1.0 Introduction

1.1 The Finance Bill, 2020 has been presented amid an economic slowdown and rising food inflation. The Finance Minister believes that the direct tax proposals in the Finance Bill, 2020 would, among others, stimulate economic growth and simplify tax structure. To quote from her Budget Speech “In continuation of the reform measures already taken so far, the tax proposals in this budget will introduce further reforms to stimulate growth, simplify tax structure, bring ease of compliance, and reduce litigations. In this Article, an attempt has been made to provide an overview of some of the important tax proposals concerning corporates and non-residents.

2.0 Corporate tax proposals

A. Abolishment of Dividend Distribution Tax (DDT):

2.1 Under the existing provisions of sections 115-O(1) and 115R(2) of the Act, a domestic company/mutual fund is required to pay DDT on the income distributed to shareholders/unit holders. The amount of DDT paid by the company is treated as the final payment of tax in respect of the amount declared, distributed or paid by way of dividend. Such dividend referred to in section 115-O is exempt in the hands of shareholders under clause (34) of section 10 except in case of a shareholder who receives dividend in excess of ₹ 10 lakh and is liable to pay tax under section 115BBDA. Similar exemption is available to unit holders receiving dividends from mutual funds under section 10(35).

2.2 The Finance Bill 2020 has proposed to amend section 115-O(1) to provide that only dividend declared, distributed or paid on or after the 1st day of April, 2003 but on or before the 31st day of March, 2020 shall be covered under the provisions of the said section. Similarly, an amendment in section 115R(2) has been made to provide that the income distributed on or before the 31st day of March, 2020 shall only be covered under the provisions of that section. Consequential amendments have been made to section 10(34), 10(35), section 115BBDA and section 57 of the Act. These amendments will be effective from the assessment year 2021-22.

2.3 The effect of the above amendments would be that the companies and mutual funds would not be liable to pay DDT on dividends declared, distributed, or paid on or after 1st April 2020. Dividends would be taxed in the hands of the recipient of income viz., shareholders/unit holders from AY 2012-22 even if the amount of dividend received is less than ₹ 10 lakhs. In this connection, one would also have to be mindful of the effect of section 8 of the Act which deems that any dividend envisaged under section 2(22) shall be taxable in the year in which such dividend is declared, distributed or paid. Section 8 also declares that an interim dividend shall be taxable in the year in which it is unconditionally made available by the company to the member who is entitled to it.

2.4 While computing the taxable income, the shareholder/mutual fund unit holder would be entitled to claim deduction on account of interest [capped to 20% of the dividend income]. This is provided under the proposed proviso to section 57. Under section 80M1, a domestic company receiving dividend from another domestic company would be eligible to claim deduction towards dividend received if the recipient company pays further dividend to its shareholders. The Memorandum to the Finance Bill explains the rationale and effect of these amendments in the following words:

“The incidence of tax is, thus, on the payer company/Mutual Fund and not on the recipient, where it should normally be. The dividend is income in the hands of the shareholders and not in the hands of the company. The incidence of the tax should therefore, be on the recipient. Moreover, the present provisions levy tax at a flat rate on the distributed profits, across the board irrespective of the marginal rate at which the recipient is otherwise taxed. The provisions are hence, considered, iniquitous and regressive. The present system of taxation of dividend in the hands of company/ mutual funds was reintroduced by the Finance Act, 2003 (with effect from the assessment year 2004-05) since it was easier to collect tax at a single point and the new system was leading to increase in compliance burden. However, with the advent of technology and easy tracking system available, the justification for current system of taxation of dividend has outlived itself.

In view of above, it is proposed to carry out amendments so that dividend or income from units are taxable in the hands of shareholders or unit holders at the applicable rate and the domestic company or specified company or mutual funds are not required to pay any DDT. It is also proposed to provide that the deduction for expense under section 57 of the Act shall be maximum 20 per cent of the dividend or income from units.”

