CA Rajesh Mehta

The Interim Budget 2024-25 was tabled in the parliament. It envisions ‘Viksit Bharat’ by 2047, with all-round, all-pervasive, and all-inclusive development.

- An Interim Budget is presented by a government that is going through a transition period or is in its year in office ahead of general elections.

- The purpose of the interim budget is to ensure the continuity of government expenditure and essential services until the new government can present a full- fledged budget after taking office

- The government in power cannot deliver the Economic Survey along with the interim budget.

What is an Interim Budget?

An interim budget is presented by the government in the Parliament if it does not have the time to present a full budget, or if the general elections are around the corner. If in case the elections are nearing, it is only correct that the incoming government will frame the full budget.

About Union Budget

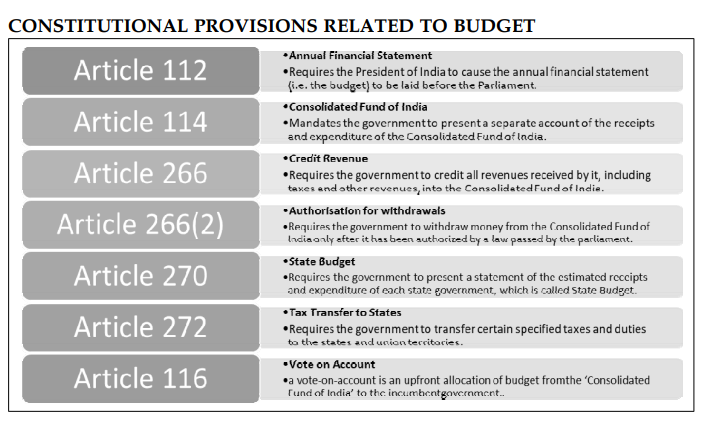

- According to Article 112 of the Indian Constitution, the Union Budget also referred to as the annual financial statement, is a statement of the estimated receipts and expenditure of the government for the upcoming financial year.

- Budget word is not there in the constitution.

- Union Budget Period: April 1 to March 31

- Interim Budget Period: From April and upto assent by President on full budget by the new Government. Generally April-July (Four months)

- Prepared by: Department of Economic Affairs, Ministry of Finance is the nodal body responsible for preparing the Budget.

- Union Budget Classification: Union Budget is classified into Revenue Budget and Capital Budget.

- Revenue Budget: It includes the government’s revenue receipts and expenditure.

- Revenue Receipts: There are two kinds of revenue receipts – tax and non-tax revenue.

- Revenue expenditure: It is the expenditure incurred on day to day functioning of the government and on various services offered to citizens.

- Revenue Deficit: If revenue expenditure exceeds revenue receipts, the government incurs a revenue deficit.

- Capital Budget: It includes capital receipts and capital expenditure.Interim Budget & Finance Bill 2024

- Capital Receipts: Loans from public, foreign governments and RBI form a major part of the government’s capital receipts.

- Capital expenditure: It is the expenditure on development of machinery, equipment, building, health facilities, education etc.

- Revenue Budget: It includes the government’s revenue receipts and expenditure.

- Fiscal Deficit: Fiscal deficit is incurred when the government’s total expenditure exceeds its total revenue.

There are times when the government provides an “interim budget” rather than a full budget. This is done before the holding of elections, the Minister of Finance will present an Interim Budget during the joint sitting of the Rajya Sabha and the Lok Sabha in Parliament.

Why an interim budget?

As per Article 112 of the Indian Constitution, a statement of the estimated receipts and expenditure of the Government of India for a specific financial year— referred to as ‘annual financial statement’ — is laid before both Houses of Parliament. The Centre seeks both Houses’ approval to withdraw the necessary funds from the Consolidated Fund of India; this statement has to be passed by both Houses.

In an election year, just before the election, the Government cannot present a full Budget. Hence, the need for an interim budget. As there is no constitutional provision for an interim budget, the Centre can choose to seek the Lower House’s approval for the funds required for the transition period (April – July) till the new government presents a full Budget— via the vote on account provision.

- The ruling government presents an Interim budget before the General Lok Sabha Elections, which are conducted every five years.

- The ruling government presents an estimate of its expenditure, revenue, fiscal deficit, financial performance, and expectations for the next fiscal year in the Interim Budget.

- At the end of its tenure, the ruling government submits an interim budget which is like a budget for the transition period (few months remaining in power) for three to four months in order to keep the country functioning smoothly.

