXI, which may be considered. The intention may be to initiate only those proceedings which are towards the non-compliance of any notice, direction or order issued under this scheme but not the other penal clauses. Probably S.271 to 271G and 272A to 272BBB may be relevant provisions contemplated under clause 6(1) of the Scheme. In any case there appears no clarity on this aspect.

-

Practical Issues & Suggestions

17.1. The first and foremost issue arising as to how the entire scheme will work. As of now, there is a doubt on the successful of its implementation unless one sees the scheme happening. For that reason, it might prove to be quite time consuming, irritating and complicated for assessee and ARs, not only in the small towns even in the metro cities, particularly when there are lot of queries and the volume of the evidences being submitted is very large. No doubt, the selection of the cases and the preparation of the initial notices 143(2) specifying the issues based on which the case was selected, which are to be replied, may be a fast process because it will be all auto generated due to use artificial intelligence, etc, yet however, once the human intervention is involved like the various units and NeAC, it may seriously hamper the speed. Assuming selection of 2 lakh cases to be done in a given time frame, make a doubt on its successful completion. Therefore, to ensure strong and adequate infrastructure is a must.

There may be many types of practical issues which may be faced by the Assessment Units. Just to take an example, the assessee is a color chemical industry situated at Pali. Now the question may relate to excess consumption of raw material while preparing a particular colour. The assessment is allotted to an Assessment Units situated at Hyderabad and they are not at all aware of the technical aspect of the colour industry. Although that assessment units may refer the matter to the Technical Unit through NeAC, and the Technical Unit may reply back, yet however, there are all the chances of lack of effective communication between the assessee to explain the excess consumption etc. which is the point of dispute and the same may not be properly appreciated by the Technical Unit and also consequently by the assessment unit. This may result in undue harassment and unwarranted additions are likely to be made.

17.2. Another issue is that the portal allows an assessee to attach only 10 documents, with 1 attachment been not more than 10 MB. Now taking the situation of a client, having a Bank statement of 500 pages which is very usual,

Then firstly how will we upload the same?

Secondly, at the time of argument, it was a usual habit of opening the relevant page and show it to the authority and thereby discuss the issue. But how that will be possible is another issue. The only solution to this is that since dept. is using software and technology for its work, we also as Tax practitioners have to use new software and technology for better representation. For Example – using hyperlink in your submission to, linking the attachments with it, add comment to the attachment file.

17.3 It is suggested that such faceless Scheme may also be extended to E-revision as well. This will completely eliminate face to face interaction between the assessee/authorized representatives with the Department.

17.4 However, during the initial period of e-appeals and e-assessment, to avoid any administrative inconvenience, an option may be granted to the parties to opt in or opt out of the scheme.

-

Tips

18.1 A useful reference can be made to a recent judgment of Hon’ble Madras High court in the case of Salem Sree Ramavilas Chit Company (P.) Ltd. vs DCIT [2020] 114 taxmann.com 492 (Madras), wherein it was opined that :

“15. The Government of India has introduced E-Governance for conduct of assessment proceedings electronically. It is a laudable steps taken by the Income-tax Department to pave way for an objective assessment without human interaction. At the same time, such proceedings can lead to erroneous assessment if officers are not able to understand the transactions and statement of accounts of an assessee without a personal hearing. The respondent should have to be therefore at least called for an explanation in writing before proceeding to conclude that the amount collected by the petitioner was unusual.

Since the assessment proceedings no longer involve human interaction and is based on records alone, the assessment proceeding should have commenced much earlier so that before passing assessment order, the respondent assessing officer could have come to a definite conclusion on facts after fully understanding the nature of business of the petitioner. It appears that the return of income was filed by the petitioner on 02-11-2017. However, the assessment proceeding commenced much later towards the end of the period prescribed under section 153 of the Income-tax Act, 1961. In my view, assessment proceeding under the changed scenario would require proper determination of facts by proper exchange and flow of correspondence between the petitioner and the respondent Assessing Officer.

……. Since the Government of India has done away with the human interaction during the assessment proceedings, it is expected that the petitioner will clearly explain its stand in writing so that the respondent assessing officer can come to an objective conclusion on facts based on the records alone….”

18.2 Drafting:

Utmost care to be taken in absence of discussion.

To make him understand through effective communication – mere writing letter will not suffice.

pointedly refer to the query raised – provide all relevant facts- then your explanation – refer and rely suitable supporting evidences – cite relevant case laws, CBDT instructions etc.

