1. Introduction

1.1. After a long wait and much deliberation, GST was finally introduced from 1-7-2017. Though there is still some feeling that it is introduced hurriedly, without full preparation etc., but, the ball has to be set rolling and it is expected that in due time things will get adjusted.

1.2. In fact, the tax laws have never got settled. We are still facing litigation for the past years under the erstwhile sales tax and other indirect tax laws. GST being complete transformation of indirect taxation, it will have more teething problems.

1.3. In this article we are going to discuss the issues relating to determining and disclosing Inward Supply in Annual Return and GST Audit Report.

2. Importance of GST Annual Return & Audit

2.1. Unlike under the Bombay Sales Tax Act, the policy of Government under GST is to have self-assessment by way of returns and to deal with only selective issues for assessment. To ensure that the self assessed returns filed by the assessee are true and correct, the concept of audit by an independent agency is prevailing under taxation laws. The concept of audit which is prevalent under Income-tax Act and which was also inducted into various State Value Added Tax Acts is continued under GST. Therefore, there is great importance to audit as it is at par with assessment.

2.2. The GST Audit is to be filed in prescribed Form-9C. There is lot of debate going on as to the scope of an Auditor since Form-9C is only a reconciliation of Annual Return with the Books of Account. Whatever be the conclusion of the debate, one thing is clear that GST Audit plays an important role in vouching that the self-assessed returns filed by the registered person are true and correct.

2.3. Under GST, there is a four tier system of ensuring and checking that correct returns are filed by the registered persons. Firstly, the registered person is required to file self-assessed returns by reporting invoice details of all his outward supplies and claiming eligible ITC on the basis of matching of inward supplies. Secondly, the registered person is liable to file an annual return to consolidate all the returns. Thirdly, if the turnover exceeds certain specified limit, the registered person is liable to file GST Audit Report which is a reconciliation of the Annual Returns with its books of account. Fourthly, all the returns and reports filed by the registered person can be scrutinized and assessed by the Department.

3. Brief introduction of Annual return

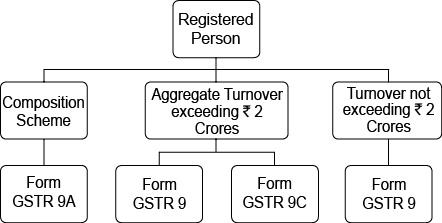

3.1. Form GSTR-9 is prescribed as Annual Return for regular tax payers and Form GSTR-9A is prescribed as Annual Return for Composition Tax payer. For the purpose of present Article, I have explained the provisions of Form GSTR 9 for regular tax payer.

3.2. Annual Return is consolidation of monthly/quarterly returns filed by the registered person. It is expected that it will be quantum merely total of monthly/quarterly returns filed by the registered person during a Financial Year. The Annual Return will also give effect to credit notes and debit notes issued against the invoices of the current financial year provided such credit notes and debit notes are issued upto the September following immediately after the end of Financial Year. Now here the issue arises is when the annual return is for a financial year, whether the said return can travel into details available in returns subsequent to said financial year. How can the said return be called as an Annual Return for a Financial Year?

3.3. It is to be kept in mind that though the Annual Return is merely consolidation of returns already filed during the Financial Year, at some places calculations are required to be made for filling the rows.

4. Explanation of relevant Rows in GSTR-9 relating to Inward Supplies

4.1. Input Tax Credit (ITC) is the back bone of any Value Added Tax System. In layman terms, ITC is nothing but tax paid on inward supplies. Where such inward supplies are used for providing outward supplies, the registered person shall be eligible to avail the ITC of tax paid on inward supplies and set off the said ITC against the tax payable on outward supplies.

4.2. Under GST also the basic concepts of ITC remain the same. However, the legislature has prescribed various conditions for availing the ITC. If the said conditions are not fulfilled, then the registered person shall not be eligible to ITC. Therefore, computation of correct ITC is very important to avoid litigation and differential payment with interest/penalty.

4.3. Under the CGST Act, the ITC provisions are contained in Section 16, 17 and 18. The provisions are not discussed herein in detail. However, the points for verification for reporting of ITC in Form GSTR-9 are discussed hereinunder.