- If the current government returns to power, the Interim Budget would most likely explain its economic outlook for the following five years.

- No substantial policy announcements in the Interim Budget, otherwise it may financially burden the future government.

- The previous year’s income and spending will be stated in the Interim Budget.

- It also details the costs for the following several months until the charge is taken up by the next government. The sources of revenue, however, will not be mentioned in the Interim Budget.

- A full budget gives the government, the spending rights until the end of the financial year (which ends on 31st March).

- In case, the government is not able to present the full budget before the end of the financial year, it will require parliamentary approval for incurring expenditure in the new financial year until a new budget is passed.

- Until the Parliament discusses the budget and passes it (for the whole year), through the interim budget, the government passes a vote-on-account which will allow the government to meet its expenses of administration. The vote-on-account passed through the interim budget, seeks parliamentary approval for the government to meet expenses for a part of the fiscal year.

What an Interim Budget cannot do according to the Code of Conduct by the Election Commission?

In an interim budget (because it is close to the general elections), the Election Commission has given regulations to the effect that any major policy changes that can influence the voters unfairly are not permitted.

It does not disclose any major policy changes that may create a considerable financial burden on the successive government responsible for presenting the full Union Budget while it is presenting the Interim Budget. According to the Code of Conduct for the Election Commission, the ruling administration cannot include any significant projects in the Interim Budget since doing so may influence the voters. This is because including such initiatives would violate the prohibition.

What is the Procedure of Budget Approval in India for the Interim Budget in an Interim Period?

- Parliament clears the government’s vote-on-account, allowing it to satisfy its obligations until the next Parliament examines and adopts a complete Budget for the remainder of the year.

- The vote-on-account is granted for a period of four months when the government changes due to General Elections rather than a loss of trust vote scenario.

- The government is constitutionally allowed to make tax changes in the interim budget, but in every interim budget since Independence, outgoing governments have respected the fact that it is only a custodian for a few months and has refrained from making major changes or introducing new schemes or plans.

Article 116 of the Constitution allows the Lower House to make any grant in advance for the estimated expenditure for part of any financial year by voting and passing such a legislation, i.e. vote on account. The Lok Sabha is empowered to authorise withdrawal of required funds from the Consolidated Fund of India for such expenditure.

A simple vote on account includes presenting the Centre’s fund requirements for salaries, ongoing projects and other expenditure for the transitional period, and is then passed via the Lok Sabha sans debate. It cannot make any changes to tax rates. It is also valid only for two months and can be extended up to four months.

However, it has been the trend for outgoing governments to present an interim budget instead of a simple vote on account. In an interim budget, the Finance Minister will present the current state of the Indian economy, its fiscal status including India’s revised estimated growth in the next year. It gives details on the government’s planned and non-planned expenditure and receipts. While the Centre has to desist from announcing any major scheme which could influence voters or present an Economic Survey, the government is allowed to revise tax rates via an interim budget.

How is an Interim budget different from a regular Union budget?

In the case of the Union Budget, the Finance Minister presents the annual financial statement to both Houses on February 1, at the beginning of Parliament’s Budget session. The document, which is now paperless, is circulated to all members as the Minister summarises key points in the Budget speech. The Minister lists the work completed in various sectors via central schemes, explains the need for proposed schemes, enumerates funds allocated for the same, and details the aims of the various departments for the next fiscal year. The Minister also briefs the Houses on the state of the nation’s economy, its growth projections, fiscal deficit and the government’s source of income via taxes and cess.

- The vote-on-account passed through the interim budget, seeks parliamentary approval for the government to meet expenses for a part of the fiscal year.

- It is not practical for the government to present a full budget when there are elections nearing, so the government presents an interim budget, which is like a budget for the transition period (few months remaining in power).

- But, like a regular budget, the estimatesare presented for the whole year.

- When the new government frames a new budget, it can concur with or change the estimates as it deems fit.

- The Constitution gives the government the power to make changes in the tax regime in the interim budget.However, in all the interim budgets that the various governments have presented so far, no major tax changes or new schemes have been announced respecting the fact that the government is in power not for whole year due to elections in between.

- Generally, an annual budget contains two segments –

- Report on the previous year ’sincome and expenses

- Proposed income generation andexpenses for the coming year

- In an interim budget, the first part is the same as the annual budget, i.e., the previous year’s income and expenses. However, only a documentation of the proposed basic expenses till the elections are included in the interim budget.

Vote-on-account

The vote-on-account is passed through the interim budget.

