A. Background

1. Section 2(13) of the CGST Act1 defines “audit” to mean “the examination of records, returns and other documents maintained or furnished by the registered person under this Act or the rules made thereunder or under any other law for the time being in force to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess his compliance with the provisions of this Act or the rules made thereunder”.

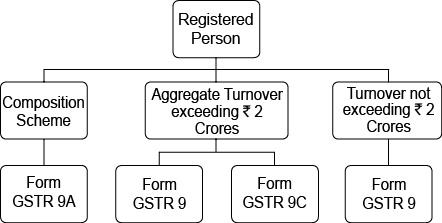

2. Section 44(1) of the CGST Act2 requires every registered person to file an Annual Return in Form GSTR 9 for every financial year and in case such registered person is a composition dealer then the Annual Return is to be filed in Form GSTR 9A. The due date for filing such return is December 31 following the end of such financial year.

3. Section 35(5) read with Section 44(2) of the CGST Act and Rule 80(3) requires such registered persons whose ‘aggregate turnover’ during a financial year exceeds ₹ 2 Crores to additionally get his accounts audited by a Chartered Accountant or a Cost Accountant and submit copies of the audited annual accounts, annual return in Form GSTR 9 along with the reconciliation statement in Form GSTR 9C (certified by such Chartered Accountant or Cost Accountant) by December 31 of the following year.

4. Filing requirements for various tax payers:

|

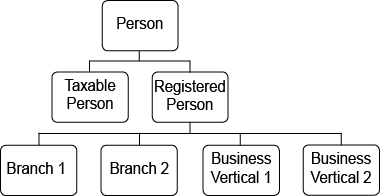

a. Registered Person – Section 2(94) of the CGST Act defines the term “registered person” to mean “a person registered under Section 25 of the CGST Act but does not include a person having a Unique Identification Number”. It would be relevant to note the difference between “taxable person” and “registered person”. While the former refers to a person registered / liable to registered under GST Law, the latter refers to only such person who has been granted a registration certificate.

b. Hence, for the Financial Year 2017-18, requirements of annual returns and conducting of audit are applicable only for those tax payers who are registered under GST law in the Financial Year 2017-18. Any tax payer who obtains registration after March 31, 2018 is not required to file annual returns or get his accounts audited for the Financial Year 2017-18.

c. Further, in case a tax payer has, say, three locations of operations in three different States and has obtained registration for two locations in the Financial Year 2017-18 but the third location was registered under GST only in the Financial Year 2018-19, then the annual returns and audit requirements for the Financial Year 2017-18 will be required only for the first two branches which were registered during the Financial Year 2017-18.

|

d. Aggregate Turnover – Section 2(6) of the CGST Act defines “aggregate turnover” to mean “the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess”.

e. Hence, a registered person under GST law with all India aggregate turnover exceeding ₹ 2 Crores but having branches with turnover of say ₹ 10 Lakhs per annum will be required to file the annual return in Form GSTR-9 and reconciliation statement in Form GSTR 9C for such branch as well. Additionally, GST audit will be required even in cases where the tax payer is dealing only in exempt supplies.

f. It would also be relevant to note that Form GSTR 9C is required to be prepared by considering the details of each GST registration. However, the Financial Statements are prepared for the entity as a whole and State level bifurcation of data may not be available. The State wise details will have to extracted from the accounting records for the purpose of Annual Return as well as Financial Statements.

5. Section 44(1) excludes input service distributor, person registered for deduction of tax at source under section 51 of the CGST Act, person registered for collection of tax at source under section 52 of the CGST Act, a casual taxable person and a non-resident taxable person from filing of annual return in Form GSTR 9.

6. However, such exclusion under section 44(2) of the CGST Act is not provided for filing of reconciliation statement in Form GSTR 9C for person mentioned in section 44(1) of the CGST Act. Therefore, the question that arises for consideration is as to whether an input service distributor, person registered for deduction of tax at source under section 51 of the CGST Act, person registered for collection of tax at source under section 52 of the CGST Act, a casual taxable person and a non-resident taxable person are required to file Form GSTR 9C. On this aspect it may be noted that section 44(2) of the CGST Act requires a registered person to file annual return along with a copy of the audited annual accounts and a reconciliation statement in Form GSTR 9C. On a combined reading of section 44(1) and 44(2) of the CGST Act, the authors are of the view that since annual return is not applicable to input service distributor, person registered for deduction of tax at source under section 51 of the CGST Act, person registered for collection of tax at source under section 52 of the CGST Act, a casual taxable person and a non-resident taxable person, are not required to file Form GSTR 9C.

