Disclosure of Foreign Income, Assets and Foreign Tax Credit

CA Natwar Thakrar

Part A: Disclosure of Foreign Income and Assets

1. Background

One salient feature of modern day business operations is its cross-border nature. This phenomenon of crossing national boundaries for business is not limited to corporations alone. Individuals, too, work abroad, earn income, own assets and engage in business transactions outside their home country or the country of their legal residence. This cross-border nature of business by tax payers creates a situation where information related to a tax payer or business transaction is scattered across multiple jurisdictions. Due to this a country has limited information about the transaction or the tax payer. At times, it is also difficult to determine if a particular cross-border transaction is legal or illegal. Even in cases which are suspected to be of illegal nature, incomplete availability of information proves a hurdle in further investigation.

To overcome some of the problems, countries across the globe have been cooperating with each other in different ways. One important and growing mode of cooperation in the arena of international taxation is known as ‘Exchange of Information’ (EOI), in which two or more countries exchange the predefined tax and financial information regarding their respective tax payers with each other. The OECD together with G20 countries and close cooperation with the EU and other stakeholders developed Common Reporting Standards (CRS), the Standard for Automatic Exchange of Financial Account Information in Tax Matters to facilitate cross-border tax transparency on financial accounts held abroad with the aim to equip tax authorities with an effective tool to tackle offshore tax evasion by providing a greater level of information on their residents’ wealth held abroad. This has resulted in systematic and periodic collection and transmission of “bulk” taxpayer information by the source country to the country of residence of the taxpayer, The receiving jurisdictions are expected to establish a procedure to utilize the bulk information so as to match the incomes earned or accounts held abroad, with that declared in their tax returns so as to detect instances, if any, of tax evasion.

In India, Section 285BA of the Income-tax Act, 1961 was inserted by the Finance Act, 2015 with effect from 1.4.2016 to provide that where any share of, or interest in, a company or an entity registered or incorporated outside India derives, directly or indirectly, its value substantially from the assets located in India, as referred to in Explanation 5 to clause (i) of sub-section (1) of section 9, and such company or, as the case may be, entity, holds, directly or indirectly, such assets in India through, or in, an Indian concern, then, such Indian concern shall, for the purposes of determination of any income accruing or arising in India under clause (i) of sub-section (1) of section 9, furnish within the prescribed time period to the prescribed income- tax authority the information or documents, in such manner, as may be prescribed.

As a consequence, Rules 114F to 114H were inserted to the Income tax Rules with effect from 7.8.2015 to implement India’s commitment to USA to implement FATCA and to the global community under EOI.

To make use of the bulk information received from across the globe; Schedule FA was introduced to the return of income in exercise of the powers under Section 139 read with Section 295 to require the tax payers to disclose information in respect of their foreign income, foreign accounts, foreign assets (including beneficial interest), etc. Most of the information sought are in the backdrop of Rules 114F to 114H introduced to Income-tax rules. Therefore, these rules provide guidance for understanding various requirements and the meaning of various terms. In addition, notes to income-tax returns also provide detailed guidance to the tax payers in filling the information under Schedule FA.

2. Understanding Taxability of Foreign Income and the disclosure requirement:

Section 5 lays down the scope of total income of a person chargeable to tax in India on the basis of the residential status of a person as follows-

- In case of a person who is resident and is an ordinary resident, his worldwide Income is taxable in India,

- In case of a person who is resident but is not an ordinary resident, apart from his Indian Income, his overseas income will be taxable in India only if it is from a business controlled in or profession set up in India.

- In case of a Non-resident, only his Indian Income is taxable unless income earned abroad is received in India.

Currently, the applicability of disclosure requirements are only for residents who are also ordinary residents of India. In other words, information under Schedule FA are not mandatory for non-residents and the persons who are not ordinary residents of India.

3. Filing Return of Income and Disclosure of Foreign Assets:

Section 139 of Income-tax Act, 1961 contains various provisions related to the filing of income tax return. The fourth proviso to section 139(1) mandates the following-

– Mandatory filing of return of income by any person resident in India (R&OR), other than not ordinarily resident in India (R but NOR), within the meaning of clause (6) of section 6 , irrespective of the fact that his income during the previous year does not exceeded the maximum amount which is not chargeable to income-tax during the previous year, if-

- has any asset (including any financial interest in any entity) located outside India or signing authority in any account located outside India,

- holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has signing authority in any account located outside India; or

- is a beneficiary of any asset (including any financial interest in any entity) located outside India (provided it is not reported under clause (b) above)

– Fill in Schedule FA of the Return of Income (ITR) and provide the required information in the prescribed manner.