2.5 Some of the other relevant amendments consequential to abolishment of DDT are tabulated below:

|

Amended provision |

Effect |

|

Section 10(23FC) |

All dividends received or receivable by business trust from a special purpose vehicle is exempt income under this clause |

|

Section 10(23FD) |

Dividend income received by a unit holder from business trust would not be exempt in the hand of unit holder of the business trust. |

|

Section 115UA(3) |

Dividend income distributed by a special purpose vehicle to business trust would be taxed in the hands of unit holder. |

|

Section 80M |

Section 80M is proposed to be incorporated in the Act to remove the cascading effect of tax on dividend income received by a domestic company from another domestic company forming part of its gross total income, where the recipient company pays further dividend to its shareholders on or before the due date. Due date has been defined to mean the date one month prior to the date of furnishing the return of income under section 139(1). The deduction in respect of dividend income would therefore be limited to the extent of dividend distributed by the recipient company one month prior to the due date of filing of return of income. |

|

Section 115A |

Section 115(1)(a) interalia provides that dividend other than dividends referred to in section 115-O included in the total income of a non-resident or a foreign company shall be taxed at 20%. Finance Bill 2020 has proposed to omit reference to section 115-O consequent to abolition of DDT regime. As a result, a foreign company or a non-resident would now have to pay tax on dividend at the rate of 20% under section 115A. |

|

Section 115AC |

Under the existing provisions of section 115AC of the In-come-tax Act, a concessional treatment is available to non-resident taxpayers in respect of income arising by way of inter¬est, dividends except dividends referred to in section 115-O or long-term capital gains from such bonds or shares of an Indian company which are issued in accordance with a scheme notified by the Central Government and which are purchased in foreign currency. Such income is charged to tax at a rate of 10% only. The Finance Bill 2020 has omitted reference to section 115-O from section 115AC. Consequently, any dividend in respect of bonds or GDRs referred to in section 115AC would be taxable at 10%. |

|

Section 115ACA |

Under the existing section 115ACA an employee of an Indian company engaged in specified knowledge based industry or service is liable to pay tax at the rate of 10% on dividends (other than dividends referred to in section 115-O) in respect of GDRs purchased in foreign currency. Section 115ACA also covers dividends income of an employee of subsidiary of the above referred Indian company. The Finance Bill, 2020 has omitted the reference to section 115-O from section 115ACA. Consequently, the employees of Indian company or its subsidiary referred to in section 115ACA would be liable to pay tax at the rate of 10% on dividends arising from the GDRs acquired in foreign currency. |

|

Section 115AD |

Under the existing section 115AD, a Foreign Institutional Investor (FII) is liable to pay tax on dividends received in respect of securities (other than dividends covered under section 115-O) at the rate of 20%. With the proposed omission of reference to section 115-O from section 115AD, FIIs would be liable pay tax at 20% in respect of any dividends arising from securities. |

|

Section 115C |

The Finance Bill, 2020 has proposed to amend the definition of ‘investment income’ under sction 115C(c) by omitting reference of section 115-O from the aforesaid definition. This proposed amendment would require the non-resident Indians to pay tax at 20% on dividends arising from a foreign exchange asset as envisaged under section 115E |

|

Section 194 |

TDS on dividend income to be made by the company / mutual fund if the amount of dividend declared to a shareholder / unit holder exceeds ₹ 5,000. Tax is to be deducted at the rate of 10% and not at the rates in force. |

|

Section 194LBA |

Tax deduction by business trust on dividend paid to unit holder at the rate of 10%. |

|

Section 194K |

Any person responsible for paying to a resident unit holder, any income in respect of units of a Mutual Fund specified under clause (23D) of section 10 or units from the administrator of the specified undertaking or units from the specified company, shall withhold tax at the rate of 10 percent, if the such income exceeds INR 5,000/- in a financial year. |