5. Part III of Form GSTR-9 – Details of ITC:

5.1. Part III of Form GSTR-9 requires reporting of details of ITC as declared in returns filed during the Financial Year. Now, from a plain reading of the description contained in the heading of PART III, one has to understand that Part III requires reporting of only figures which are reported in monthly returns during the Financial Year. Simply put, Part III is merely consolidation of whatever figures have been shown in the monthly returns. There shall be no amendment or revision of figures in any circumstances, whether the said availment of ITC in monthly returns is incorrect or ineligible. In some of the erstwhile VAT Acts such as Maharashtra Value Added Tax Act, the dealers were eligible to revise the entire years turnover of sales and purchases and ITC by filing one annual return at the time of VAT Audit. However, such is not the case with GST Annual Return. For filling up the GST Annual Return, the old but golden rule for Bank Reconciliation has to be applied, i.e. “DO WHATEVER IS DONE, DO NOT DO WHATEVER IS NOT DONE”. In other words, do not treat the Annual Return as a platform for revising the monthly returns. Under the current law, revising the returns is neither intended nor provided.

5.2. Now, the Part III of GSTR-9 is divided into three main tables of reporting.

-

Table 6 – Details of ITC availed as declared in returns filed during the FY.

-

Table 7 – Details of ITC Reversed and Ineligible ITC declared in returns filed during the FY.

-

Table 8 – Other ITC related information

5.3. In addition to Part III, Rows 12 and 13 of Part V are also relevant for the purpose of reporting ITC reversed or availed in relation to current Financial Year but included in the returns filed for the period April to September of immediately succeeding financial year.

5.4. Now let us exame the points of verification in each Table of Part III of Form GSTR-9.

6. Points of verification in Table 6 of Part III of Form GSTR 9

6.1. Row 6A of Part III of Annual Return

6.1.1. Row 6A is the annual total of ITC availed during all the months of A Financial Year as Table 4A of GSTR 3B. The figures in row 6A shall be auto populated. However, looking at the forms, it seems that the auto-populated figure can be edited manually if the auto-populated figure is incorrect or if there is an error in generating the auto-populated figure. The total ITC appearing in Row 6A shall be further bifurcated into various heads in Row 6B to 6H. Thereafter, the total of 6B to 6H will be compared with total of 6A in order to ensure that there is no difference. Thus, total ITC in 6A is the basis for comparing the ITC under various. Naturally the said total ITC is the total of all ITC claimed in GSTR-3B under all heads of 4A for a Financial Year.

6.1.2. The total of ITC in row 6A shall also be the basis of comparing the total ITC as per GSTR-2A. GSTR-2A is the total of all inward supplies received by a registered person where his corresponding suppliers have filed return in GSTR-1.

6.2. Rows 6B to 6H of Part III of Annual Return

6.2.1. While filing GSTR-3B, Table 4A only requires bifurcation of total ITC availed in that month on following accounts:

-

ITC on import of goods

-

ITC on import of services

-

ITC on inward supplies liable to reverse charge

-

ITC on inward supplied from ISD

Thus, the Table 4A did not provide for any bifurcation of ITC on the basis of inputs, capital goods or input services.

6.2.2. However, Table 6B to 6E requires reporting of the bifurcation of ITC on the basis of inputs, capital goods and input services.

6.2.3. Row 6B requires reporting of inward supplies including services received from SEZ but excluding imports and inward supplies liable to reverse charge. Now, the difficulty which a Registered Person will face is that while claiming the ITC in GSTR-3B, there was no bifurcation of supplies received from normal suppliers and SEZ suppliers. Further 6B only requires to include inward services received from SEZ suppliers since the inward supplies of goods has to be reported in Row 6E. Thus, a registered person will have to once again visit all the ITC invoices for a Financial Year to find out the bifurcation as required in Table 6B. This will only increase the efforts of the tax-payers. In my view the Government should have simply included the said bifurcation in the GSTR-3B itself in order to avoid the double efforts and save the man hours. If not in the past, at least for the future the said bifurcation can be adopted in the GSTR-3B. This is will further help in autopopulating the figures in the annual return which in essence is nothing but mere mathematical consolidation of 12 month’s figures.