- It allows the government to meet its expenses in the short period leading up to the elections.

- The vote-on-account is passed as a convention without discussion, as opposed to a full budget where the budget is passed only after discussions are held.

- It is like a grant-in-advance to the government to function properly until the voting on the demands for grants, as well as the passing of the Finance Bill and the Appropriation Bill.

- The sum of this grant is 1/6th of the estimated expenditure for the whole year under various demands for grants.

- The vote-on-account is valid for two months usually. The full budget is valid for a year.

- A vote-on-account contains only the expenditure of the government whereas the interim budget deals with both receipts and expenditure.

Difference Between The Interim Budget and the Vote on Account:

Now, what is the difference between the Interim Budget and the Vote on Account? An interim budget is the same as the entire budget; the primary difference is that an interim budget is only utilised for a certain length of time. Like the budget of the Union, it consists of an exhaustive collection of accounts that provides specifics about both spending and income.

In addition, the predictions, much like the overall budget, are broken down into each month of the year. Nevertheless, the government will typically refrain from introducing major tax adjustments or schemes in the interim budget during election years, even though the Constitution does not expressly prohibit it.

On the other hand, a vote-on-account is just concerned with the expenditure. There is no formal discussion during the voting in Parliament, which results in a unanimous vote.

What is the Difference Between

Interim Budget and Vote on Account?

| Feature | Interim Budget | Vote on Account |

| As per Constitution of India under which Article | Article 112 | Article 116 |

| Why | Financial Statement presented by the government ahead of general elections. | To meet essential government expenditures for a limited period until the budget is approved. |

| For Expenditure of which period | Covers a specific period, usually a few months until a new government is formed and a full budget is presented. | It is generally granted for two months for an amount equivalent to one-sixth of the total estimation. |

| Policy changes | Can propose changes in the tax regime | Cannot change the tax regime under any circumstances |

| Impact on Governance | Provides continuity in governance during the transition period between two governments. | Ensures the smooth functioning of the government and public services until the regular budget is approved. |

Interim Budget Vs Full Budget

| Aspect | Interim Budget | Full Budget |

| Timing | Interim Budget Presented by the outgoing government before General elections. | Full Budget Presented by thenewly elected government. |

| Scope | Covers expenditures and receipts for a short period. | Encompasses all aspects of government finances for the fiscal year. |

| Purpose | Ensures continuity of essential functions temporarily. | Serves as a strategic guide for the entire fiscal year. |

| Policy Announcements | Limited policyannouncements. | Allows for comprehensive and major policy declarations. |

| Economic Survey | No presentation before the Interim Budget. | Usually presented a day before the Full Budget. |

What are the Funds Related to the Budget in India?

- Consolidated Fund of India: Article 266(1) of the Constitution consolidates all revenues, loans, and loan repayments received by the Union Government into a single fund known as the Consolidated Fund of India.

o Withdrawal needs parliament permission (except for Charged Expenditure like Judges’ salaries).

- Public Account of India: Under Article 266 (2), it includes incoming money from provident fund, small savings, postal deposit etc.o Government acts similar to a banker transferring funds from here to there so parliament permission is not necessary.

- Contingency Fund of India: It is established under the Contingency Fund of India Act, 1950 and operates as an imprest in accordance with Article 267(1).

-

- It serves the purpose of offering advances to the government for unforeseen expenditures during the fiscal year, pending authorization by Parliament.

- Funds withdrawn from the Contingency Fund are replenished upon parliamentary approval through Supplementary Demands for Grants.

Interim Budget 2024 Highlights

Interim Budget: Part A

- Vision of Budget: Viksit Bharat by 2047 “Prosperous Bharat in harmony with nature, modern infrastructure and opportunities for all”

- Development Mantra of Budget: Sabka Saath, Sabka Vikas, and Sabka Vishwas’ whole of nation’ approach of ‘Sabka Prayas’.

- Philosophy is to cover all elements of inclusivity.

- Social inclusivity- through coverage of all strata of the society,

- Geographical inclusivity- through development of all regions of the country.

FOCUS AREAS:

The government is focusing on four aspects of our society i.e.,GYAN.

GYAN:

- ‘Garib’ (Poor),

- ‘Yuva’ (Youth),

- ‘Annadata’(Farmer)

- ’Nari’ (Women).

- Garib (Poor)

- Alleviation of poverty: 25 crore people got freedom from multi- dimensional poverty.