|

Section 195 |

Section 195 would be applicable qua dividends paid to a non-resident. Section 195 prescribes that taxes are to be deducted at the rates in force. Rates in force for the purposes of section 195 is defined under section 2(37A)(iii). As per 2(37A)(iii), the expression ‘rates in force’ for the purpose of deducting tax under section 195 means rate specified in the Finance Act of the relevant year or rate specified in the applicable Treaty, whichever is more beneficial to the assessee. The Finance Bill, 2020 has prescribed TDS rate for different categories of payees. For a non-resident Indian payee, TDS rate on investment income is 20%. For a foreign company, there is no specific rate of TDS qua investment income or dividends. Consequently, for investment income or dividends, the residuary rate of 40% would be applicable. The rates prescribed in the Finance Bill 2020 would then have to be compared with the rate of tax prescribed under the applicable Treaty. TDS would have to be made at the rate specified in the Treaty only if the same is less than 20% or 40%, as the case may be. |

|

Section 196A |

This section has been revived. TDS on income in respect of units of mutual funds to a non-resident would have to be made by a person responsible for paying such income. |

|

Section 196C and 196D |

These sections have been amended to remove exclusion provided to dividend income referred to in section 115-O. |

The amendments in TDS sections listed above are applicable from 01-04-2020. Other amendments will be applicable from AY 2021-22.

B. Proposals related to start-ups:

2.6 During her Budget Speech, the Finance Minister emphasised that start-ups have emerged as engines of growth for the Indian economy and accordingly the Government is committed to hand hold them and support their growth. In line with the said commitment, the Finance Minister has proposed following for the start-ups.

2.7 The first proposal concerns the rationalisation of section 80IAC. Section 80IAC in its current form provides for a deduction of an amount equal to 100% of the profits and gains derived from an eligible business by an eligible start-up for 3 consecutive assessment years. The 3 consecutive years can be chosen by the eligible start-up out of 7 years beginning from the year in which the eligible start-up has been incorporated. The deduction is available subject to the conditions that (i) the eligible start-up is incorporated on or after 01-04-2016 but before 01-04-2021; and (ii) the total turnover of its business does not exceed 25 crore rupees.

2.8 It is proposed to amend section 80IAC to extend the tax holiday benefit to larger start-up by enhancing the turnover limit for eligibility from existing limit of

₹ 25 crores to ₹ 100 crores. The Government has also taken cognizance of the fact that it is less likely that a start-up would be generating profits in the initial years so as to enjoy the tax holiday benefit. Hence it has proposed to extend the period of eligibility for claim of deduction from the existing 7 years to 10 years. These amendments would be applicable from AY 2021-22.

2.9 Under the second proposal, the Government has proposed to defer the tax deduction and tax payment on perquisite value on exercise of ESOPs by employees of start-ups by introducing sub-section 1C in section 192. The rationale for this proposal has been explained by the Finance Minister in her Budget Speech. The relevant portion of the speech reads as under:

“During their formative years, start-ups generally use Employee Stock Option Plan (ESOP) to attract and retain highly talented employees. ESOP is a significant component of compensation for these employees. Currently, ESOPs are taxable as perquisites at the time of exercise. This leads to cash-flow problem for the employees who do not sell the shares immediately and continue to hold the same for the long-term. In order to give a boost to the start-up ecosystem, I propose to ease the burden of taxation on the employees by deferring the tax payment by five years or till they leave the company or when they sell their shares, whichever is earliest.”

2.10 Under the proposed section 192(1C), an eligible start-up referred to in section 80-IAC paying any income to the assessee being perquisite arising from ESOPs as referred to in section 17(2)(vi) shall deduct or pay tax on such income within 14 days of the earliest of the following events:

(i) expiry of 48 months from the end of the relevant assessment year;

(ii) the date of sale of such specified security or sweat equity share by the assessee;

(iii) the date on which the assessee ceases to be the employee of the start-up.

Tax is to be deducted at the rates in force of the financial year in which the said specified security or sweat equity share is allotted or transferred. Consequential amendments have been made under section 191, 156 and 140A so as to defer collection of tax relating to ESOP perquisite from an employee of start-up. These amendments have ushered a new concept of ‘deferred demand notice’. If an eligible employee fails to pay tax on ESOPs within the time period proposed in section 156(2) then a demand notice could be served on him by the department.