6.2.4. In a case where the Total in Row 6A is more than Total ITC as per GSTR 2A, it means that, the registered person has claimed ITC in GSTR 3B in excess of what is shown by its suppliers in their GSTR 1. This difference can be on account of ITC on import of goods and services of ITC on supplies liable on RCM basis. Assuming, that proper ITC has been availed by the Registered Person based on the tax invoices available with him and there is no import or RCM based ITC, one of the most common reason for difference is that some of the suppliers may not have filed returns in GSTR – 1 or have filed the returns but have filed incorrect data.

6.2.5. As per Section 42 of the CGST Act, 2017 the details off every inward supply furnished by a registered person shall be matched with the corresponding outward supply shown by the corresponding supplier. In a case where the ITC claimed by the registered person of an inward supply is in excess of the tax declared by the supplier for the same supply or where the outward supply is not declared by the supplier in his returns, the discrepancy shall be communicated to both the persons. Where the amount claimed as ITC is found to be in excess, it shall b added to the output tax liability of the registered person who claimed excess ITC.

6.2.6. Now, the above mechanism prescribed in Section 42 of matching inward supply with outward supply would be possible only if the return system as originally envisaged under the GST law would have been if force, i.e. GSTR-2 which is the details of inward supplies would have been in force. In the absence of GSTR-2, matching the inward supply with outward supply is not possible on the system.

6.2.7. However, the Revenue can still check whether there is any excess ITC claimed by the registered person by simply comparing the total of Row 6B with the Total ITC as per GSTR-2A. When, there is an exess amount in Row 6B, there can be only two conclusions, either the supplier of the registered person has not filed the return or the registered person has claimed excess credit.

6.2.8. Thus, in case where the total of Row 6B is more than the total of ITC as per GSTR 2A, it is advisable that the registered person carries out the exercise of invoice wise matching of inward supplies with his GSTR 2A for that F.Y. and find out the discrepancy. If the excess credit is taken due to any reason such a duplicay of invoices, error in figures, etc. the same shall be part of reconciliation in GSTR-9C. No effect shall be given in GSTR-9 for that Financial Year.

6.2.9. However, if the ITC pertaining to the concerned FY. is already reversed by the registered person in the returns filed for the month of April to September following the concerned FY., then the same shall be reported in Row 12 of Part V of Form GSTR-9 of th concerned FY.

6.2.10. In a reverse case where the total of ITC in GSTR-2A is more than the total in Row 6B, it can be safely concluded that the registered person has availed lesser ITC that eligible to him. Now, this lesser ITC may be due to various reasons such as, blocked ITC under Section 17(5) is not availed at the threshold, the registered person missed out to include or did not receive certain invoices for the inward supplies received during the FY., the registered person has not accounted for the debit note raised by the supplier, etc. In such case, one has to be careful to avail the eligible ITC on missed out invoices and debit notes by including the same in returns filed for April to September immediately succeeding the FY. No ITC shall be allowed for any invoice pertaining to a particular FY. after the due date of furnishing return for the month of September following the end of FY. as per Section 16 (4) of the CGST Act, 2017.

6.2.11. It may be noted that the Government’s intention as per the recent press note and tweets has been clear that any ITC for invoice pertaining to FY. 2017-2018 shall be not allowed after due date for filing GSTR 3B for September 2018. The due date for filing GSTR-3B for September 2018 was 25th October 2018. In my view the above stand of the Government is debatable and needs to be tested in court of law. Firstly, GSTR-3B is not a return as envisaged under Section 16(4) read with Section 39 of the CGST Act, 2017. GSTR-3B is merely a makeshift return or a summary return till the time the actual return in GSTR-3 is brought into force. The implementation of GSTR-3 has been stalled due to various system problems being faced by the Government. Without referring to such problems, it will be suffice to say that the restricting or foreclosing the rights of the registered person without fulfilling the promise on their part will be wholly unjustifiable on the part of the Government. Secondly, looking at the larger perspective, the said restriction for availing the credit may also be challenged as unconstitutional since it is against the basic tenets of a value added tax system wherein the tax paid on inward shall be set off against the out put tax liablity. Having said so, the restriction on time limit for availing ITC is not uncommon to Indirect Tax legislation. The Service Tax Acts (Finance Act, 1994) as well as certain State VAT Act already had provisions similar to GST putting restriction on time limit for availing the ITC on inward supplies.