- Direct Benefit Transfer: 34 lakh crore DBT using PM-Jan Dhan accounts has led to savings of 2.7 lakh crore for the Government.

- PM-SVANidhi

- Credit assistance provided to 78 lakh street vendors.

- 2.3 lakh have received credit for the third time. Interim Budget & Finance Bill 2024

- PM-JANMAN Yojana: Helped in reaching out to the particularly vulnerable tribal groups.

- PM-Vishwakarma Yojana: Provided end-to-end support to artisans and craftspeople engaged in 18 trades.

- Yuva (Youth or Amrit Peedhi)

- The National Education Policy 2020 is ushering in transformational reforms.

- PM ScHools for Rising India (PM SHRI) delivering quality teaching, and nurturing holistic and well- rounded individuals.

- The Skill India Mission: Trained 1.4 crore youth, upskilled and reskilled 54 lakh youth, and established 3000 new ITIs.

- New institutions of higher learning: 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMS and 390 universities have been set up.

- PM Mudra Yojana- Sanctioned 43 crore loans aggregating to 22.5 lakh crore.

- Fund of Funds, Start Up India, and Start Up Credit Guarantee schemes: Assisting youth and making them ‘rozgardata’.

- Youth in Sports:

- The highest ever medal tally in Asian Games and Asian Para Games in 2023.

- Chess prodigy Praggnanandhaa put up a stiff fight against the reigning World Champion Magnus Carlsson in 2023.

- India has over 80 chess grandmasters compared to little over 20 in 2010.

- Annadata (Farmer)

- PM-KISAN SAMMAN Yojana: Direct financial assistance is provided to 11.8 crore farmers, including marginal and small farmers.

- PM Fasal Bima Yojana: Crop insurance is given to 4 crore farmers.

- Electronic National Agriculture Market: Integrated 1361 mandis, and providing services to 1.8 crore farmers with trading volume of ₹ 3 lakh crore.

- Other measures like farmer- centric policies, income support, coverage of risks through price and insurance support, promotion of technologies and innovations through start-ups.

- Nari/Mahilayen (Women)

- Thirty crore Mudra Yojana loans have been given to women entrepreneurs.

- Female enrolment in higher education has gone up by twenty- eight per cent in ten years.

- In STEM courses, girls and women constitute forty-three per cent of enrollment – one of the highest in the world.

- Enhancement of Women’s dignity by Making ‘Triple Talaq’ illegal

- Reservation of one-third seats for women in the Lok Sabha and State legislative assemblies

- Giving over 70% houses under PM Awas Yojana in rural areas to women as sole or joint owners.

STRATEGY For AMRIT KAAL

Sustainable Development

- Commitment to meet ‘Net Zero’ by 2070: GREEN ENERGY

- Viability gap funding allocated for wind energy projects.

- Establishment of coal gasification and liquefaction capacity.

- Gradual implementation of mandatory blending of CNG, PNG, and compressed biogas.

- Financial aid provided for the procurement of biomass aggregation machinery.

Initiative for rooftop solarization: facilitating 1 crore households to receive up to 300 units of free electricity monthly.

- Integration of e-buses into the public transport network.

- Support for the enhancement of the e-vehicle ecosystem, including manufacturing and charging infrastructure.

- Introduction of a new scheme for bio manufacturing and bio-foundry to promote eco-friendly alternatives.

Other Achievements:

- Over 10 crore LPG connections distributed under PMUY.

- Distribution of 36.9 crore LED bulbs, 72.2 lakh LED tube lights, and

- 23.6 lakh energy-efficient fans through UJALA.

- Installation of 1.3 crore LED street lights under SNLP.

- Non-Fossil Fuel installed energy capacity increased from 30.4% in 2004 to 43.9% in 2023.

Infrastructure and Investment

- Execution of three major railway corridor initiatives under PM Gati Shakti aimed at enhancing logistics effectiveness and cutting costs.

- Three major economic railway corridor programmes will be implemented- energy, mineral & cement corridors, port connectivity corridors, and high traffic density corridors.

- Forty thousand normal rail bogies will be converted to Vande Bharat standards for enhanced safety, convenience, and passenger comfort.

- Encouragement of foreign investment through the negotiation of bilateral investment treaties.

- Enlargement & Expansion of current airports and comprehensive establishment of new airports as part of the UDAN scheme.

- Advancement of urban renewal & transformation through the implementation of Metro rail and NaMo Bharat initiatives.

Inclusive Development

- Aspirational Districts Programme to assist States in faster development and employment generation.