2.11 It is important to note that no amendment has been proposed to sections 15 or 17(2)(vi) which currently governs the taxability of perquisite arising from ESOPs. Section 15 read with section 17(2)(vi) mandates that the value of perquisites arising on ESOPs is chargeable to tax in the year in which specified security or sweat equity shares under the ESOPs are allotted to the employee. The value of perquisite is computed having regard to the fair market value of such security / shares on the date of exercise of options under the ESOPs. Section 192 only deals with tax deduction from payments constituting salary. Despite introduction of section 192(1C) and amendments 191, 140A and 156, value of perquisite arising from exercise of ESOPs would be chargeable to tax in the year of allotment of specified security / seat equity shares [and hence includible in the total income of the year of allotment of shares].

2.12 The objective of deferring the ‘collection of tax’ by altering the provisions of section 140A, 156, 191 and 192 was to give relief to employees of start-up companies. The amendments may not achieve the desired result in the absence of a specific amendment to other sections like 200, 234A, 234B, 234C, 40(a)(ia) etc. For instance, absence of amendments in sections 234A, 234B and 234C may lead to a situation where the concerned employee may have to pay interest thereunder. This situation would also be applicable for an individual opting for the proposed regime of taxation under section 115BAC.

C. Modification of concessional tax schemes for domestic companies under section 115BAA and 115BAB

2.13 Sections 115BAA and 115BAB were introduced in the Act vide the Taxation Laws (Amendment) Act, 2019. These sections provide domestic companies an option to be taxed at concessional tax rates provided they do not avail specified deductions and incentives. Some of the deductions prohibited are deductions under any provisions of Chapter VI-A under the heading “C. Deduction in respect of certain incomes” other than the provisions of section 80JJAA.

2.14 Amendments have been proposed to rationalise the provisions of sections 115BAA and 115BAB to provide that any domestic company (both existing as well as new) opting for concessional tax regime will not be allowed to claim any deduction under Chapter VIA of the Act except deductions under sections 80JJAA or section 80M. Thus, earlier the bar was related to deductions covered under Part C of Chapter VI-A except deduction under section 80JJAA. The companies opting for tax regime under section 115BAA and 115BAB were allowed to claim applicable deductions contained in other parts of Chapter VI e.g., deductions under sections 80G / 80GG. With the proposed amendments, these companies can only claim deduction under sections 80JJAA and 80M. These amendments would be applicable from AY 2020-21.

D. Exemption of income of sovereign wealth funds generated from investments in Indian infrastructure companies – Section 10(23FE):

2.15 Section 10(23FE) has been proposed to be incorporated in the Act with effect from AY 2021-22 to incentivise the investment by the Sovereign Wealth Fund of foreign governments [including the wholly owned subsidiary of Abu Dhabi Investment Authority (ADIA)] in Indian infrastructure companies. As per this section, exemption would be available qua dividend, interest or long-term capital gains arising from an investment made by ADIA and sovereign wealth fund in debt or equity of Indian infrastructure companies carrying on business referred to in Explanation to section 80-IA(4)(i) of the Act or such other business as may be notified by the Central Government in this behalf. In order to be eligible for exemption, the investment is required to be made on or before 31-03-2024 and is required to be held for at least 3 years.

3.0 Tax proposals related to non-residents

A. Amendment to section 6 proposing taxation of global income of non-resident Indian citizen:

3.1 It has been proposed to insert sub-section (1A) in section 6 to provide that an Indian citizen who is not liable to tax in any other country or territory shall be deemed to be resident in India. In other words, the proposed amendment to encompass Indian citizens within the tax net who are Globally ‘stateless’ for tax purposes. The rationale of this proposal has been explained in the following terms in the Memorandum to Finance Bill 2020 in the following words “The issue of stateless persons has been bothering the tax world for quite some time. It is entirely possible for an individual to arrange his affairs in such a fashion that he is not liable to tax in any country or jurisdiction during a year. This arrangement is typically employed by high net worth individuals (HNWI) to avoid paying taxes to any country/ jurisdiction on income they earn. Tax laws should not encourage a situation where a person is not liable to tax in any country. The current rules governing tax residence make it possible for HNWIs and other individuals, who may be Indian citizen to not to be liable for tax anywhere in the world. Such a circumstance is certainly not desirable; particularly in the light of current development in the global tax environment where avenues for double non-taxation are being systematically closed.”