7. The definition of registered person excludes persons holding Unique Identity Number– Specified Agency of the UN or such other notified person. Therefore, audit is not applicable to such person.

8. GST Audit is not applicable for the following persons

a. Persons not registered under GST

b. Persons who have opted for composition scheme

c. Input Service Distributor

d. Persons registered under Section 51 and Section 52 for deduction / collection of tax at source

e. Casual Taxable Person

f. Non Resident Taxable Person

g. Persons holding UIN – Specified Agency of the UN or such other notified person

9. Reconciliation v. Certification

a. Section 35 requires a tax payer to get his accounts “audited” and then file a Reconciliation Statement in Form GSTR 9C. The question which arises here is whether Form GSTR 9C is a Reconciliation Statement or a GST Audit?

The format of GSTR 9C has two parts wherein Part A is a reconciliation statement and Part B is a certificate to be issued by a Chartered Accountant or Cost Accountant. Part B has two circumstances – in first circumstance the reconciliation statement is certified by a Chartered Accountant or Cost Accountant who has conducted the audit of the entity; and in second circumstance the reconciliation statement is certified by a Chartered Accountant or Cost Accountant who has not conducted an audit of the entity but relies on the audit report of another auditor.

b. It would be pertinent to note that reconciliation will arise if a particular transaction is recorded in the Annual Returns but not recorded in Audited Financials or vice versa. But transactions not required to be reported in Audited Financials and omitted to be reported in Annual Returns will not find any place in the Part A of Form GSTR 9C and it would be the duty of the auditor to report the same in Part B as part of his certification.

B. Scope of Audit and Certification

1. Audit refers to systematic and independent verification of records / documents. This involves an auditor to rely on various judgements, estimates and opinions which are very subjective and would vary under each circumstance. Consider the case of valuation of goods / services which are supplied to a related party. Section 15 of the CGST Act read with Rule 28 prescribes various options to arrive at the correct value for computation of tax applicable on such transaction. The adoption of one method over another is judgmental and may vary from person to person. The person conducting the audit may be satisfied with the reason for adopting a method over another but the same may be objected by the revenue authorities and yet the auditor may confirm that he is satisfied with the records maintained by the tax payer and that according to him the same are in line with the requirements of the law.

2. Certification is a written confirmation of a fact which cannot be based on an estimate or an opinion. Under the Central Excise Laws, the exporter was required to furnish the value of goods exported by him during a particular period. The said report was to be certified by a Chartered Accountant. This report was a certification because the certificate was issued based on the export invoices, Bill of Export attested by the Customs Officer, Shipping Bill and Forex Realization Advice from the Bank. There was no requirement of framing an opinion whether the transaction was export or not or if the value of exports was received or not since the information was available for validation from more than one source.

3. Form GSTR 9C requires Certification from the Auditor which may not be correct since Certification means confirmation of facts whereas at many occasions, the auditor will be required to use his professional judgement for the purpose of conduct of audit. Further, the format of the Certificate requires the auditor to certify that in his “Opinion”, the particulars furnished in Form GSTR 9C is true and correct which effectively means that the form requires the auditor to frame an opinion and provide the observations / comments.

4. Overview of Form GSTR 9C

Form GSTR 9C is bifurcated into two parts:

1. Part A – Reconciliation Statement which is further divided into 5 tables (detailed below)

2. Part B – Certification which is further divided into 2 parts

a. Part I when the Form GSTR 9C is certified by person who has conducted audit of the financial statements

b. Part II when the Form GSTR 9C is certified by person who has not conducted audit of the financial statements.

