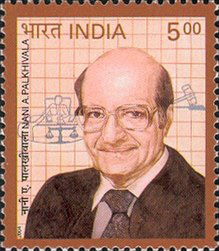

Early years

In the 1950s, one advantage of being a part time student in the Government Law College, Bombay was that it used to recruit a distinguished set of part-time teachers who would stray from their legal practice to give morning lectures. Undoubtedly, the most outstanding professor was young Nani Palkhivala. He happily did not restrict himself to the bare subject of the Evidence Act, 1872. He had become a part-time teacher in 1949 when he was 29 years old. He aroused the keen interest of the students even from neighbouring classes. The most fascinating part of his lecture was the way in which he could weave stories and contentions in law. You heard as much about Macaulay, the Draftsman as Macaulay, the Author. He had a way of narrating one story after another by holding the spell-bound attention of students. For instance, while speaking on language, Macaulay first was introduced as an author of Evidence Act, 1872 and the Indian Penal Code, 1860 but slowly moved to his mastery of language and literature.

Palkhivala was keen to teach not merely the text of the law but the principle behind it. One first observed how a persuasive and successful lawyer could cultivate legal logic in students, but it was the insight behind the thought that really ignited their curiosity. Palkhivala’s class attracted a large number of students who moved to his class.

Budget Speeches

In March 1958, the Forum of Free Enterprise arranged Palkhivala’s first talk on the Union Budget at the Green’s Hotel, where Taj Intercontinental is standing now. His talks on the budget were continued to be held at this venue till 1964 when it was found that the venue was inadequate to accommodate the increasing attendance, which had exceeded 1000. The meeting in 1965 was shifted to the more spacious Sir Cawasji Jehangir Hall, and when this venue was also found to be inadequate, the venue was shifted to the Cricket Club of India’s (CCI) East Lawns in 1966 where it continued till 1982. (In 1971 and 1980, since the Budgets were presented to the Parliament during the monsoon season, the meetings were held at the Shanmukhananda Hall. In 1978 and 1979, Palkhivala did not speak as he was in Washington DC as India’s Ambassador to the USA.)

The audience also grew from 3000 in 1966 to over 20,000 in 1982. At the 1982 meeting, Mr. Vijay Merchant, the then President of CCI, jocularly said that the meeting should be shifted to the Brabourne Stadium itself. The Forum promptly shifted the meeting to the Brabourne Stadium where Palkhivala spoke on the Union Budget from 1983 till his last talk on this subject in 1994. (In 1991 Mr. Palkhivala did not speak due to a major heart surgery). The attendance at this venue grew from about 35,000 in 1983 to over a staggering 100,000 in 1992, 1993 and 1994.

Every year Palkhivala would address two public meetings after the Budget was presented to the Parliament; one on the Budget on the Forum’s platform and the following day at the same venue on Finance Bill on the platform of the Institute of Chartered Accountants of India (WIRC). His talks on the Finance Bill were always technical as he analysed and discussed important provisions in detail. Even these talks also attracted attendance in excess of 25,000, mainly professional Chartered Accountants, and tax practitioners, as well as by students of Chartered Accountants’ course. It was a sight to see thousands of members in the audience taking copious notes of Mr. Palkhivala’s analysis of the Finance Bill. It was a classroom-like atmosphere.

After addressing the two meetings in Bombay, Mr. Palkhivala would proceed to a few other cities for talks on the Budget. The cities included New Delhi, Calcutta, Madras, Bangalore, Poona, Hyderabad and Ahmedabad. Needless to say, thousands attended these meetings in each place.

Contribution to tax law

The following cases stand out as benchmarks in the growth of tax law in our country and the principles laid down in those cases, thanks to his arguments, have stood the test of time. They are not in chronological order, but chosen at random.

Nalinikant Ambalal Mody1 was a practising lawyer in the Bombay High Court. He was elevated to the bench. After his elevation to the High Court of Bombay, he received a substantial amount as arrears of fees for his professional services as a lawyer. He claimed that these were not taxable, since he had discontinued his profession, and while carrying on the profession, he was following the cash method of accounting. According to him, there was no provision in the income-tax law to bring to tax such receipts. The tax authorities took the view that the receipts may not be income from profession (since Mr. Mody had ceased to carry on the profession when he was in receipt of the arrears of fees), but assessed the amount under the head “income from other sources”, the residual head, relying on the principle embodied in the statute that income of any kind not chargeable to tax under other heads of income (including profession) can be charged to tax under the residual head. Palkhivala, who argued the case before the Supreme Court (the High Court having held against Mr. Mody), could successfully persuade the court to lay down the fundamental proposition that the heads of income did not overlap but were mutually exclusive, and if an item of income, which was properly chargeable under the head “profession” but could not be charged because of non-fulfillment of certain conditions, cannot be brought to tax under the residual head. For a long time, this judgment held the field not only with respect to professional income, but also formed the basis for exempting arrears of rent from property etc.

