General:

In order to support and enable Companies and Limited Liability Partnerships (LLPs) in India to focus on taking necessary measures to address the COVID-19 threat, including the economic disruptions caused by it, Ministry of corporate Affairs vide its general circular No 11/2020 announced certain measures in order to reduce compliance burden and other risks on companies. In the said circular it was announced that no additional fees shall be charged for late filing during a moratorium period from 01st April to 30th September 2020, in respect of any document, return, statement etc., required to be filed in the MCA-21 Registry, irrespective of its due date, which will not only reduce the compliance burden, including financial burden of companies/ LLPs at large, but also enable long-standing noncompliant companies/ LLPs to make a fresh start’.

Companies Act 2013 requires all companies to make annual statutory compliance by filing the Annual Returns end Financial Statements. Apart from this, various other statements, documents, returns, etc are required to be filed on the MCA 21 electronic registry within prescribed time limits along with prescribed filing fees.

In furtherance to Ministry’s Circular No 11/2020 dated 24.3.2020 and in order to facilitate the companies registered in India to make a fresh start on a clean state, the Ministry has issued a circular No 12/2020 dated 30.3.2020 granting one time opportunity to companies to complete the pending compliances by filing necessary documents in the MCA 21 registry including annual filing without being subject to hire additional fees on account of any delay .

Companies Fast Track Scheme and Objective:

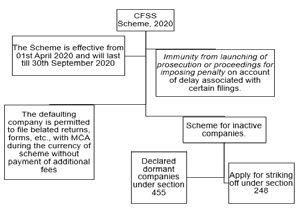

To give an opportunity for the defaulting companies and to enable them to File the belated documents in the MCA 21 registry, the central government in exercise of powers conferred under the Companies Act 2013 has decided to introduce scheme namely Companies Fresh Start scheme, 2020 ( CFSS – 2020) ( referred to as “the Scheme”) condoning the delay in filing the aforementioned documents with the Registrar, insofar as it relates to charging of additional fees and granting of immunity from launching of prosecution or proceedings for imposing penalty on account of delay associated with certain filings. Only normal fees for filing of documents in the MCA – 21 registry will be payable in such case during the currency of CFSS-2020.

In addition, the scheme also provides an opportunity to inactive companies to get their companies declared as “dormant company’ under section 455 of the Act by filing a simple application at a normal fee. The same provision enables inactive companies to remain on the register of companies with minimal compliance requirements.

Details of the scheme are as under:

-

Scheme Shall be Effectivefrom 1st April 2020 till 30th September 2020

-

Definition:

(a) “Act” means the Companies Act,2013 and Companies Act 1956

(b) “Defaulting Company “ means company defined under the Companies Act 2013 and which has made default in filing any of the documents, statement, returns etc including annual statutory documents on the MCA-21 registry.

(c) “Designated Authority” means the Registrar of Companies having jurisdiction over the registered office of the company.

(d) “Immunity Certificate’ means based on declaration made in form CFSS 2020 an immunity certificate issued by the designated authority in respect of documents filed under the Scheme .

(e) “Inactive Company” means a company as defined in Explanation (i) to section 455(1) of the Companies Act.

-

Applicability : Benefit of scheme available to Defaulting Cos.

(i) The Scheme shall be applicable only to “defaulting company” which has not filed any document, statement, return etc. including annual statutory documents, which were due for filing on any given date in accordance with the provisions of this Scheme .

(ii) The defaulting company is permitted to file belated documents which were due for filing on any given date in accordance with the provisions of this scheme.

-

Manner and payment of fees for filing belated documents

Every defaulting company shall be required to pay normal fees as prescribed under the Companies ( registration Office and Fee) Rules 2014 on the date of filing of each belated document and no additional fees shall be payable.

-

Immunity under Scheme

Immunity from launch of prosecution or proceedings for imposing penalty shall be provided only to the extent such prosecution or the proceedings for imposing penalty under the Act pertain to any delay associated with the filings of belated documents. It means that immunity from any penalty or prosecution shall be provided only if that penalty and prosecution arises directly from delay in filing of documents.

Any other consequential proceedings, including any proceedings involving interest of any shareholders or any other person qua the company or its directors or key managerial personnel would not be covered by such immunity. Thus Immunity is not against any substantive violation of law.

For Example: under section 42(8), every company is required to file a return of allotment within the period provided therein. However the proviso to section 42(4) also requires that utilization of money raised through private placement shall not be made unless the return of allotment has been filed in the registry.

Now immunity under the scheme shall only be available in respect of the proceedings for imposing penalty on account of delay in filing the return of allotment, but not on account of utilization of the money raise through private placement prior to filing of the return with registry.

Thus the scheme prohibits immunity from prosecution or penalty in case of consequential default.

Further it is to be noted that The Ministry has provided list of 76 “Eligible Forms” which is available on MCA website for waiver off additional fees for belated filings which comprises of eforms under the Companies Act 2013/ Companies Act 1956 and LLP’s and immunity is available to belated filing of related 76 forms only.

It is also to be noted that the scheme provides regularization of filing of belated documents/ statements /returns etc hence it is procedural in nature and does not provide any benefit for violation of consequential default or substantive law.