3.2 The proposed sub-section 1A to section 6 reads as under:

“Notwithstanding anything contained in clause (1), an individual, being a citizen of India, shall be deemed to be resident in India in any previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.”

3.3 Going by the intention of the Government (as forthcoming from the Memorandum), an Indian citizen who invites residency in any other country / territory would not be covered within the ambit of section 6(1A). On the other hand, if an India citizen avoids residency in any country / territory would be covered under section 6(1A). However, section 6(1A) in its present form will not only cover an Indian citizen who avoids residency but would cover all cases where an Indian citizen has not paid tax in any other country / territory. This is because of the deployment of the phrase ‘not liable to tax in any other country or territory’.

3.4 In fact, subsequent to presentation of the Budget, it was reported that the proposed section 6(1A) is being understood as a provision to tax every Indian working in other countries where they are not liable to pay income tax by reason of the domestic laws of such countries. The CBDT on 02-02-2020 issued a press release clarifying that the proposed amendment is an anti-abuse provision to capture some Indian citizens who shift their stay in low or no tax jurisdiction to avoid payment of tax in India. It was also stated therein that the proposed amendment in section 6 should not be interpreted to create an impression that those Indians who are bonafide workers in other countries, including in Middle East, and who are not liable to tax in these countries will be taxed in India on the income that they have earned there. The CBDT further clarified that an Indian citizen who becomes deemed resident of India under this proposed provision, income earned outside India by him shall not be taxed in India unless it is derived from an Indian business or profession. The Board has also stated that necessary clarification, if required, shall be incorporated in the relevant provision of the law.

3.5 The issuance of the above clarification by the CBDT is unusual as the same has been issued in respect of a provision which is yet to be enacted. Notwithstanding the same the press release by CBDT has equated the proposed section 6(1A) with section 6(6) read with proviso to section 5(1) which taxes income earned of a RNOR. This could lead to unintended interpretations.

B. Amendment to section 9 – Significant economic presence (SEP) and Business connection

3.6 The Finance Bill, 2020 proposes certain changes to the SEP provisions. The applicability of SEP is proposed to be deferred to Assessment Year 2022-23. The Memorandum to Finance Bill clarifies that SEP is determined on the basis of payments arising from the specified transactions or the number of users crossing the prescribed threshold. However, since discussion on this issue is still going on in G20-OECD BEPS project, these thresholds are not yet prescribed. G20-OECD report is expected by the end of December 2020. It is therefore proposed to defer the applicability of SEP provisions.

3.7 Explanation (2A) which dealt with SEP is proposed to be in force in a substituted form. The said Explanation which was a clarificatory provision is now being re-introduced as a ‘declaratory’ provision. The substituted Explanation (2A) states that transaction in respect of goods, services or property carried out by non-resident with any person in India would constitute SEP. Thereby, business connection scope appears to have been expanded by encompassing transactions ‘with India’ which was hitherto only limited to ‘in India’.

3.8 Explanation 1(a) to section 9(1) states that if the operations of non-resident’s business are not wholly carried out in India, only such part of income as is reasonably attributable to operations carried out in India would be deemed to accrue or arise in India. Such Explanation 1(a) is proposed to be applied in situations when SEP fails in establishing business connection. This amendment is proposed to be effective from AY 2022-23. The consequence is a business connection which emerges on account of SEP need not have any operations in India and could still have income which is deemed to accrue or arise in India. In other words, physical operations in India is not a pre-condition for attributing income to a SEP.