It is essential to disclosure the relevant information accurately to avoid mismatch with the information available with the income tax authorities.

4. Implications under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 for non-filing of return/ non- disclosure under Schedule FA

The Black Money (Undisclosed Foreign Income and Assets) Imposition of Tax Act (Black Money Act) which came into force from July 1, 2015 provides for increased tax and penal consequences for the non-disclosure of income and assets held abroad. The following income and asset of a taxpayer will come within the preview of Section 4 of Act –

- The income from a source located outside India which has not been disclosed in the return of income furnished within the time specified in Explanation 2 to sub- section (1) or under sub-section (4) or sub- section (5) of section 139 of the Income-tax Act or

- The income from a source located outside India in respect of which a return is required to be furnished under section 139 of the Income-tax Act but no return of income has been furnished within the time specified in Explanation 2 to sub- section (1) or under sub-section (4) or sub- section (5) of section 139 of the said Act will come within the preview of Section 4 of the Black Money (Undisclosed Foreign Income & Assets) Act, 2015.

- the value of an undisclosed asset located outside India.

Under the Black Money Act, undisclosed foreign income and asset will be taxed at a flat rate of 30%. Further, there may be significant monetary penalties (up to 300% of the tax) along with the risk of criminal prosecution. Additionally, failure to furnish any information or furnishing inaccurate information in the return with respect to foreign income and foreign assets could also trigger a penalty of INR 10 lakhs.

5. Meaning of ‘Financial Interest’

A financial interest can be anything that has a monetary value and includes the rights and obligations to acquire such an interest. For the purpose of Schedule FA (in table B), the financial interest it will include, but not limited to, any of the following where the resident assesse –

- is the owner of record or holder of legal title of any financial account, irrespective of whether he is the beneficiary or not; or

- the owner of record or holder of title is one of the following:

- an agent, nominee, attorney or a person acting in some other capacity on behalf of the resident assessee with respect to the entity;

- a corporation in which the resident assessee owns, directly or indirectly, any share or voting power;

- a partnership in which the resident assessee owns, directly or indirectly, an interest in partnership profits or an interest in partnership capital;

- a trust of which the resident assessee has beneficial or ownership interest; or

- any other entity in which the resident assessee owns, directly or indirectly, any voting power or equity interest or assets or interest in profits..

6. Beneficial Owner & Beneficiary

The meaning of Beneficial Owner and Beneficiary is provided in the instructions for filing the ITR for the purpose of Schedule FA as follows-

- Beneficial owner in respect of an asset means:o a person who has provided, directly or indirectly, consideration for the asset and where such asset is held for the immediate or future benefit, direct or indirect, of the individual providing the consideration or any other person.

- Beneficiary in respect of an asset means:o an individual who derives an immediate or future benefit, directly or indirectly, in respect of the asset and where the consideration for such asset has been provided by any person other than such beneficiary.

For example, when an employee is granted a Stock Option, he becomes a beneficiary until Stock Options vest in him. He becomes beneficial owner once the Stock Options vest in him as he gets ownership right to deal with the stock options.

7. Rate of exchange for conversion of foreign asset/ income

The disclosure under Schedule FA is required in Indian rupees. For conversion of foreign asset or foreign-sourced income in Indian rupee, the rate of exchange is prescribed to be “telegraphic transfer buying rate”, (i.e. the rate of exchange) adopted by the State Bank of India (SBI) for buying such currency where such currency is made available to the bank through a telegraphic transfer.

For conversion of income and capital gains earned in foreign currency, Rule 115 & 115A of the Income-tax Rules should be followed.

8. Distinction between Depository and Custodian

Certain important distinctive features of a depository and a custodian are summarised in the table below;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Relevant Period for disclosure under Schedule FA

The disclosure under Schedule FA is for the calendar year. For the purpose of this Schedule, the calendar year ending on 31st December 2022 means the period comprising:-

- from 1st January, 2022 to 31st December, 2022 in respect of foreign assets or accounts etc. held in those jurisdictions where calendar year is adopted as basis for the purpose of closing of accounts and tax filings;

- from 1st April, 2022 to 31st March, 2023 in respect of foreign assets or accounts etc. held in those jurisdictions where financial year is adopted as basis for the purpose of closing of accounts and tax filings; or

- that period of 12 months, which ends on any day succeeding 1st April, 2022, in respect of foreign assets or accounts held in those jurisdictions where any other period of 12 months is adopted as basis for the purpose of closing of accounts and tax filings.