-

Withdrawal of appeal against any prosecution launched or proceedings for imposing penalties initiated.

The defaulting company or its officer in default needs to withdraw the appeal filed against the notice issued or complaint filed or an order passed by a court or by an adjudicating authority under the Act in respect of which application is made and furnish proof of such withdrawal along with application.

-

In cases where the order was passed by Adjudicating authority but appeal could not be filed:

Where penalties were imposed by an adjudicating authority in case of delay associated in filing of any document/statement/return in MCA 21 registry and no appeal has been preferred by the concerned company or its officer before the Regional Director under section 454(6) as on the date of commencement of the scheme in that case ;

(A) Where the order of the Adjudicating Authority falls between the 1st March 2020 to 31st March 2020, a period of 120 additional days shall be allowed with effect from such last date for filing appeal before the concerned regional directors,

(B) No prosecution shall be initiated under section 454(8) for non compliance of the order of the adjudicating authority relating to delay in filing any documents/statement or return etc in MCA 21 registry.

-

Application for issue of immunity in respect of documents filed under the Scheme:

The application seeking immunity in respect of belated documents filed under the scheme shall be made electronically in the form CFSS 2020 after the closure of the scheme and after the documents are taken on file or on record or approved by Designated authority as the case may be but not after the expiry of six months from the date of closure of scheme.

No fee shall be payable in this regard.

-

Immunity shall not be applicable in respect of :

(i) Appeal pending before the Court of law and in case of management disputes of the company pending before any court of law or tribunal;

(ii) Where any court has ordered any conviction in any matter, or an order imposing penalty has been passed by adjudicating authority under the Act , and no appeal has been preferred against such orders of the court or adjudicating authority as the case may be, before the scheme has come in to force.

-

Order of designated authority granting immunity from penalty and prosecution-

Based on declaration made in the form CFSS-2020 an immunity certificate in respect of documents filed under the scheme hall be issued by designated authority.

-

Scheme not to apply in certain cases-

The Scheme shall not apply :-

(A) To companies against which final notice for striking off the name u/s248 of the Act ( Section 560 of erstwhile companies Act 1956) has already been initiated by designated authority.

(B) Application has already been filed by the companies for action of striking off the name of the company.

(C) Companies which have amalgamated under the scheme of arrangement or compromise under the Act .

(D) Application filed for obtaining dormant status under 455 of the Act.

(E) To vanishing companies.

(F) Increase in authorized capital is involved ( SH-7) and also charge related documents (CHG-1, CHG-4, CHG-8 and CHG-9)

-

Effect of immunity:

After granting the immunity, the designated authority concerned shall withdraw the prosecution pending if any before the concerned court(s) and the proceedings of adjudication of penalties under section 454 of the Act, other than those prohibited under the Scheme, in respect of defaults against which immunity has been so granted shall be deemed to have been completed without any further action on part of designated authority.

It is to be noted that company whose name has been struck off from the register of companies u/s 248 of the companies Act 2013 by the Registrar of Company ,shall no longer be a company and hence shall not fit within the definition of defaulting company and thereby benefit of such scheme shall not apply to it.

In such case only remedy available to company shall approach NCLT or High Court for restoration of name of the company by the Registrar.

-

Scheme for Inactive Companies :

The defaulting inactive companies while filing due documents under CFSS-2020 can simultaneously, either:

(i) apply to get themselves declared as dormant company under Section 455 of the Companies Act, 2013 by filing e-form MSC-1 at a normal fee on said form; or

(iii) apply for striking off the name of the company by filing e-Form STK-2 by paying the fee payable on form STK-2Yes, the defaulting LLPs, which have filed their pending documents till 30 September, 2020 and made good the default, shall not be subjected to prosecution by Registrar for such defaults

-

Action against defaulting companies not opted for scheme:

At the conclusion of the Scheme, the Designated authority shall take necessary action under the Act against the Companies who have not availed this Scheme and are in default in filing theses documents in timely manner.

-

FAQ’s given by MCA on its website:

Some of the selected important FAQ’s given by MCA on its website are reproduced herein under for better understanding of the Scheme:

(a) Is the CFSS 2020 applicable on foreign company? Will the forms FC-1, FC-2 and FC-3 be covered under the scheme?

Ans: Yes.

(b) Can Deactivated director activated through this scheme?

Ans: Yes. He can file DIR-3 KYC eform/Web form and INC-22A (Active) as applicable without any payment of fee provided such director is not disqualified under section 164 of the CA 2013.

(c) Under this scheme whether AoC-4 for a year can be filed, without filling the AOC-4 for the previous year?

Ans: Yes, you can file without filing for the previous year. There is no restriction, however it is expected that complete and continuous year filing (without skipping intermediate year) will be good corporate governance.

(d) Whether CFSS scheme is applicable for the companies which have been automatically struck off due to non-filing of annual documents i.e. Annual Returns?

Ans: The struck off companies have to approach the NCLT for reviving their companies first and a copy order of NCLT approving for such revival under section 252 of the CA 2013 to be filed in Form NO.INC-28. Later on they can take the benefit of this scheme.