5. Difference in Certification under Part I and Part II

| Particulars | Part I | Part II |

| To be certified by | Chartered Accountant who has conducted audit of the financial statements | Any other Chartered Accountant |

| Financial Statements | Auditor to confirm that he has examined the Financial Statements | Auditor to merely state that he has annexed the Financial Statements (including other related documents) |

| Obtaining Information | Specifically confirm if all the information has been provided and also mention if any information was not provided or partially provided | No such requirement |

| Location of Books of Accounts | Confirm that the books of account are maintained at principal place of business | No such requirement |

Thus, a Statutory Auditor conducting an audit has a lot more responsibility when he conducts the audit of his clients under GST.

6. Tables under Part-A of GSTR-9C

a. Basic Details

Details of Financial Year, GSTIN, legal name and trade name and liability to get the books audited under any Act is required to be provided.

Legal name refers to the name as appearing on the PAN of the tax payer. Trade name refers to the name / brand under which the tax payer wants to be identified.

Legal name and trade name have relevance in case of Sole Proprietorship Firms where the legal name will be the name of the individual whereas the trade name will be the name by which his venture / entity is recognized by others. These details will be auto populated based on the details provided at the time of migration / registration.

b. Reconciliation of Turnover declared in Audited Annual Financial Statement with the Turnover declared in Annual Returns in Form GSTR 9

The reconciliation process commences with the turnover declared in the Audited Annual Financial Statements and suggests various adjustments which are required to be effected to the said turnover to arrive at the derived Annual Turnover which is to be compared with the Actual Annual Turnover as declared Annual Returns and tables have been provided to list out the reasons for differences between these turnovers. Any irreconcilable difference would require payment of taxes (Difference 1).

The adjustments between values declared in Annual Financial Statements and derived Turnover as per Annual Returns are tabulated below:

| Matters related to Financial Statements (Exclude)3 | Turnover for Financials but not for GST (Subtract) | Turnover for GST and not for Financials (Add) |

| Unbilled revenue at the beginning and end of the year | Unadjusted advances at the beginning of the financial year – NIL in the first year | Unadjusted advances at the end of the financial year – Since advances on goods are not taxable from November 15, 2017, this would ideally include unadjusted advances received for services |

| Adjustment in Turnover due to Foreign Exchange Fluctuation |

Turnover for the period April 2017 to June 2017

Turnover under Composition Scheme |

Deemed Supplies under Schedule I – Branch Transfer, Management Cross Charge but not including import of services from related parties since it is a inward supply etc |

| Credit Notes issued after the end of the Financial year – The format requires these adjustments to be added. May be the expectation would be to feed in negative values which would effectively mean SUBTRACT | Credit Notes not permissible under GST – The format requires these adjustments to be subtracted. May be the expectation would be to feed in negative values which would effectively mean ADD | |

| Trade Discounts not permissible under GST | ||

| Supplies by SEZ to DTA – considered as import of goods by DTA if the bill of entry for such supplies is filed by DTA | ||

| Adjustment in turnover due to Valuation Rules – Generally, valuation rules only enhances the value of supply and hence these adjustments will be added to the financial statement turnover though the format suggests that adjustment may require subtraction as well | ||

The derived Annual Turnover is again taken as a base and all the sales which are not liable to GST are reduced from the derived Annual Turnover to arrive at the derived Taxable Turnover. This derived Taxable Turnover is then compared with the Actual Taxable Turnover reported in the Annual Return in Form GSTR 9 and tables have been provided to list out the reasons for differences between these turnovers. Any irreconcilable difference would require payment of taxes (Difference 2)

c. Reconciliation of Rate Wise Liability and Amount Payable thereon

Under this table, the Taxable Turnover is required to be classified into various rates including turnover of the supplier where the recipient is required to pay taxes (to be reported by the supplier only) and arrive at the GST Payable.

This GST Payable is compared with the GST Paid in Annual Return in Form GSTR 9 and tables have been provided to list out the reasons for differences between payable and paid amounts. Any irreconcilable difference would require payment of taxes (Difference 3).