Health:

- More medical colleges will be set up by utilizing the existing hospital Infrastructure.

- Cervical Cancer Vaccination for girls in age group of 9 to 14 years.

- Maternal and child health care- Various schemes to be brought under one comprehensive programme for synergy in implementation.

- Upgradation of anganwadi centres under “Saksham Anganwadi and Poshan 2.0” initiatives will be expedited for enhanced and improved nutrition delivery, early childhood care and development.

- U-WIN platform will be rolled out for managing immunization and intensified efforts of Mission Indradhanush.

- Extension of health coverage under Ayushman Bharat scheme to all ASHA workers, Anganwadi Workers and Helpers.

Housing

- Pradhan Mantri Awas Yojana (Grameen) is on track to reach the goal of 3 crore houses.

- Additional 2 crore houses targeted for next 5 years under PM Awas Yojana (Grameen) – An additional target of 2 crore houses is set for the next 5 years.

- Housing for middle class scheme to be launched to promote middle class to buy/ built their own houses.

Tourism

- States will receive encouragement to develop iconic tourist centres to attract business and foster local entrepreneurship.

- Development of the East To make the eastern region and its people a powerful driver of India’s growth.

- Long-term interest free loans will be provided to States for financing such development on matching basis. Provision of long-term interest-free loans to States to incentivise development efforts.

- Projects for port connectivity, tourism infrastructure, and amenities will be taken up for islands, including Lakshadweep.

Agriculture and Food Processing

- Promotion of private and public investment in post-harvest activities by the government.

- Expansion of the application of Nano- DAP across all agro-climatic zones.

- Formulation of the Atmanirbhar Oilseeds Abhiyaan Strategy to achieve self- sufficiency in oilseeds.

- Development of a comprehensive program for dairy development.

- Stepping up the implementation of the Pradhan Mantri Matsaya Sampada Yojana to boost aquaculture productivity, double exports, and create more employment opportunities.

- Establishment of 5 Integrated Aquaparks.

Other Measures

- To enhance the target for Lakhpati Didi from 2 crore to 3 crore.Lakhpati Didi refers to women members of Self Help Groups (SHGs) who earn a sustainable income of at least ₹ 1 lakh per year per household.

- Promoting Research and Innovation

- A corpus of rupees one lakh crore will be established with fifty-year interest free loan.

- A new scheme will be launched for strengthening deep-tech technologies for defence purposes and expediting ‘atmanirbharta’.

- Reforms in the States for ‘Viksit Bharat’: A provision of seventy-five thousand crore rupees as fifty-year interest free loan is proposed to support milestone- linked reforms by the State Governments.

- Addressing Societal Challenges: A high- powered committee will be formed to address challenges due to fast population growth and demographic changes and achieve the goal of ‘Viksit Bharat’.

- Capital Expenditure: An 11.1% increase in the capital expenditure outlay for 2024- 2025 was announced.

- The capital expenditure is set at ₹ 11,11,111 crore constituting 3.4% of the GDP.

- Economic Growth Projections: The GDP growth for FY 2023-24 real GDP growth is projected at 7.3%, aligning with the RBI’s revised growth projection.

- The International Monetary Fund upgraded India’s growth projection to 6.3% for FY 2023-24. It also anticipates India becoming the third-largest economy in 2027.

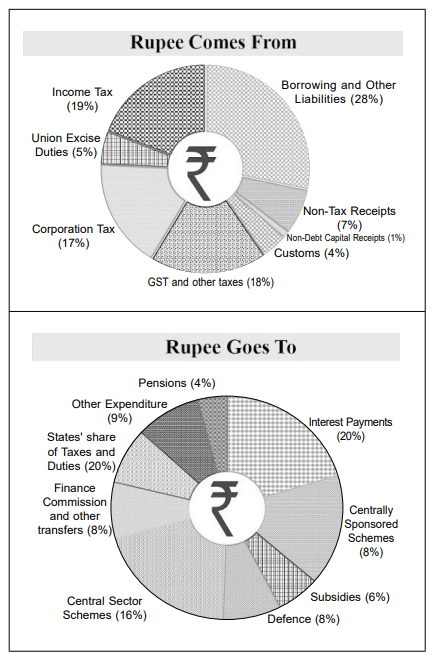

- Revenue and Expenditure Estimates (2024-25):

- Total Receipts: Estimated at ₹ 30.80 lakh crore, excluding borrowings.

- Total Expenditure: Projected at ₹ 47.66 lakh crore.