K. P. Varghese v. ITO2, a case in which several leading tax lawyers appeared, including Palkhivala, is a decision rendered by a Division Bench of the Supreme Court; the judgment was written by Justice Bhagwati. Several important rules of interpretation applicable to income-tax law were laid down in the judgment, and every word in the judgment, in my humble opinion, is worth its weight in gold. The basic rule set out was that taxing any notional income (as opposed to real income) was opposed to and was violative of Entry 82 of the Union list, and a mere difference between the actual sale price of a property and its market value could not be brought to tax as it represented notional and not real income. The Entry, it was held, did not authorise such notional income to be brought to tax. Whenever the tribunals or the courts are faced with a knotty interpretational problem, this judgment often comes to their aid even today, as the principles laid down therein are enduring and govern the contours of the taxing provisions. This judgment is not any longer looked upon with the reverence it commands, and frequent violations thereof are evident in the Income tax Act, 1961; sections 50C and 56(2)(x) stark examples.

In Carborandum & Co v. CIT3, several questions relating to non-resident taxation arose. Questions also arose as to the jurisdiction of the High Court in a reference from the order of the Income Tax Appellate Tribunal. The entire issues, which were quite complex in nature, were simplified by Palkhivala in four propositions placed before the Supreme Court, all of which were accepted and the judgment of the Madras High Court was reversed. The limits of the advisory jurisdiction under section 256(1) of the Income-tax Act, 1961 were clearly spelt out in the judgment, including the proposition that in the guise of treating a specific question of law as being compendious and general in nature, the court cannot examine the correctness of findings of fact rendered on appreciation of evidence and seek to reverse them which would be in excess of its jurisdiction.

Gotan Lime Syndicate v. CIT4 is a case where Palkhivala took up the case of capital expenditure v. revenue expenditure, a vexed question in income-tax law those days. In a complicated set of facts, he was able to weave a simple solution by pointing out to the Supreme Court that ultimately what the assessee-company paid as royalty was for obtaining raw material, viz., limestone, and for the acquisition of an asset which contained deposits of limestone. The case may look simple and irrelevant in today’s focus of tax-law being at transfer-pricing issues with huge stakes, but with very little law involved and where minds are becoming stale and stagnant with mere application of formulae; but at a time when companies spent huge amounts as royalty payments, the tax effect was quite crucial for them, and it hurt them badly if the payments which were in reality revenue payments for obtaining the raw material were disallowed on a hyper-technical view of the matter and without having regard to the substance of the payments.

S. C. Parashar v. Vasantsen Dwarkadas5is a case in which Palkhivala appeared and argued when he was 46 years old, and if one reads the judgment one would be left in awe at the complex questions of law that were raised and decided in that case in relation to section 34 of the Indian Income Tax Act, 1922, and the various amendments it received.

In CWT v. Trustees of HEH Nizam’s Family6, a case in which Palkhivala appeared for the assessee, very interesting questions arose for consideration. One of them was whether the trustees could be charged to wealth tax under section 3 of the Wealth Tax Act, 1957, which did not, unlike the Income-tax Act, 1961, charge an association of persons with wealth-tax. Palkhivala did not press this question because in his view, which was accepted to be the correct view by the Supreme Court, they could be assessed to wealth-tax in the status of “individual”. Several important issues, basic and fundamental in nature, were decided in the case in the matter of assessment of trustees in accordance with section 21 of the Wealth Tax Act, 1957; uniformity in the treatment of the trustees for both income-tax and wealth-tax purposes was achieved through the judgment. It is a pleasure to read the judgment where ideas are very clearly expressed in the simplest of languages and style, and it is difficult to imagine all this would have happened without Palkhivala’s nuanced assistance.

One could go on citing cases in which Palkhivala had appeared and revel in his mastery of the facts and law; what I have attempted here is too miniscule a part of his monumental contribution to the development of the income-tax law.

Unfortunately, it would appear that neither the tribunals nor the courts have the time today to pay more attention to the development of this branch of the law. Tax litigation and the tax lawyer somehow do not seem to command the same respect from the courts as they used to, for unfathomable reasons. It can even be said that there is a tendency on the part of courts today to treat tax litigation as somewhat inferior to other branches of law. It is unfortunate that a general perception has gained currency that judges tend to avoid sitting in tax roster.

[Courtesy- Essays & Reminiscences: A Festschrift in honour of Nani A. Palkhivala, Edited by Arvind P. Datar, 2020, LexisNexis]

1 Nalnikant Ambalal Mody v. Commissioner of Income Tax, Bombay, (1966) 61 ITR 428.

2 K.P. Varghese v. ITO, (1981) 131 ITR 597.

3 Carborandum & Co v. CIT, (1977) 108 ITR 335.

4 Gotan Lime Syndicate v. CIT, AIR 1966 SC 1564.

5 S.C. Parashar v. Vasantsen Dwarkadas, AIR 1963 SC 1356.

6 CWT v. Trustees of HEH Nizam’s Family, AIR 1977 SC 2103.