Tax payable due to various differences [Difference 1, Difference 2 and Difference 3] is required to be reported and tax payable, if any needs to be mentioned.

d. Reconciliation of Input Tax Credit

Under this table in Part IV of Form GSTR 9C, ITC availed as per the Audited Financials need to be adjusted with the timing difference of credits between Audited Financials and Annual Return in Form GSTR 9 to arrive at the derived ITC availed by the tax payer. This derived ITC availed by the tax payer is matched with the actual ITC availed as mentioned in annual return in Form GSTR 9 and tables have been provided to list out the reasons for differences between the credits. Any irreconcilable difference would require payment of taxes (Difference 4)

Additionally, the inward supplies are required to be reported based on their grouping in the financial statements along with the details of credit available and credit availed on such supplies. The total of the credit availed on such inward supplies is matched with the actual ITC availed as mentioned in annual return in Form GSTR 9 and tables have been provided to list out the reasons for differences between the credits. Any irreconcilable difference would require payment of taxes (Difference 5)

Excess Credit availed due to various differences [Difference 4 and Difference 5] is required to be reported and tax payable, if any needs to be mentioned.

e. Auditor’s Recommendation on Additional Liability due to Non-Reconciliation

The sum total of all the differences arising out of the reconciliation [Difference 1 to Difference 5) are to be summarized in this table along with the details of erroneous refund claimed by the tax payer and details of outstanding demands which needs to be settled.

7. Who can certify Form GSTR-9C?

A practicing Chartered Accountant or Cost Accountant can certify this form. However, a Chartered Accountant who is an internal auditor of a tax payer is not allowed to get himself appointed as GST Auditor to ensure independence while certifying the GST records.

C. Duties and Responsibilities of an Auditor

The duties and responsibilities of the Auditor can be understood by referring to declarations under “Verification” and “Certification”. Declaration under Verification reads as follows “I hereby solemnly affirm and declare that the information given hereinabove is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom.”

1. Solemnly Affirm – “Solemnly” refers to “formally” and “Affirm” refers to “confirmation”. Together, Solemnly Affirm, refers to “a written statement under an oath”. This expression is generally used while recording a statement of a witness during a Court proceeding. Based on the usage of the terminology, it appears that an auditor is required to solemnly affirm that what is mentioned in the report is true and correct which effectively means that he takes the entire responsibility of the disclosures made in the Form GSTR 9C reconciliation statement. While the form may not be complete without providing “solemn affirmation”, it could have larger ramifications in case the revenue authorities want to invoke “abetment” proceedings against the Auditor who has concluded his audit based on best of his judgement and knowledge.

2. True and Correct – The expressions “true and correct” unlike “true and fair” assumes mathematical precision in the information being reported in the Form GSTR 9 C. True and correct rules out any scope for using professional judgement, estimation and assumption. In contrast, True and Fair factors the scope of judgement, estimation, assumptions and more importantly materiality of the transaction when an auditor provides his opinion on a subject matter. Arriving at a mathematical precision on a subject like law, which involves multiple interpretations, is impossible to achieve. There are various avenues where the question of truth and correctness can arise like Eligibility of the credit claimed, rate of tax charged based on the understanding of the composition of the product, valuation of supplies etc.

3. Concealment – “Conceal” refers to “hiding or keeping something a secret. The word finds mention in the Verification Declaration to be given by the tax payer in Form GSTR 9 as well as the Verification Declaration to be given by the Auditor in Form GSTR 9C.

Concealment will arise when the tax payer / auditor hides something which was required to be reported. There are a plethora of decisions under the Excise Laws which clearly states that if an information is not required to be disclosed (based on say the format of the returns) then it cannot be said that the tax payer has concealed the information. Hence, this expression will come into play when there is requirement of disclosure but the same has not been disclosed either by the tax payer or by the auditor.

In this context, it would be relevant to note that Form GSTR 9 appears to be summation of the GST Returns filed by the tax payer (in Form GSTR 1 for outward supplies and Form GSTR 3B for input tax credit) and that Form GSTR 9C requires reconciliation of the details appearing in the financial statements with those mentioned in Form GSTR 9. As long as this requirement is met, there can be no allegation of concealment by the revenue authorities.