- Tax Receipts: Estimated at ₹ 26.02 lakh crore.

- Fiscal Deficit and Market Borrowing: Fiscal deficit is estimated at 5.1% of GDP in 2024- 25, aligning with the goal of reducing it below 4.5% by 2025-26 (announced in budget 2021-22).

- Gross and net market borrowings through dated securities in 2024-25 are estimated at ₹ 14.13 and 11.75 lakh crore, respectively.

Interim Budget: Part B

DIRECT & INDIRECT TAXES

Direct Tax:- developments in recent years

- Direct Tax Collections more than trebled in last 10 years.

- Number of return filers swelled to 2.4 times.

- Faster Refunds: Reduction in average processing time of returns from 93 days in 2013-14 to 10 days in 2023-24.

- New Tax regime resulted in reduced and rationalized tax rates

- Taxpayers with income up to ₹ 7 lakh have no tax liability

- The threshold for presumptive taxation for retail businesses raised is ₹ 2 crore and threshold raised to ₹ 3 crore if aggregate amount received in cash is not more than 5% of turnover or gross receipts).

- Corporate tax rate decreased from 30% to 22% for existing companies and 15% for new manufacturing companies.

- Improvement in tax-payer services through Faceless Assessment and Appeal

- New Form 26AS and prefilling of tax returns.

Indirect Tax

- Average monthly Gross GST collections doubled to ₹ 1.66 lakh crore in FY24.

- Increase in tax buoyancy of State revenue from 0.72 (2012-16) to 1.22 in the post-GST period (2017-23)

- Reduction in logistics cost and prices of most goods and services

- Decline in import release time since 2019 by:

- 47 per cent at Inland Container Depots

- 28 per cent at Air Cargo complexes

- 27 per cent at Sea Ports

- Supply Chain Optimization by eliminating tax arbitrage and octroi. Positive sentiment about GST- 94% of industry leaders view the transition to GST as largely positive and 80% of respondents feel GST has led to supply- chain optimisation.

TAX PROPOSALS: Finance Bill 2024

Interim Budget

No changes in tax rate proposed. No changes to corporate tax rates.

Continuity in taxation: Certain tax benefits to Start-ups and investments made by sovereign wealth funds/pension funds and tax exemption of some IFSC units extended up to 31.03.2025 earlier expiring on 31.03.2024

To improve taxpayer services FM also announced withdrawal of petty, non-verified, non-reconciled or disputed direct tax demands:

– This is expected to benefit approx. 1 crore taxpayers

- Up to ₹ 25,000 pertaining up to FY 09-10

- Up to ₹ 10,000 for FY10-11 to FY 14-15

Retention of same tax rates for direct and indirect taxes, import duties, corporate taxes

- For direct and indirect taxes, including import duties

- For Corporate Taxes-22% for existing domestic companies, 15% for certain new manufacturing companies

- No tax liability for taxpayers with income up to ₹ 7 lakh under the new tax regime

For the domestic companies, for lower basic tax rate of 25% in Tax year 2024-25, the base year for turnover less than ₹ 400 crore is shifted ahead by one year to FY 2022-23. Accordingly, a domestic company having turnover not exceeding INR400 crore in Tax year 2022-23 will be eligible to basic tax rate of 25% in Tax Year 2024-25 (regardless of the quantum of turnover in Tax Year 2023-24 or Tax Year 2024-25).

DIRECT TAXES:-

Changes in TCS provisions – Tax Collection at Source (TCS):-

Changes in TCS rates which were done earlier by CBDT circular No. 10/2023 dated 30th June, 2023, now covered in Finance Bill, 2024

The Finance Bill 2024 introduced the TCS changes as notified in CBDT circular 10/2023. The applicable TCS rates are:

- LRS for education financed by loan from a qualifying financial institution:- NIL up to ₹ 7,00,000, 0.5% on amount in excess of ₹ 7,00,000

- LRS for medical treatment/education (other than financed by loan from qualifying financial institution):- NIL up to ₹ 7,00,000, 5% on amount in excess of ₹ 7,00,000

- LRS for other purposes:-NIL up to ₹ 7,00,000, 20% on amount in excess of ₹ 7,00,000.

- Purchase of Overseas Tour Program Package:-5% upto ₹ 7,00,000, 20% on amount in excess of ₹ 7,00,000.