6.2.12. As this point is also relevant to the recent press note of CBIC wherein it has been clarified that in September return eligible ITC for 2017-18 can be claimed irrespective of reconciliation with GSTR 2A. In other words, it is conveyed that one should avail all eligible ITC whether reflected in 2A or not in September, 2018 return and the actual reconciliation can be done subsequently.

6.2.13. As far as the reporting in the Annual Return is concerned of inward supply invoices of concerned FY for which the ITC is availed in the returns filed for the period April to September following the concerned FY, the same shall be reported in on consolidated figure in Row 13 of Part V of Form GSTR 9.

6.2.14. Row 6C and Row 6D requires reporting of inward supplies attracting reverse charge liability on which tax is paid and ITC is availed. It may be noted that there are two Sections for liability on RCM basis. One is Section 9(3) of CGST Act, 2017 which is in case of specific notified services such as GTA, Sponsorship, Legal Services, etc. Another is liability for RCM under Section 9(4) of CGST Act, 2017 which is on any supplies received from an unregistered person. Corresponding provisions in IGST Act, 2017 is Section 5(3) and Section 5(4) respectively. In Table 4A of GSTR-3B, the registered person may have already reported ITC on inward supplies liable on RCM basis. However, now the same needs to be bifurcated in Inward Supplies from Unregistered Person under Section 9(4) which is to be reported in Row 6C and Inward Supplies from specified suppliers in Row 6D. Again the said bifurcation needs to be worked out. One may also note that w.e.f. 13-10-2017, the RCM liability under Section 9(4) has been exempted till further notification. Thus, atleast from 13-10-2017 there shall be no liability under Section 9(4) for the FY 2017-2018.

6.2.15. Row 6E requires reporting of ITC availed only on imports of goods including supplies from SEZ. This will be readily available in Table 4A of GSTR-3B.

6.2.16. One more important task to be done in reporting all the above Row 6B to 6E is that there is sub-bifurcation required between ITC on inputs, capital goods and input services. Now, this requirement is a herculean task at this stage. If this had been included in the monthly returns itself or had been prescribed earlier, the registered person would have maintained the data or customized the system accordingly. To take out the bifurcation now for the entire year is like rebooking all the invoices for the entire year based on the above heads of inputs, capital goods and input services. Large business houses which have robust accounting softwares may still manage to do it, however for small and medium enterprises this will be additional efforts.

6.2.17. Row 6F requires reporting of ITC availed on Import of Services but excluding services received from SEZ suppliers. Services received from SEZ suppliers is included in Row 6B. The same is available in Table 4A of GSTR-3B with little work over on supplies from SEZ.

6.2.18. Row 6G requires reporting on ITC on inward supplies received from input Service Distributor. The same is readily available in Table 4A of GSTR 3B.

6.2.19. Row 6H requires reporting of reclaimed ITC under any of the provisions of Act. For example, where the registered person has reversed the credit on inputs for non payment to the vendor beyond 180 days, the ITC can be availed on making the payment. The same said reclaimed ITC shall be reported in Row 6H and not in Row 6B. In Row 6B it is already reported once and the reversal of same is also reported in Row 7A.

6.3. After reporting the bifurcation of ITC in Rows 6B to 6H the total of the said rows will be reported in Row 6I. The total in Row 6I will be compared with Total in Row 6A and the difference shall be reported in the Row 6J. According to me, there should be no difference in total of 6I and 6A since it is total in row 6A only which is bifurcated into 6B to 6H. Thus, if there is any difference, then the total in Row 6B to 6H need to be checked until the difference becomes zero.

6.4. Rows 6K to 6L of Part III of Annual Report

6.4.1. Row 6K requires reporting of Transitional Credit availed by a registered person by filing TRAN I or revised TRAN I as the case may be. The final figure appearing as per the Revised TRAN I will be reported over here.

6.4.2. Row 6L requires reporting of Transitional Credit availed by a registered person by filing TRAN II or revised TRAN II as the case may be. The final figure appearing as per the Revised TRAN II will be reported over in this Row.

6.4.3. It may be note that only transitional credit availed during the concerned FY will be appearing in these Rows. The time limit of filing TRAN-I and

TRAN-II has been extended periodically and as of now the last date is 31st January 2019. In such case, even though the transitional credit is availed by the registered person by filing the TRAN-I in say December 2018, it will not be reported in Annual Report for 2017-2018. The said transitional credit availed by filing the TRAN-I or TRAN-II shall be disclosed in Annual Return for 2018-19.