Ensure a complete reply – may include past history-as also expected query trading addition

Take legal objection wherever needed.

Must ask for third party information or material relied upon by department.

Where statement recorded and relied – must ask for copy as also opportunity for cross examination- ref Andaman Timber 281 CTR 241(SC)

Make Para Wise Reply

Give Detailed reference to the evidence

Divide Submission into suitable paras

Evidence to be submitted as annexures in Paper Book form

Request for summon u/s 131.

Take care not to admit/confess an income or a fact adversial

Check if notices had been issued/ served properly and within time (in limited situations)

Be aware of the related provision and the existing judicial pronouncement, circular etc.

Repetition should be avoided

18.3 Reply of the assessee must always be filed from his registered account/email id only, registered with the department in the PAN hence to ensure the same Email id everywhere.

18.4. Information Technology Act, 2000 and E-Assessment Scheme: Section 81 of the Information Technology Act, reads as under:

“The provisions of this Act shall have effect notwithstanding anything inconsistent therewith contained in any other law for the time being in force:

Provided that nothing contained in this Act shall restrict any person from exercising any right conferred under the Copyright Act, 1957 (14 of 1957) or the Patents Act, 1970 (39 of 1970).”

Accordingly, if there is any conflict between the provision under the Income-tax Act and Information Technology Act, the Information Technology Act, being the latter provision, it will provide for the earlier provision. The definitions of the e-assessment scheme, a number of definitions refer to the Information Technology Act, 2000. Accordingly, the understanding of the provisions of the Information Technology Act is very essential to make better representation in the e-assessment proceedings.

Important Note: Some of the relevant provisions of Information & Technology Act, 2000 referred in the Scheme are also annexed herein below. (Annexure – 1)

18.5 One must ensure that the correct and registered email id (with the Dept.) is filled in and uploaded every time, at each place where ever required, which is being regularly seen and checked by the assessee, to avoid non-receipt or missing of the mail sent by the Dept. inviting severe consequences.

18.6 In this changed scenario it has now become most essential for assessee/AR to ensure filling of the return correctly, fully and truly containing all relevant details and thus no relevant column should be left blank. For reference, refer FAQ in circular no. 26/2019 dated 26.09.2019.

18.7 The Name of the designated portal incometaxindiafilling.gov.in should now be replaced by incometaxindia.gov.in.

18.8 Document Identification Number (DIN):

Ensure that all sort of the communication issued by any IT authorities, on or after 01.10.2019 must bear a computer-generated DIN.

If it is not so, the communication shall be treated as invalid and deemed to have never been issued, unless there are exceptional circumstances. For detailed procedure refer Circular No. 19/ 2019

[F. No. 225/95/2019], dated 14.08.2019).Interestingly however, the statutory provision being S. 282B which provided for DIN is no more in the statute book as was omitted by Finance Act, 2011 w.e.f. 1.4.2011. Thus, it is pointed out that the erstwhile section 282B needs to be revived/reintroduced.

-

Conclusion

The Scheme has been launched by the Government on 07.10.2019 and 58322 cases have already been selected for assessment under it in the first phase by issue of e-notices on taxpayers for the cases related to tax returns filed u/s 139 of the Act after 01.04.2018 onwards.

There is no doubt that the Scheme has conceptualized a complete paradigm shift in the way assessments will be carried out in future. The assessments have been centralized and made faceless. Exchange of communication between taxpayers and the tax department as well as amongst the income tax authorities in the tax department has been centralized. The allocation of cases by the NEC would be based on the automated allocation system. Thus, it goes without saying that both the taxpayers and the tax department will need to gear up their systems to adapt to the Scheme.

“THE POTENTIAL BENEFITS OF ARTIFICIAL INTELLIGENCE ARE HUGE, SO ARE THE DANGERS.”