D. GST Records and Books of Account

We find reference to the term “Books of Accounts” multiple times under the GST Law. But the said term is neither defined nor a list of what constitutes “Books of Accounts” is provided. Accordingly, reference to “Books of Account” will have to be understood to be accounting records which are generally maintained by the tax payer including those required under any other law applicable to the tax payer. It would be relevant to note that Section 35 of the CGST Act r/w Rule 56 of the CGST Rules requires the tax payer to maintain a true and correct account of :

a. production or manufacture of goods;

b. inward and outward supply of goods or services or both;

c. stock of goods;

d. input tax credit availed;

e. output tax payable and paid;

f. Such other documents as may be prescribed (Reference could be made to Rule 56 which lists down such prescribed documents)

E. Meaning of Term Unbilled Revenue

Unbilled revenue is an accounting concept which implies recognition of revenue on accrual basis though the date for raising invoice could be a future date. Eg. Construction Work done as on say March 31, 2017 will be accounted as revenue for the purposes of drawing the books of accounts but the invoice against the same can be raised only on completing the milestone defined in the Contract. The revenue so accounted will be treated as unbilled revenue but will not find a place in the GST Returns since the time of supply for such transaction has not yet arrived.

Unbilled revenue will be one of the adjustment while reconciling the revenue between financials and GST returns. Unbilled revenue in the current year will be reduced from the revenue of the financial year to reach the revenue as per GST returns and Unbilled revenue of the previous year (provided it is invoiced in the current year) will be added to the revenue of the current financial year to reach the revenue as per the GST returns.

F. Cancellation of Registration during the year

A registered person is required to file both Form GSTR 9 and GSTR 9C for a Financial Year. There could be occasions where the registered person has de-registered himself from GST. In such a scenario, whether these two Forms are required to be submitted or not is not clear. However, based on the current treatment of de-registration applications, we can infer the following

a. Application for Cancellation Filed – The portal is open for the tax payer and he is required to file his regular periodic returns. Accordingly, he would be required to submit the aforementioned forms as well

b. Application for Cancellation Filed and status updated by the officer as “Surrender”- The tax payer cannot file any returns. We could in the absence of any clarification on this aspect, presume that the tax payer is not required to file the aforementioned forms

c. Application for cancellation approved – The tax payer can file the Final Return declaring any balance tax liability. We could in the absence of any clarification on this aspect, presume that the tax payer is not required to file the aforementioned forms.

G. Penalty for Delay in Filing of Form GSTR 9C

There is no specific provision which provides for penalty in the event of delay in filing of Form GSTR 9C. Section 125 of the CGST Act provides for general penalty of up to ₹ 25,000/-. Similar provision is provided under the State GST law and effectively the penalty would be up to ₹ 50,000/- (₹ 25,000/- CGST+ ₹25,000/- SGST).

There is one more school of thought on this matter. Section 44(2) of the CGST Act specifically provides that every person required to get an audit conducted will have to file Annual Returns as well as reconciliation statement in Form GSTR 9C. This would effectively mean that the annual returns and Form GSTR 9C will have to be filed together and non-filing of the same would lead to late fee as applicable to Annual Returns. The late fee for delay in filing of Annual Returns is ₹ 200 per day (₹ 100/- CGST+ ₹ 100/- SGST) subject to a maximum of 0.5% of the turnover in the State.

Conclusion

An attempt has been made in this paper to make a reader understand the basis of aspects of audit under the GST law. This paper only provides a glimpse of the issues that may arise. This paper is written with a view to incite the thoughts of a reader who could have different views of interpretation. Disparity in views, would only result in better understanding of the underlying principles of law and lead to a healthy debate or discussion. The views written in this article is as on 26-10-2018.

1. CGST Act and CGST Rules refers to the Central Goods and Services Tax Act, 2017 and Central Goods and Services Tax Rules, 2017 and reference to any provisions of the CGST Act and CGST Rules will include reference to the corresponding provisions under the respective State Goods and Services Tax Act, 2017 and State Goods and Services Tax Rules, 2017 unless specifically mentioned otherwise

2. CGST Act and CGST Rules refers to the Central Goods and Services Tax Act, 2017 and Central Goods and Services Tax Rules, 2017 and reference to any provisions of the CGST Act and CGST Rules will include reference to the corresponding provisions under the respective State Goods and Services Tax Act, 2017 and State Goods and Services Tax Rules, 2017 unless specifically mentioned otherwise

3. Will be required to be added or subtracted based on the nature of adjustment