6.4.4. It is further to be noted that any reversal of excess transitional credit actually done in the concerned financial year only will be reported in Row 7F and 7G of Annual Return for that FY. Where the reversal is made in any subsequent financial year, than said reversal shall be reported only in the Annual Return for such subsequent financial year.

6.5. Row 6M requires reporting of ITC availed but not specified in Rows 6A to 6L. As per the instructions the said Row 6M will contain details of ITC availed under Form GST ITC-01 on account of stock held on application of new registration within the prescribed limit. Row 6M may also cover ITC availed in Form GST ITC-02 on account of transfer of ITC on sale, merger, demerger, amalgamation, lease transfer, etc.

6.6. Thereafter Row 6O will contain the total of ITC availed by the registered person during the Financial Year.

7. Points of verification in Table 7 of Part III of Form GSTR-9

7.1. Table 7 of the Annual Report requires reporting of ITC reversed and ineligible ITC declared in the returns filed for the Financial Year. Again, the figures are merely the addition of the monthly returns and no revised figure can be added or deducted from Table 7. If there is any less reversal or excess reversal, the same can be either given effect by row 12 or 13 if such changes are effected in the monthly returns filed for the period of April to September following the end of financial year.

7.2. Row 7A requires reporting of reversal of ITC on account of non-payment of conservation beyond 180 days as per Section 16(2) of the CGST Act, 2017. It is to be noted that, in Row 7A only that figure which has been reported in the monthly returns will be shown. If for any reason the registered person has failed to report any such reversal any of the monthly return than the same will not appear in Row 7A. The effect for the same shall be either given in Row 12 or in the Annual Return of the next financial year. The said figure of reversal under Rule 37 will be included in Row 4B(2) of the GSTR-3B. Individual bifurcation of the same needs to be worked out for reporting in Row 7A.

7.3. Row 7B requires reporting of ITC which is reversed from the distribution made by the Input Service Distributor under Rule 39 of the CGST Rules. The said figure is not separately shown in Table 4B of GSTR-3B, hence it needs to be worked out manually. Rule 39(1)(i) provides for reversal of ISD, if there is credit note in respect of which ITC is distributed. When the supplier of ISD issues credit note there will be reduction in distributable ITC. Therefore, ITC has to be correspondingly reduced by the recipient. Rule 39(2) provides similar position for reduction in distributable ITC for any other reasons. The reversal of ISD credit can be verified from the GSTR – 6 filed by the ISD for distributing the credit.

7.4. Rows 7C and 7D requires reporting of reversal made by the registered person on account of Rule 42 and Rule 43 of the CGST Rules. As per section 17(1) or (2) of CGST, the ITC which pertains to Input or input services used for non business activity is required to be reduced. Similarly when the ITC is for taxable as well as for exempt supplies, it is required to be reduced on pro rata basis given in rule in relation to exempt supplies.

7.5. Rule 42 of the CGST Rules provides for manner of distribution of input tax credit in respect of inputs or input services used partly for business purposes and partly for other purposes, or partly for effecting taxable supplies including zero rated supplies and partly for effecting exempt supplies. Similarly, Rule 43 provides for manner of distribution of input tax credit in respect of capital goods used partly for business purposes and partly for other purposes, or partly for effecting taxable supplies and partly for exempt supplies.

7.6. The above figure for reversal under Rules 42 and 43 is available in Row 4B(1) of GSTR-3B. The same needs to be bifurcated into Rows 7C and 7D. Any lower reversal or excess reversal which has been given effect to in the returns filed for April to September following the end of financial year shall be shown in Rows 12 or 13 of the Annual Return.

7.7. Row 7E of the annual return requires reporting of ineligible ITC on account of blocked credit under Section 17(5) of the CGST Act. The said figure is readily available in Row 4D(1) of GSTR-3B. It is to be noted here that many registered persons while filing the return had shown the ITC in Row 4A of GSTR 3B as net of blocked credit in Section 17(5). In such case, my opinion would be to continue to show the ITC in Row 6A as net ITC excluding blocked credit under 17(5) in order to avoid the difference. The figure in Row 7E relating to blocked credit will appear only if the same is also included in total ITC as pr Row 6O. If the blocked credit is not included in Row 6O, then it will result in difference in Net ITC as per Annual Return and as per GSTR 3B.