10. Disclosure requirements in ITR in Schedule FA

For AY 2023-24, schedule FA is divided into 10 Tables. The prescribed disclosure requirements are analysed in the table below.

| S.

No. |

Table No & Type of Accounts/ Assets | Nature of Disclosure | Remarks |

| 1 & 2 | Table – A1: Foreign Depository Accounts (Including any beneficial interest) at any time during the calendar year

Table A-2: Foreign Custodian Accounts (Including any beneficial interest) at any time during the calendar year |

|

|

| 3 | Table A-3: Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the calendar year |

|

|

| 4 | Table A-4: Foreign Cash Value insurance contract or annuity contract |

|

|

| 5 | Table- B: Financial interest in any entity outside India |

|

|

| 6 | Table- C: Any immovable property outside India |

|

|

| 7 | Table – D: Any other capital assets outside India |

|

|

| 8 | Table –E: Any other account located outside India in which taxpayer is a signing authority (not reported in tables A1 to D) |

|

|

| 9 | Table – F: Trust created outside India in which taxpayer is a trustee, a beneficiary or settlo |

|

|

| 10 | Table – G: Any other income derived from any foreign source (which is not reported in tables A1 to F) |

|

|

Details of foreign directorship are not required under Schedule FA. However, this information is required to be reported as a part of general disclosure in the ITR.

11. Penalties on Non-disclosure of Foreign Assets

If you fail to report the details of your foreign assets or furnish inaccurate information, you might face severe penalties. Following are the penalties for non-disclosure or misrepresentation of foreign assets.

- You might have to pay a penalty of INR 10 lakhs for every year that you fail to disclose your foreign assets.

- Any non-reporting of foreign assets while filing the ITR is considered a wilful evasion of tax and, you might have to face imprisonment of up to 7 years.

- Non-declaration also revokes your right to claim relief under the Double Taxation Avoidance Agreement for your foreign income.

Irrespective of the slab rate applicable, you must file ITR if you hold any foreign asset at any time in the financial year. Tax2win assists you with premium tax filing services and the accurate disclosure of foreign assets in ITR.

PART B: Foreign Tax Credit

Most of the times, foreign sourced income is also taxed in the home jurisdiction. This could results in double taxation of income, once in the country of source and second time in the country of residence of the tax payer.

To provide relief to tax payers, countries across the globe have entered into double tax avoidance agreements “DTAA” to share tax revenue and have also devised tax credit rules to provide credit for the taxes paid in the source country by the home jurisdiction.

1. Relevant provisions under the Income-Tax Act

Sections 90, 90A & 91 of Income Tax Act, 1961 (‘Act’) deal with the provisions relating to elimination of double taxation and provide for credit of the taxes paid in foreign jurisdiction.

Sections 90 / 90A of the Act contains provisions related to relief from double taxation in a scenario where India has entered into DTAA with a foreign country or a specified territory outside India..

Section 91 contains provisions for the unilateral credit of foreign taxes in the scenario where there is no DTAA between India and the specified foreign country.

2. Foreign Tax Credit Rules

A resident taxpayer shall be allowed credit for any foreign tax paid “FTC” in a country or specified territory outside India, by way of deduction or otherwise, in the year in which the income corresponding to such tax has been offered to tax or assessed to tax in India.

The manner and the extent to which the FTC shall be available is specified in Rule 128 of the Income-tax Rules. The salient features are as follows:-

- Where the income on which foreign tax has been paid or is deducted is offered to tax in more than one year, FTC shall be allowed across those years in the same proportion in which the income is offered to tax or assessed to tax in India.

- The FTC shall be available against the amount of tax, surcharge and cess payable under the Act but will not include any sum paid/ payable by way of interest, fee or penalty.

- No FTC shall be available in respect of any amount of foreign tax or part thereof which is disputed in any manner by the assesse. Credit of such disputed tax shall be allowed in the year in which such income is offered to tax or assessed to tax in India subject to compliance with the following conditions:-

- the taxpayer within a period of six months from the end of the month in which the dispute is finally settled furnishes evidence of settlement of dispute and an evidence to the effect that the liability for payment of such foreign tax has been discharged by him and

- the taxpayer furnishes an undertaking that no refund in respect of such amount has directly or indirectly been claimed or shall be claimed.