3.9 Explanation 3A to section 9(1) is proposed to be inserted. It is an explanation to an explanation [i.e., Explanation 1(a)]. The proposed Explanation (3A) reads as under:

“Explanation 3A.— For the removal of doubts, it is hereby declared that the income attributable to the operations carried out in India, as referred to in Explanation 1, shall include income from– (i) such advertisement which targets a customer who resides in India or a customer who accesses the advertisement through internet protocol address located in India;

(ii) sale of data collected from a person who resides in India or from a person who uses internet protocol address located in India; and

(iii) sale of goods or services using data collected from a person who resides in India or from a person who uses internet protocol address located in India.”

3.10 Explanation 3A ushers in certain situations income from which is deemed to be attributable to operations carried out in India. It intends to extend the gamut and reach of income which are said to be attributable to operations carried out in India. There are three instances captured herein.

3.11 The first instance is about an advertisement which targets an Indian customer or which is accessed by such customer through an internet protocol address in India. The advertisement could be of goods, property or service. It could be communicated physically, digitally, electronically or through any modes of internet. It should be a targeted advertisement. The target should be Indian resident(s); although not limited to such Indian residents. The closing portion of this clause states that a customer who accesses this advertisement through an internet protocol address in India would result in non-resident having operations in India. Such advertisement need not be a targeted one. The only pre-condition is access of such advertisement through internet protocol in India. As an overall point, it is important to analyse which non-residents could possibly be covered within the provision? There could be various players in an advertisement business. The ad-designing, advertisement agency, broadcasting agency, liasoning personnel etc. One would have to await for any clarifications if each of these businesses is impacted by such amendment.

3.12 The second instance deals with sale of data. Such data should be collected from a person who resides in India or from a person who uses internet protocol address located in India. The contents of the data are irrelevant. The nexus of the data contents with India is not relevant. It is interesting to observe that this limb only deals with ‘sale’ of data. Thereby it does not cover ‘use’ or ‘exploitation’ of data collected from India. The legislative intent is possibly not to cover such ‘use’ or ‘exploitation’ as it may result in unintended clash with the concept of royalty. Further, such data should be collected from a person residing in India. It means that such data should be gathered or fetched. It could be for consideration or without consideration [CIT vs. Smt. Padma S. Bora [2013] 355 ITR 368 (Bombay)].

3.13 The third instance deals with sale of goods or services. Such sale should use data collected from a person who resides in India or from a person who uses internet protocol address located in India. The locale of sale is inconsequential. The linkage of the sale to the data collected in India is the clinching factor to establish operations being in India. The use of the data collected in India could take any form. (a) It could be one of the constituents of the sale/ service; (b) it could be instrumental in creation of the goods or service being sold; (c) it could be critical to determine the time and place of sale; (d) it could empower the non-resident with experience or technical specifications which enables the sale. Thus, the reach is wide and deep.

3.14 A proviso is proposed to be appended below Explanation (3A) which states that that the provisions contained in Explanation (3A) shall also apply to the income attributable to the transactions or activities referred to in Explanation 2A [or SEP]. The use of the term ‘also’ indicates that income attribution in Explanation 3A is not only applicable to SEP but also other forms of business connection referred in Explanation 2.

3.15 The Finance Bill, 2020 proposes to include attribution of profits to Business connection/ SEP within the framework of the safe harbour rules and the Advance Pricing Arrangement regimes, which were hitherto limited to Arm’s Length Price determination.

C. Proposals related to APA and safe harbour rules:

3.16 Section 92CB of the Act empowers the Central Board of Direct Taxes (Board) for making safe harbour rules (SHR) to which the determination of the arm’s length price (ALP) under section 92C or section 92CA of the Act shall be subject to. As per Explanation to said section the term “safe harbour” means circumstances in which the Income-tax Authority shall accept the transfer price declared by the assessee.

3.17 Section 92CC of the Act empowers the Board to enter into an advance pricing agreement (APA) with any person, determining the ALP or specifying the manner in which the ALP is to be determined, in relation to an international transaction to be entered into by that person.