7.8. Rows 7F and 7G require reporting of any reversal in Transitional Credit made during the F.Y. The same will be included in Row 4B(2) of GSTR-3B.

7.9. Row 7H relates to any other ITC Reversal which may be made but not included in any other Rows of Table 7. This may include the reversals made on account of Show Cause Notice or pursuant to any order of the court, etc.

7.10. Row 7I is the total ITC reversed or ineligible included in Rows 7A to 7H.

7.11. Row 7J provides the total of net ITC availabe for utilization by deducting the total ITC reversal in 7I from the total ITC availed in 6O. The Net ITC availed in 7J is an important figure as the same will be taken as base to compare the ITC as per books of account in Row 12E of the Audit Report in Form GSTR-9C. The total in Row 7J will also be the base for comparison of expenses wise ITC in Row 14S of Audit Report in Form GSTR-9C.

8. Points of verification in Table 8 of Part III of Form GSTR-9

8.1. Table 8 of the Annual Return prescribes other information relating to ITC such as total amount of ITC available as per GSTR 2A, total amount of ITC lapsed during the Financial Year. The said figures of lapse of ITC will then be available in the system of GST for cross reference during assessment.

8.2. Row 8A will be auto populated figures of total ITC as per the GSTR-2A. The same will be used for comparison of ITC as per Row 6B. The same is intended to verify that the total ITC availed matches with the tax paid by the suppliers on supplies made to the registered person.

8.3. Row 8B will also be auto populated figure containing total of Row 6B and 6H. Row 8C requires reporting of total ITC on inward supplies received during the FY 2017-18 but availed in the return filed for the period April 2018 to September 2018.

8.4. In Row 8D, the total ITC as per GSTR 2A will be compared with the Total ITC claimed by the registered person for FY 2017-18. The difference of the total ITC as per GSTR-2A and total ITC claimed by the registered person for FY 2017-18 upto the due date for filing the return for the month of September 2018 will be reported in Row 8D.

8.5. If the difference in Row 8D is in positive, it means that Registered Person has claimed less ITC than what is available as per GSTR-2A. If the difference in Row 8D is negative, it means that Registered Person has claimed excess ITC than what is available as per GSTR-2A. In such case, again the reason needs to be found out for such excess credit. The excess credit may be on account of duplicate credit availed in monthly returns or the suppliers of the registered person have not filed the

GSTR-1.

8.6. If the difference is in positive, than said difference will be further bifurcated in Rows 8E and 8F. Row 8E is the amount of ITC out of the difference in 8D which was available as per GSTR 2A but has not been availed by the registered person in any of the GSTR-3B till return filed for the month of September 2018. Row 8F is the amount of ITC out of the difference in 8D which was available as per GSTR-2A bot not availed by the registered person on account of ineligibility, e.g. blocked credits.

8.7. Row 8G requires reporting of Total IGST paid on import of goods (including supplies from SEZ). The same needs to be found out by the registered person for the FY from its books of account. Row 8E is the Total ITC availed on import of goods including supplies of goods from SEZ. The same will be autopopulated as per Row 6E.

8.8. The difference between, 8G and 8E is reported in 8I. The said difference amount in 8I is nothing but ITC available on import of goods but not availed by the registered person as appearing in Row 8J.

8.9. Row 8K is the total of Row 8D and Row 8J. The said total is the amount of ITC which was available to registered person but not availed for any reason. As per description of Row 8K, the same total is proposed to be lisped ITC for the said FY.

8.10. In my view, the legal effect of the said Row 8K needs to be challenged on two grounds, 1) the unveiled ITC which was eligible but not availed beyond September 2018 may be challenged on the grounds discussed in Para 6.2.11 above. 2) the unallied ITC on import of goods needs to be challenged on the ground that there is no time limit prescribed under the CGST Act or the Rules for availing ITC on the basis of Bill of Entry filed for imported goods. As per Section 16(2)(a) the registered person shall be entitled to claim ITC on the basis of three documents, namely;

-

Tax invoice issued by registered supplier

-

Debit note issued by registered supplier

-

Such other tax paying documents as may be prescribed in Rule 36(1). Bill of Entry is one of the tax paying documents.