- FTC shall be the aggregate of the amount of credit computed separately for each source of income arising from a particular country or specified territory outside India.

- FTC shall be the lower of the tax payable under the Act and the foreign tax paid on such income.

- Where the foreign tax paid exceeds the amount of tax payable as per the Agreement/ DTAA, such excess shall be ignored

- FTC shall be determined by conversion of the currency of payment of foreign tax at the telegraphic transfer buying rate on the last day of the month immediately preceding the month in which such tax has been paid or deducted

- In a case where any tax is payable under the provisions of section 115JB or section 115JC, FTC shall be allowed against such tax in the same manner as is allowable against any tax payable under the provisions of the Act .

- The FTC shall be claimed by online submission of Form 67 through e-filing account of the taxpayer.

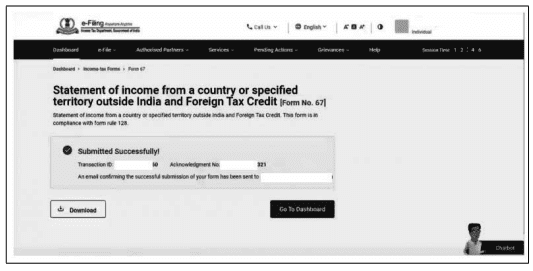

3. Procedure for filing Form 67

- The CBDT, vide notification no. 9/2017 dated 19 September 2017 has prescribed the procedure for filing Form 67 which has been enumerated as under:

- Form 67 is to be prepared and submitted online through e-filing portal account of the taxpayer

- The form shall be verified through Digital Signature Certificate (DSC) or Electronic Verification Code (EVC)

- Submission of Form 67 shall precede the filing of the return of income.

- FTC shall be allowed on furnishing the following documents by the taxpayer :—

- A statement of foreign income offered to tax along with foreign tax deducted or paid on such income in Form No. 67

- Certificate or statement specifying the nature of income and the amount of tax deducted therefrom or paid by the taxpayer:

- From the tax authority of the foreign country or

- from the person responsible for the deduction of such tax or

- Statement signed by the taxpayer along with proof of payment of taxes outside India.

- The statement in Form No. 67 along with the certificate or the statement referred to above shall be furnished on or before the end of the assessment year relevant to the previous year in which the income has been offered to tax or assessed to tax in India and the return for such assessment year has been furnished within the time specified under sub-section (1) or sub- section (4) of section 139. [Applicable w.e.f. 1.4.2022 through substitution of Sub- rule (9)]

- Where the return has been furnished under sub-section (8A) of section 139 (Updated Return), the statement in Form No. 67 and the certificate or the statement referred to in clause (ii) of sub-rule (8) to the extent it relates to the income included in the updated return, shall be furnished on or before the date on which such return is furnished.

4. Gist of select case Laws

| Citation | Gist |

| Sonakshi Sinha v. CIT in ITA.No. 1704/Mum/2022 for AY: 2018-19 dated 20.09.2022 |

|

| Ganesh Anandrao Ingulkar v. Assistant Director of Income-tax CITATION: 2023 TAXSCAN (ITAT) 900 |

|

| Sobhan Lal Gangopadhyay v. Asstt. Director of Income Tax CITATION: 2023 TAXSCAN (ITAT) 1060 |

|

| Deelip Kanhailal Chawla v. The Income Tax Officer CITATION: 2023 TAXSCAN (ITAT) 689 |

|

| Rohan Hattangadi v. CIT CITATION: 2023 TAXSCAN (ITAT) 189 / ITA No.1896/Mum/2022 AY 2021-22 |

|

5. Steps to fill and submit Form 67

Step 1: Log in to the Income Tax e-Filing portal using your user ID and password.

Step 2: On the ‘Dashboard’, click ‘e-File’, click ‘Income Tax Forms’ and select ‘File Income Tax Forms’

Step 3: : On the next page, select ‘Form 67’

Step 4:Select the ‘Assessment Year (AY)’ and click ‘Continue’

Step 5: On the instructions page, click ‘Let’s Get Started’.

Step 6: Form 67 will be displayed. Fill the required details and click ‘Preview’

Step 7: Verify the details and click ‘Proceed to e-Verify’.

Step 8: Click ‘Yes’ on the confirmation message to submit the form

Step 9: : It will be redirected to the e-verify page. After successful e-verification, a success message will be displayed along with a transaction ID and acknowledgement number.

Note the transaction ID and acknowledgement for future reference. You will also receive a confirmation message to the email ID registered on the e-Filing portal.