—DAVE WATERS

Annexure – 1

Provisions of Information & Technology Act, 2000

-

Section 2 (1)(b)

-

“addressee” means a person who is intended by the originator to receive the electronic record but does not include any intermediary;

-

-

Section 2 (1)(k)

“Computer resource” means computer, computer system, computer network, data, computer data base or software;

-

Section 2 (1)(l)

“computer system” means a device or collection of devices, including input and output support devices and excluding calculators which are not programmable and capable of being used in conjunction with external files, which contain computer programmes, electronic instructions, input data and output data, that performs logic, arithmetic, data storage and retrieval, communication control and other functions

-

Section 2 (1)(t)

“Electronic record” means data, record or data generated, image or sound stored, received or sent in an electronic form or micro film or computer generated micro fiche;

-

Section 2 (1)(ta)

“Electronic signature” means authentication of any electronic record by a subscriber by means of the electronic technique specified in the Second Schedule and includes digital signature;

-

Section 3 (2)

“hash function” means an algorithm mapping or translation of one sequence of bits into another, generally smaller, set known as “hash result” such that an electronic record yields the same hash result every time the algorithm is executed with the same electronic record as its input making it computationally infeasible

-

Section 3A –Electronic signature

-

Notwithstanding anything contained in section 3, but subject to the provisions of sub-section (2), a subscriber may authenticate any electronic record by such electronic signature or electronic authentication technique which–

-

is considered reliable; and

-

may be specified in the Second Schedule.

-

-

For the purposes of this section any electronic signature or electronic authentication technique shall be considered reliable if–

-

the signature creation data or the authentication data are, within the context in which they are used, linked to the signatory’ or, as (the case may be, the authenticator and to no other person;

-

-

-

Section 2 (1)(za)

“originator” means a person who sends, generates, stores or transmits any electronic message; or causes any electronic message to be sent, generated, stored or transmitted to any other person but does not include an intermediary;

-

Section 13 – Time and place of dispatch and receipt of electronic record

-

Save as otherwise agreed to between the originator and the addressee, the dispatch of an electronic record occurs when it enters a computer resource outside the control of the originator.

-

Save as otherwise agreed between the originator and the addressee, the time of receipt of an electronic record shall be determined as follows, namely:–

-

if the addressee has designated a computer resource for the purpose of receiving electronic records,–

-

receipt occurs at the time when the electronic record enters the designated computer resource; or

-

if the electronic record is sent to a computer resource of the addressee that is not the designated computer resource, receipt occurs at the time when the electronic record is retrieved by the addressee;

if the addressee has not designated a computer resource along with specified timings, if any, receipt occurs when the electronic record enters the computer resource of the addressee.

-

-

-

Save as otherwise agreed to between the originator and the addressee, an electronic record is deemed to be dispatched at the place where the originator has his place of business, and is deemed to be received at the place where the addressee has his place of business.

-

The provisions of sub-section (2) shall apply notwithstanding that the place where the computer resource is located may be different from the place where the electronic record is deemed to have been received under sub-section (3).

-

For the purposes of this section,–

-

if the originator or the addressee has more than one place of business, the principal place of business, shall be the place of business;

-

if the originator or the addressee does not have a place of business, his usual place of residence shall be deemed to be the place of business;

-

“usual place of residence”, in relation to a body corporate, means the place where it is registered.

-

-

Annexure – 2

Notifications/ Circulars related to the Scheme:

|

S. No. |

Notification / circulars Number |

Subject |

|---|---|---|

|

1. |

61/2019 |

E-Assessment Scheme, 2019 |

|

2. |

62/2019 |

Directions u/s 143(3B) |

|

3. |

65/2019 |

Prescribed authority to issue notices |

|

4. |

72/2019 |

National E-assessment centre, Delhi |

|

5. |

77/2019 |

Regional E-assessment centres and units |

- Sections/chapter covered by directions issued u/s 143(3B) vide Notification No. 62/2019.

|

Section |

Subject matter |

|---|---|

|

2(7A) |

Meaning of AO |

|

92CA |

TP Officer |

|

120 |

Jurisdiction of IT Authorities |

|

124 |

Jurisdiction of AO |

|

127 |

Power to transfer cases |

|

129 |

Change of incumbent |

|

131 |

Power regarding discovery, production of evidence |

|

133 |

Power to call for information |

|

133A |

Power of survey |

|

133C |

Power to call for information by prescribed income tax authorities |

|

134 |

Power to inspect register of companies |

|

142 |

Inquiry before assessment |

|

142A |

Estimate of value of assets by Valuation officer |

|

143 |

Assessment |

|

144A |

Power of JCIT to issue directions on certain cases |

|

144BA |

Power of PCIT or CIT in certain cases |

|

144C |

DRP |

|

246A |

Appealable Orders |

|

Chapter XXI |

Penalties Imposable |