3.18 Taking cue from the fact that both SHR and the APA have been successful in reducing litigation in determination of the ALP, amendments have been proposed in section 92CB and section 92CC to cover determination of attribution to PE within the scope of SHR and APA. These amendments will apply from AY 2020-21.

D. Power to make rule in respect of income from business connection

3.19 Section 295 of the Act deals with power of the Board to make rules for carrying out of the purposes of the Income-tax Act. The Finance Bill 2020 has proposed to amend section 295 of the Act so as to empower the Board for making rules to provide for the manner in which and the procedure by which the income shall be arrived at in the case of:

(i) operations carried out in India by a non-resident; and

(ii) transaction or activities of a non-resident.

The amendment for clause (i) will take effect from AY 2021-22. The amendment for clause (ii) will take effect from AY 2022-23.

E. Amendment in section 94B:

3.20 Section 94B, inter alia, provides that deductible interest or similar expenses exceeding one crore rupees of an Indian company, or a permanent establishment (PE) of a foreign company, paid to the associated enterprises (AE) shall be restricted to 30% of its earnings before interest, taxes, depreciation and amortisation (EBITDA) or interest paid or payable to AE, whichever is less. Further, a loan is deemed to be from an AE, if an AE provides implicit or explicit guarantee in respect of that loan. AE for the purposes of this section has the meaning assigned to it in section 92A of the Act. Interest paid to all the AE’s [except as provided in section 94B] are covered under section 94B.

3.21 Under the existing provisions, a branch of the foreign company in India is regarded as a non-resident in India. Further, the definition of the AE in section 92A, inter alia, deems two enterprises to be AE, if during the previous year a loan advanced by one enterprise to the other enterprise is at 50 per cent or more of the book value of the total assets of the other enterprise. Thus, the interest paid or payable in respect of loan from the branch of a foreign bank may attract provisions of interest limitation provided for under this section.

3.22 In order to give relief to foreign banks receiving interest from its branches in India, the Finance Bill, 2020 has proposed to amend section 94B of the Act so as to provide that provisions of interest limitation would not apply to interest paid in respect of a debt issued by a lender which is a PE of a non-resident, being a person engaged in the business of banking, in India. This amendment would be applicable from AY 2021-22.