(e) For filing MGT 14, AOC-4 for the past year, do we need to apply for condonation also?

Ans: For filing MGT-14 beyond 300 days, condonation is required. However, AoC-4 for the past year(s) can be filed without any condonation.

(f) If the Company is in Active mode, but the directors’ DINs are deactivated, what should we do?

Ans: Deactivated DINs for not filing the DIR-3 KYC can be activated by filing it now without the fee of INR 5000 during the currency of the CFSS, 2020 provided such director is not disqualified under section 164 of the CA 2013.

(g) In our case, company was struck off and as a result both directors were disqualified. Now Company was revived by NCLT and revival order has been passed. (i) How to remove disqualification of director u/s 164(2) (a)?

Ans: The removal of disqualification is not automatic and the same cannot be cured under the provisions of CA, 2013.

(h) Can a company also file its old annual returns for 3 to 4 years without late fees?

Ans: Yes, without additional fees.

(i) Please let us know the List of eForms eligible for additional fee waiver during the currency of the CFSS, 2020?

Ans: List of forms (CA56/CA13) eligible for additional fee waiver is available at the link: http://www.mca.gov.in/Ministry/pdf/CFSS2020_02042020.pdf

(j) How to rectify AOC 04 filed with inadvertent errors?

Ans: AoC-4 or any other STP form filed with inadvertent errors can be marked as ‘defective’ by the jurisdictional RoC’s based on evidence and formal request. Once the particular STP is marked as defective fresh filing has to be made.

(k) Where orders have been passed by Hon’ble NCLT to restore the name of the company under section 252/253 subject to filing of all the pending documents and returns and no time limit is given in the order to file pending documents /forms/returns. The company has not yet filed the copy of order of NCLT with ROC. Can company avail this scheme and file all the pending documents without any additional fee?

Ans: Yes, after filing INC-28 with a copy of order passed by NCLT.

(l) What about the additional fee already paid by the entities? Is this not a hardship on them who have already paid heavy additional fee in order to abide the compliance?

Ans: The CFSS 2020 and LLP Modified Settlement Scheme 2020 have been notified in view of the COVID19. To provide a first of its kind opportunity to both Companies and LLPs to make good any filing related defaults, irrespective of duration of default, and make a fresh start as a fully compliant entity.

(m) Does the CFSS 2020 allows refund of the late filing fee and penalty which are already paid on Company fillings made before March 2020?

Ans: No

(n) In the case of a company whose status as per MCA is active (for filing) but whose all directors are disqualified, what is the way out to avail the benefits of the fresh start scheme?

Ans: Disqualification of Directors cannot be cured under the scheme.

(o) Can companies with paid up capital between 5 crores to 10 crores which did not file Active form since CS was not appointed file the form now since threshold was increased to 10 crores from 5 crores from 01.04.2020?

Ans: ACTIVE form can be filed without the fee of INR 10000.

(p) What are options available to a company the name of which has been struck off by the ROC but is having business activities for availing this scheme?

Ans: The Company has to approach NCLT and get an Order for reviving. Thereafter the company can take the benefit under CFSS.

(q) If the director has been disqualified in FY 2016-17 and filling is pending, can still the benefit of the CFSS scheme can be availed by the company (if status of company is still active)?

Ans: CFSS 2020 does not cure the disqualification of Director. If there are no authorized signatories left in the company, the company may approach the jurisdictional RoC with a formal request to add one authorized signatory from backend. Later on the company may file the belated documents under the scheme.

(r) Will this scheme be applicable on filing, if due date is falling between period April 2020 to September, 2020?

Ans: Irrespective of the due date additional fee waiver can be availed during the currency of the scheme.

(s) Is every company availing this scheme need to file FORM CFSS-2020 before filling the all the belated documents or should we file the documents directly?

Ans: Belated documents have to be filed during the currency of the scheme. If the scheme benefits are availed, such a company has to file the CFSS eform on or after 1st October, 2020 and before 31st March, 2021.

-

Important issues for consideration:

(i) Company whose name has been struck off

It is worth to note that in case of company whose name has been struck off from the register of companies u/s 248 of the companies Act 2013 by the Registrar of Company, benefit of the scheme shall not be available as the company is no longer in existence and hence shall not fall within the definition of defaulting company. Therefor benefit of such scheme shall not apply to it. In such case only remedy available to company shall approach NCLT for restoration of name of the company by the Registrar. This aspect has been clarified in FAQ,s para 15(d) above,

(ii) Disqualification of directors:

The disqualification of Directors under section 164 of the Companies Act,2013 can not be cured under CFSS 2020 scheme. The removal of disqualification is not automatic and the same cannot be cured under the provisions of Companies Act, 2013. One has to choose appropriate legal remedy for removal of disqualification of director. This point has been clarified in FAQ given above in para 15(b) (f) (g) & (n).

At the end , the CFSS 2020 scheme announced will certainly provide a noble opportunity to all companies to make good any previous filing defaults without paying any additional fees and become a compliant company more particularly in present scenario of Corona Virus ( COVID 19) which has brough entire country to standstill.