8.11. Section 16(4) of the CGST Act, 2017 provides that a registered person shall not be entitled to ITC is respect of any invoice or debit note after the due date for filing return for the month of September following the end of FY. The said Section 16(4) does not speak about ITC on the basis of specified documents such as Bill of Entry. It only provides for invoice or debit note.

8.12. Thus, Row 8K providing for lapse of unavailed ITC on import of goods is not sustainable and against the provisions of law.

9. Brief introduction of GST Audit Report

9.1. After GSTR-9, the next requirement is filing GSTR-9C which is the prescribed Form for GST Audit Report. The GST Audit is applicable only when the turnover of registered person exceeds ₹ 2 crores in a financial year.

9.2. This is last tier of self-assessment and verification of correctness of returns filed during the year is carried out by an Independent Auditor.

9.3. Though the Form-9C is loosely called as GST Audit Report, in essence it is a reconciliation of Annual Return with the books of account. Form GSTR-9C is reconciliation of figures given in GSTR-9 vis-à-vis books of account for the financial year. An issue can arise whether the auditor is required to see correctness of the books of account or to report the details as asked in Reconciliation Statement.

9.4. For example, the registered person has claimed ITC on food services to employees. It is blocked credit as per section 17(5). It will be reflected in ITC availed in 3B and correspondingly in GSTR-9. While giving reconciliation statement, auditor notices this wrong availing. Whether auditor should do reconciliation with account as filled up in GSTR-9 by audited or should change the same to correct position? Issue requires clarification from authorities.

10. Explanation of relevant Rows in GSTR-9C relating to Inward Supplies

10.1. Tables 12, 13, 14, 15 and 16 are relevant for reporting on Inward Supplies. Out of the aforesaid Tables, Tables 13 and 15 are merely list of reasons for differences in reconciliation of Table 12 and Table 14 respectively. Table 16 is further calculation of liability on difference listed in Table 13 and Table 15.

11. Points of verification in Table 12 of Part IV of Form GSTR-9C

11.1. Table 12 is reconciliation of Net ITC availed as per Annual Return with ITC availed in the books of account. The reconciliation starts with manually filling the figure of Net ITC availed for the FY. in a State as per the Books of Account. The first problem which may be faced by a multi state registered person not maintaining separate trial balance for each State will be about finding out the Net ITC for each State. Here, the registered person is expected to internally derive their ITC for each individual GSTIN and declare the same in Row 12A. The next question which may arise is whether the Auditor is to verify the correctness of Net ITC figure derived by the Registered Person for declaration in Row 12A. In my view, the same is the responsibility of the registered person to arrive at the correct figure and any figure nearest to the correct figures. The Auditor may not be required to go behind the figures declared by the Registered Person for verifying the same. In any case, the more the difference between the GSTR-9 and the declared figure, more will be the liability on the Registered Person. At the same time, to avoid any discrepancy, it will suffice if the Auditor merely takes note of the method employed for arriving at the figure of Net ITC for each State.

11.2. Row 12B requires addition of ITC which was booked in the earlier FY years but claimed in the current FY of Audit. The said addition is to arrive at the figure

of Net ITC as per GSTR-9 where the ITC is claimed in this FY. This will also include Transitional Credit which may have been booked in the earlier FY year but claimed in the GST Return in current FY.

11.3. Row 12C requires deduction of ITC booked in the current FY but claimed in the return of subsequent FY. This is required to arrive at the ITC claimed in returns for the current FY.

11.4. Row 12D arrives at the net ITC availed as per the audited financial statement for the current FY. The said total in Row 12D will be compared with Net ITC claimed in the Annual Return as shown in Row 7J of Annual Return equal to Row 12E of the Audit Report.

11.5. If there is difference in the ITC as per Audited Books of Account and Annual Return, the same shall be shown as un-reconciled ITC in Row 12F. If there is a positive difference, it means that ITC in audited books of accounts is higher than the ITC as per Annual Return. The balance ITC not availed in Annual Return may lapse for not being availed within time limit prescribed subject to other provisions of the Act. In any case, the difference for un-reconciled ITC needs to be explained in Table 13. However, if there is negative difference meaning thereby the ITC as per the Audited Books is less than the ITC as per the Annual Return, the difference needs to be be explained in Table 13. It also means that registered person has availed more ITC than what is available as per books of account. This may result in demand depending upon the reasons for difference.