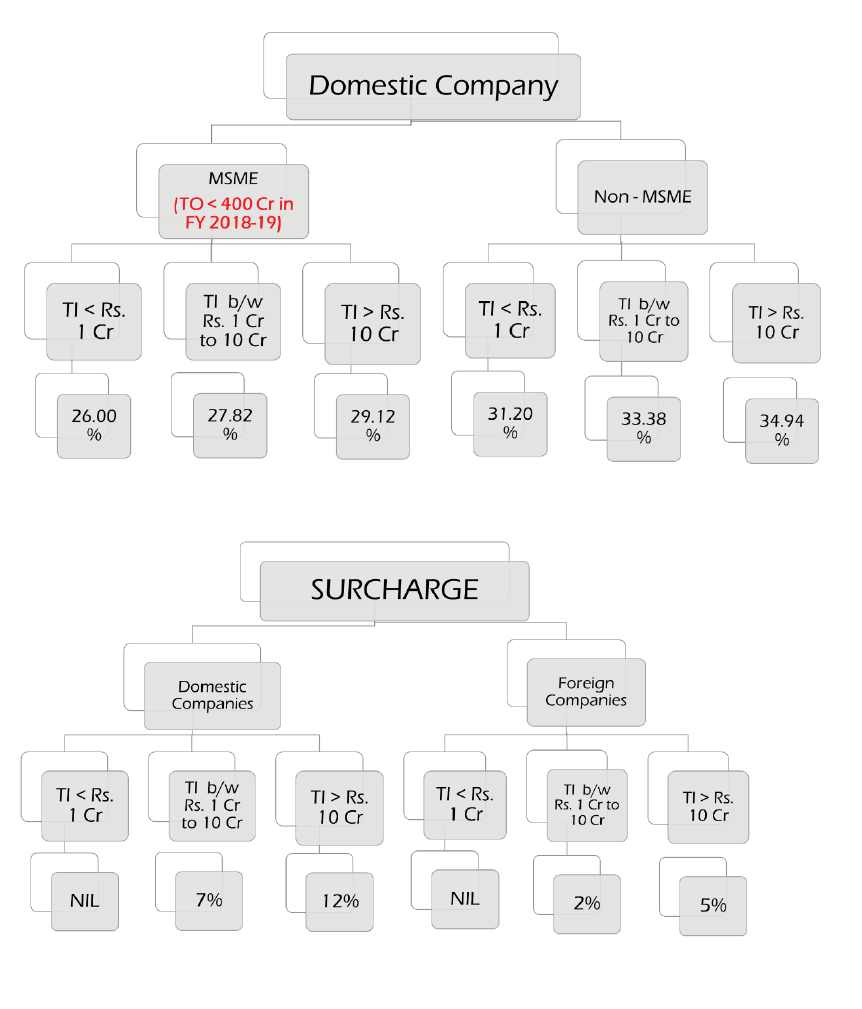

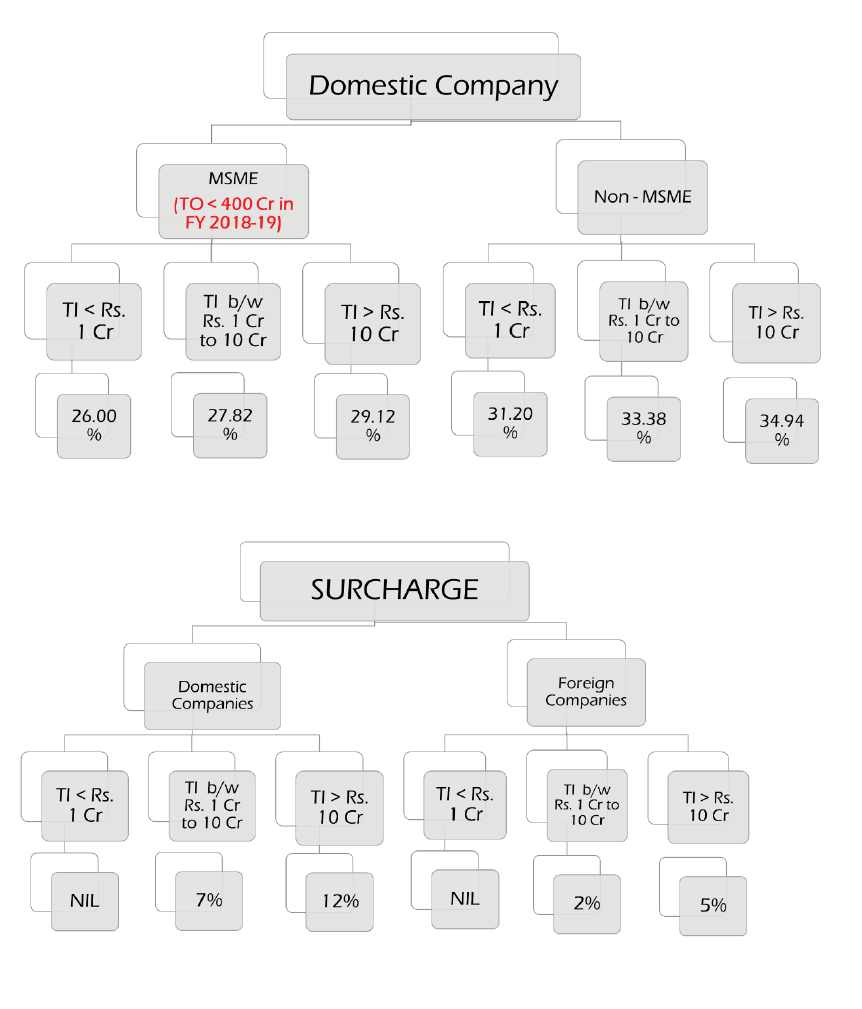

4 Applicable tax rates for companies (as amended by proposals under Finance Bill, 2020):