Extending certain timelines

Timeline for tax benefits being provisions pertaining to commencement of operations in the International Financial Services Centre (IFSC) units, incorporation of certain start-ups being eligible for tax holiday, investments made by sovereign wealth funds/pension funds, is extended from 31 March 2024 to 31 March 2025.

However, timeline of 31 March 2024 applicable for claim of concessional tax rate by a new domestic manufacturing company has not been extended.

Further, certain conditions for claiming exemption from establishing business connection in India/residency test were relaxed for fund managers in IFSC, who commence their operations on or before 31 March 2024. This deadline has not been extended. No extension provided for domestic manufacturing companies for availing 15% concessional tax rate benefit.

Extension of timeline relating to faceless schemes

Further, timeline for notification of faceless schemes extended to 31 March 2025.

The deadline for the Central Government to issue directions for introduction of faceless schemes for undertaking transfer pricing matters, international taxation matters before the Dispute Resolution Panel and appeals before Tax Tribunals has been extended from 31 March 2024 to 31 March 2025.

Timelines under the Income-tax Act, 1961 extended from 31 March 2024 to 31 March 2025 for the following:

| Sr.No. | Exemption/deduction | Criterion for extension |

| 1. | Exemption to specified income earned by Investment division of non- resident International Financial Services Centre (IFSC) Banking Unit | Date ofcommencement of operations to claim exemption by Investment Division of Offshore BankingUnit in IFSC |

| 2. | Exemption of income of a Non- Resident by way of royalty or interest on account of lease of an aircraft/ ship paid by a unit of an IFSC | Date ofcommencement of operations for IFSC unit to claim exemption on aircraft/ ship lease |

| 3. | Capital gain exemption on transfer of leased ship/aircraft by a IFSC unit | Date ofcommencement of operations forIFSC Unit. |

| 4. | Exemption to Sovereign Wealth Fund /Pension Fund/ wholly ownedSubsidiary of Abu Dhabi Investment Authority on specifiedinvestments | Date for investment for exemption |

| 5. | Deduction of 100% of profits of eligible start up from eligible business for a period of three consecutive tax years out of 10 tax years beginning from the tax year in which the eligible start-up is incorporated | Date of incorporation for eligible start-ups to claim deduction |

Goods and Services Tax

Distribution of input tax credit (ITC) made mandatory through Input Service Distributor (ISD) mechanism

- The office receiving invoices for or on behalf of distinct persons shall be required to get registered as Input Service Distributor (ISD) and distribute the credit of GST to such distinct persons through the prescribed document.

- Consequential amendment has been made in the definition of Input Service Distributor.

- ISD shall distribute the ITC in such manner, within such time and subject to such restrictions and conditions as may be prescribed.The definition of ISD is proposed to be amended to mean an office which receives tax invoices for or on behalf of distinct persons and is liable to distribute the input tax credit in respect of such invoices

It is proposed to cover invoices for input services including those for services liable to tax under domestic reverse charge

An office receiving invoices for services for or on behalf of a distinct persons will be required to be registered as an ISD

The manner of distribution of credit by an ISD will be prescribed through the rules

The credit will be distributed by way of issue of a document containing the amount of input tax credit.

Offence related provisions

Introduction of penalty for not following special procedures

Penalty provisions are proposed to be introduced for failure to register certain machines used in manufacture of specified goods (such as tobacco, pan-masala, hookah, khaini, snuff, etc.) as per special procedure. Registered person manufacturing pan masala, chewing tobacco and other tobacco-related products are required to follow special procedure under GST for registration of the machines used in packaging of such goods.

Key provisions proposed to be introduced:-

New penalty provision is introduced for non- registration of such packing machines by manufacturers in addition to other applicable penalties

Penalty of ₹ 1 lakh per machine for non- registration, A penalty of ₹ 2 lakh (₹ 1 lakh each under CGST and SGST Act) shall be payable for every machine not so registered.

Such unregistered machines shall also be liable for seizure and confiscation. Confiscation not applicable if penalty is paid and such machine is registered within 3 days of the receipt of the order of penalty, unless: the penalty so imposed is paid.

The above amendments shall come into force from the date to be notified.

Pan masala, tobacco manufacturers may have to pay ₹ 1 lakh penalty for packing machines not registered under GST. Pan masala and tobacco manufacturers that do not register their packing machines with goods and services tax (GST) authorities may face a penalty of ₹ 1 lakh per machine.