12. Points of verification in Table 14 of Part IV of Form GSTR-9C

12.1. Apart from the Reconciliation of Net ITC as per Annual Return with the Net ITC as per Books of Account, the registered person is also liable for reconciling the ITC on the basis of each expense head.

12.2. Row 14A to 14Q require the registered person to classify the net ITC as per the books of accounts and Annual Return on the basis of various expense heads such as, purchases, freight / carriage, power and fuel, rent and assurance, imported goods (including received from SEZ), goods lost, stolen, written of, or disposed of by way of gift or free samples, royalties, employee’s cost, etc. The said list is only illustrative and not exhaustive. Thus, it may happen that whatever heads of expenses are shown in the debit side of trading and profit and loss account, all such heads needs to be mentioned in Table 14. The ITC on each of such head as per the books of accounts needs to be mentioned in the Table 14 along with its value, the total amount of ITC, the total amount of eligible IT availed in the books of account. This, is going to be a challenging part of the Audit Report, as many registered persons may not have maintained the books of accounts in a manner in which the ITC on above heads can be clearly distinguished and arrived at. If the ITC is parked in a common account, the same needs to be worked out entirely for a particular year with utmost accuracy to avoid any differences. The various heads of expenses in Table 14 are extracted below for ready reference:

|

Description |

Value |

Amount of Total ITC

₹ |

Amount of eligible ITC availed |

|

1 |

2 |

3 |

4 |

|

A |

Purchases |

|

|

|

|

B |

Freight / Carriage |

|

|

|

|

C |

Power and Fuel |

|

|

|

|

D |

Imported goods

(Including received from SEZs)

|

|

|

|

|

E |

Rent and Insurance |

|

|

|

|

F |

Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples |

|

|

|

|

G |

Royalties |

|

|

|

|

H |

Employees Cost (Salaries, wages, Bonus etc.) |

|

|

|

|

I |

Conveyance charges |

|

|

|

|

J |

Bank Charges |

|

|

|

|

K |

Entertainment charges |

|

|

|

|

L |

Stationery Expenses (including postage etc.) |

|

|

|

|

M |

Repair and Maintenance |

|

|

|

|

N |

Other Miscellaneous expenses |

|

|

|

12.3. Row 14R is the total of ITC availed on all the expense heads mentioned in Table 14. The said total in Row 14R will be compared with Net ITC claimed in the Annual Return as shown in Row 7J of Annual Return equal to Row 14S of the Audit Report.

12.4. If there is difference in the ITC as per Audited Books of Account and Annual Return, the same shall be shown as un-reconciled ITC in Row 14T. If there is a positive difference, it means that ITC in audited books of account is higher than the ITC as per Annual Return. The balance ITC not availed in Annual Return may lapse for not being availed within time limit prescribed subject to other provisions of the Act. In any case, the difference for un-reconciled ITC needs to be explained in Table 15. However, if there is negative difference meaning thereby the ITC as per the Audited Books is less than the ITC as per the Annual Return, the difference needs to be be explained in Table 15. It also means that Registered Person has availed more ITC than what is available as per books of account. This may result in demand depeding upon the reasons for difference.

13. Conclusion

13.1. Though the attempt by the GSTR-9 and GSTR-9C is well intended to find out ultimate ITC as per books, the process will be far fetched and will require separate exercise and efforts. There are chances that there will be multiple interpretation of various ITC items like expenses heads. No provision is made to give details about grouping made. Great care will be required as well as consistency will be required to be maintained from year to year.

The details in audit report also required to auditor to prevail in the records and returns of the previous and subsequent year. This is also unexpected like the auditor will be reporting about ITC taken in the returns of April to September of subsequent year from the end of the financial year under Audit. This figures will be unaudited and will be incorporated as given by auditee. In my opinion this aspect is also required to be clarified by the authority.

13.2. One more missing aspect is as to how to carry out recommendation for payment etc. There should be provision for filing up one final return post audit like it is under MVAT Act. Such return will be updated and will be in consensus with report and finality will come to the GSTR-9 and returns. At the end, we expect modification and much more clarification in the forms in future.

Who makes us ignorant? We ourselves. We put our hands over our eyes and weep that it is dark.

— Swami Vivekananda