Customs:-

No changes have been introduced under Customs Act as well as Customs Tariff

However, the government issued certain notifications effectuating rate rationalization for telecom sector and extension of validity of specific exemptions/exemption notification(s) from 31 March 2024 to 30 September 2024

The aforementioned amendments have an impact on value chain for various sectors such as mobile phones, electronics, power, pharmaceuticals etc. which reflects the government’s focus on the creation of deeper value addition in India.

Furthermore, CBIC aims to foster greater transparency with increase in non-tariff measures including provision of centralized repository and centralized control number.

Few Key paras from budget speech:-

- Research and Innovation for catalyzing growth, employment and development:- Prime Minister Shastri gave the slogan of “Jai Jawan Jai Kisan”. Prime Minister Vajpayee made that “Jai Jawan Jai Kisan Jai Vigyan”. Prime Minister Modi has furthered that to “Jai Jawan Jai Kisan Jai Vigyan and Jai Anusandhan”, as innovation is the foundation of development. For our tech savvy youth, this will be a golden era. A corpus of rupees one lakh crore will be established with fifty-year interest free loan. The corpus will provide long-term financing or refinancing with long tenors and low or nil interest rates. This will encourage the private sector to scale up research and innovation significantly in sunrise domains. We need to have programmes that combine the powers of our youth and technology.

A new scheme will be launched for strengthening deep-tech technologies for defence purposes and expediting ‘atmanirbharta’

- Infrastructure Development:-Building on the massive tripling of the capital expenditure outlay in the past 4 years resulting in huge multiplier impact on economic growth and employment creation, the outlay for the next year is being increased by 11.1 per cent to eleven lakh, eleven thousand, one hundred and eleven crore rupees (₹ 11,11,111 crore). This would be 3.4 per cent of the GDP.

- Promoting Investments:-The FDI inflow during 2014-23 was USD 596 billion marking a golden era. That is twice the inflow during 2005-14.

For encouraging sustained foreign investment, we are negotiating bilateral investment treaties with our foreign partners, in the spirit of ‘first develop India’

- Revised Estimates 2023-24:-

- The Revised Estimate of the total receipts other than borrowings is ₹ 27.56 lakh crore, of which the tax receipts are ₹ 23.24 lakh crore. The Revised Estimate of the total expenditure is ₹ 44.90 lakh crore.

- The revenue receipts at ₹ 30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy.

- The Revised Estimate of the fiscal deficit is 5.8 per cent of GDP, improving on the Budget Estimate, notwithstanding moderation in the nominal growth estimates.

- Budget Estimates 2024-25:Coming to 2024-25, the total receipts other than borrowings and the total expenditure are estimated at ₹ 30.80 and 47.66 lakh crore respectively. The tax receipts are estimated at ₹ 26.02 lakh crore.

- The scheme of fifty-year interest free loan for capital expenditure to states will be continued this year with total outlay of ₹ 1.3 lakh crore.

- We continue on the path of fiscal consolidation, as announced in my Budget Speech for 2021-22, to reduce fiscal deficit below 4.5 per cent by 2025-26. The fiscal deficit in 2024-25 is estimated to be 5.1 per cent of GDP, adhering to that path.

- The gross and net market borrowings through dated securities during 2024- 25 are estimated at ₹ 14.13 and 11.75 lakh crore respectively. Both will be less than that in 2023-24. Now that the private investments are happening at scale, the lower borrowings by the Central Government will facilitate larger availability of credit for the private sector.

- Vote on Account:-I will be seeking ‘vote on account’ approval of the Parliament through the Appropriation Bill for a part of the financial year 2024-25.

- Tax proposals:-As for tax proposals, in keeping with the convention, I do not propose to make any changes relating to taxation and propose to retain the same tax rates for direct taxes and indirect taxes including import duties. However, certain tax benefits to start-ups and investments made by sovereign wealth or pension funds as also tax exemption on certain income of some IFSC units are expiring on 31.03.2024. To provide continuity in taxation, I propose to extend the date to 31.03.2025.

- Moreover, in l ine with our Government’s vision to improve ease of living and ease of doing business, I wish to make an announcement to improve tax payer services. There are a large number of petty, non-verified, non-reconciled or disputed direct tax demands, many of them dating as far back as the year 1962, which continue to remain on the books, causing anxiety to honest tax payers and hindering refunds of subsequent years.

I propose to withdraw such outstanding direct tax demands up to twenty-five thousand rupees (₹ 25,000) pertaining to the period up to financial year 2009-10 and up to ten-thousand rupees (₹ 10,000) for financial years 2010-11 to 2014-15. This is expected to benefit about a crore tax-payers.